ASIC focus areas for 30 June 2023 financial reports

ASIC focus areas for 30 June 2023 financial reports

The Australian Securities and Investments Commission (ASIC) conducts surveillance on the full year financial reports of Australian entities (mainly listed entities) as part of its financial reporting surveillance program. As a result of these risk-based reviews, ASIC conducts inquiries on matters of concern, and depending on the outcome, entities may be ‘named and shamed’ in media releases if they restate financial reports as a result.

In its recent Media Release, ASIC outlined its focus areas for its surveillance of 30 June 2023 financial reports. Directors, preparers, and auditors should take note of these to ensure financial reports provide useful and meaningful information for investors and other users. Focus areas of other regulators are consistent with ASIC.

Six focus areas

ASIC’s focus areas media release highlights six areas that it will focus on when it conducts these reviews:

- Uncertainties and risks

- Asset values

- Provisions

- Subsequent events

- Disclosures in the financial report and the Operating and Financial Review (OFR)

- Impact of the new insurance standard for insurers.

These are discussed further below. In addition, ASIC highlights that:

- Entities need to consider whether off-balance sheet exposures should be recognised on-balance sheet (for example, interests in non-consolidated entities)

- Groups that have operations in countries that have enacted the Pillar II tax reforms and also have operations in low-tax jurisdictions need to include information in their financial report about the impact of the Pillar II reforms

- The financial statements of registered schemes, where individual scheme members have pooled interest in the assets and returns of the registered scheme with some or all other members, must recognise the following:

- Assets and liabilities in the balance sheets, and

- Income and expenses in the income statements.

- Previously ‘grandfathered’ large proprietary companies with year-ends after 10 August 2022 are now required to lodge financial statements with ASIC.

Uncertainties and risks

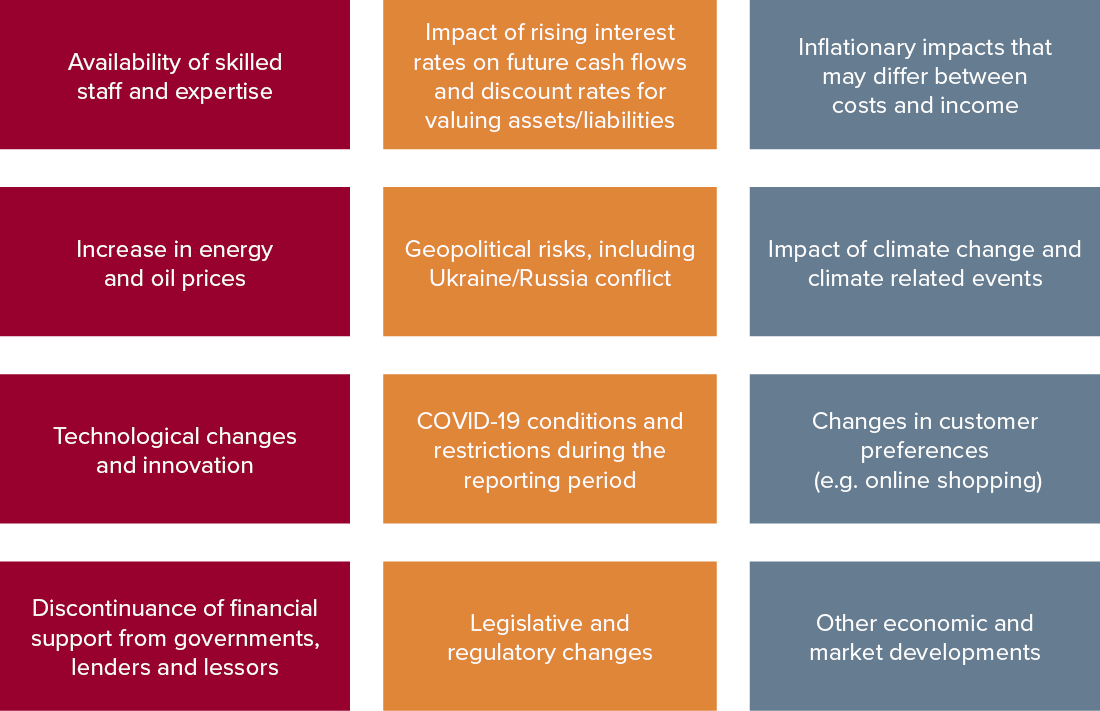

Entities continue to face changes in circumstances and uncertainties about future economic and market conditions that may impact their business strategies and future financial performance. These uncertainties should be factored into the assumptions used for financial reporting purposes and should be reasonable and supportable. Examples of changes in circumstances, uncertainties, and risks to be considered when preparing the 30 June 2023 financial reports include those listed in the diagram below. This list is not exhaustive.

Asset values

ASIC’s focus on asset values relates to the following areas:

|

Financial statement area |

Focus areas |

|

Impairment of non-financial assets |

|

|

Values of property assets |

Note: Refer to our Lease Accounting web page for more information about the complexities of lease accounting, including software solutions, training materials, and publications. |

|

Expected credit losses (ECL) on loans and receivables |

|

|

Financial asset classification |

|

|

Value of other assets |

|

Provisions

Entities should consider the need for, and adequacy of, provisions for onerous contracts, leased property make good, mine site restoration, financial guarantees given, and restructuring.

Subsequent events

Entities should review events occurring after the end of the reporting period to determine whether these are ‘adjusting’ or ‘non-adjusting’ post-balance date events.

Disclosures in the financial report and operating and financial review (OFR)

Lastly, entities should focus on ensuring adequate disclosures as outlined in the table below.

|

Consider |

Focus areas |

|

General considerations |

|

|

Disclosures in financial report |

|

|

Disclosures in OFR |

Note: The media release notes that the OFR should discuss environmental, social and governance (ESG) risks. Disclosing an exhaustive list of generic risks that might affect many entities is not helpful, and these risks should be described in context. For example, it could include a discussion about:

Also, refer to ASIC’s separate Media Releases MR 23-018 and MR-23-058 that call for greater focus on material business risk disclosure in annual reports, and BDO’s article. |

|

Non-IFRS financial information |

|

|

Disclosure in half-year financial reports |

|

Impact of new accounting standards for insurers

Insurers must continue to disclose the impact of the new insurance accounting standard, IFRS 17 Insurance Contracts, in the notes to the 30 June 2023 financial report. Given that the new standard applies for periods beginning on or after 1 January 2023 (i.e. to 30 June 2024 year-ends), it is reasonable to expect insurers should be able to quantify the new standard’s impact in their 30 June 2023 financial reports. Non-insurers affected by IFRS 17 for certain transactions should include similar note disclosures.

Insurers that have a 30 June 2023 half-year need to:

- Follow all recognition and measurement requirements in IFRS 17 in their half-year financial report, and

- Disclose the changes in accounting policies from adopting IFRS 17 in their 30 June 2023 half-year financial report.

Private health insurers should consider the impacts on their deferred claims liability for changes in the backlog of deferred procedures. A liability may be required for a commitment to return premiums to existing policyholders for savings during the pandemic.

Private health insurers with a 30 June 2023 half-year need to:

- Ensure that the deferred claims liability has been calculated in accordance with IFRS 17

- Disclose the impact of the change in accounting policy, particularly if there has been a significant impact on the deferred claims liability

- Disclose any significant impact on profit from the change in the accounting policy in its OFR.

Need assistance?

Please contact our IFRS Advisory team if you need support with any financial reporting matters for your 30 June 2023 financial reports.