Australia’s largest privately owned and wealthy groups are advised to ensure their governance and documentation processes are up to scratch, as targets for the Australian Tax Office’s (ATO’s) Next 5,000 tax performance program.

What is the Next 5,000 program?

The Next 5,000 program is targeted at individual Australian residents who, together with their associates, control wealth of more than AUD $50 million – and aims to ensure they are paying the right amount of tax.

Using sophisticated data matching and analytical modelling tools, the ATO can group and link high net worth individuals to their controlled and associated entities. All entities within the group will be reviewed.

Review timeframes

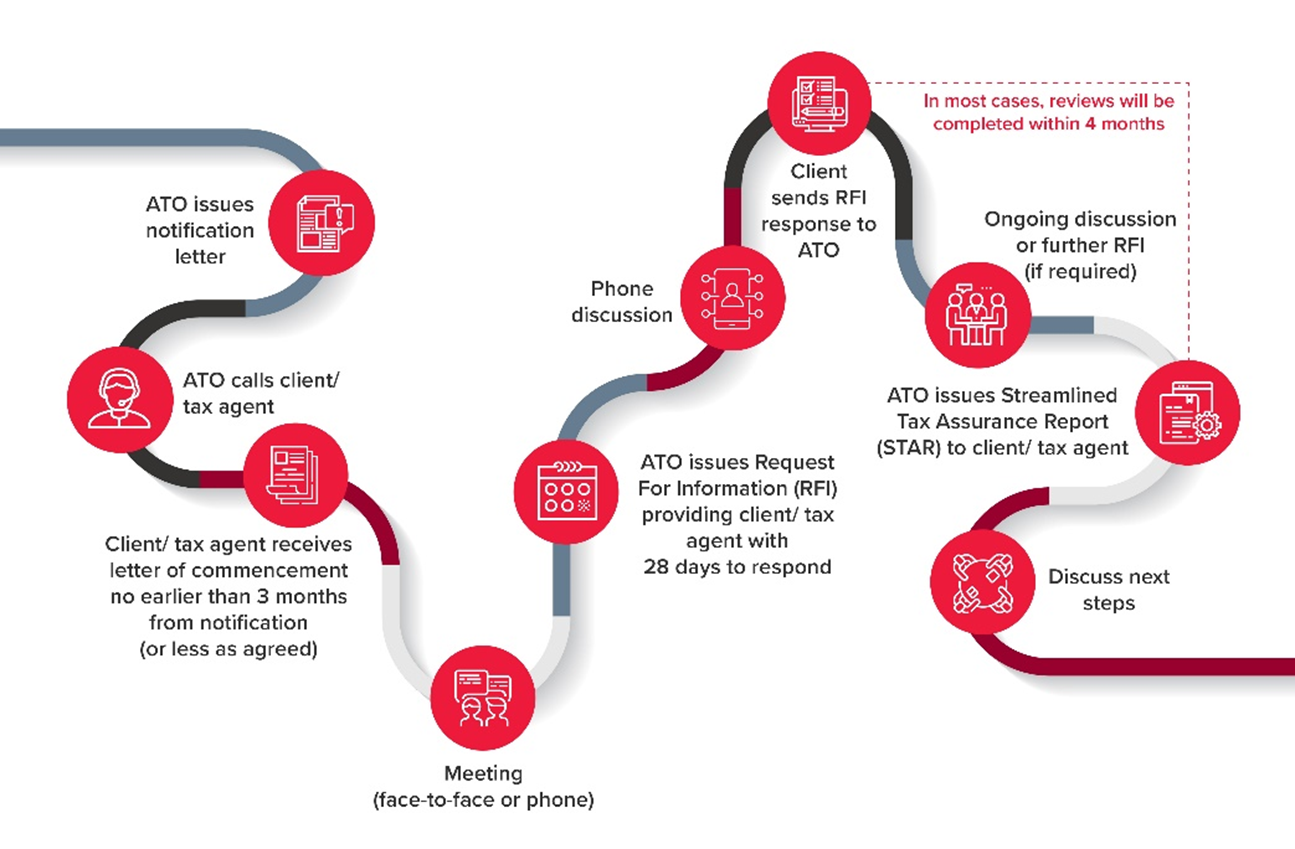

The program focuses on the last two years of lodged income tax returns and the audit process usually lasts four to six months. The ATO has advised that groups subject to the Next 5,000 program are given three months advance notice before commencement of reviews.

The following diagram, based on the ATO’s review roadmap, outlines the expected process and timeframes.

Next 5,000 Program | Client Experience Roadmap

Next 5,000 areas of focus

The key principle underlying these reviews is that of ‘justified trust’, whereby the ATO will try to gain a full understanding of the taxpayer’s unique profile and situation.

The ATO will focus on four key areas:

- Governance: The existence of key roles and responsibilities in recognising, managing and mitigating tax risks

- Tax risks flagged to market: Ensuring none of the risks or concerns raised in Practical Compliance Guidelines (PCG) and Taxpayer Alerts (TA) are present in the group

- New and significant transactions: Whereby new and significant transactions are reviewed, and tax outcomes of these transactions are understood

- Book to tax: Ensuring the difference between business performance and tax performance is not too significant.

Unlike most corporate entities, private family groups often lack documented governance procedures and clear processes. The ATO want private wealth groups to have a clear framework in place, to ensure key management can clearly identify tax risks and mitigate them.

Findings from the Next 5,000 program

Late last year, the ATO released the first key findings of the Next 5,000 program, which showed:

- A lack of documented governance procedures and processes

- A lack of clearly documented roles and responsibilities related to tax governance

- A need for documentation of the tax return preparation and review process, to demonstrate private groups can recognise tax risks and avoid errors

- Evidence that private groups that sought tax advice for material risks were likely to make the correct disclosures and adopt the correct tax treatments.

How can your group be prepared?

Those groups with a clear, structured approach to tax management should find their Next 5,000 review process straightforward and are more likely to achieve better outcomes with the ATO.

We recommend groups have the following in place:

- Clearly documented procedures and processes

- Clearly defined roles and responsibilities for those in your family group and organisation

- Ensure all documents, such as Division 7A agreements, trust distribution and dividend minutes are signed when the decisions are made

- Collate all trust deeds, trust distribution resolutions, company constitutions and constituent documents

- Ensure you have documented the tax return review and return process

- Obtain appropriate written tax advice to support your tax position, especially on large and significant transactions prior to the transaction being undertaken

- Ensure consistency with the different tax reporting systems - i.e. GST, FBT and income tax returns - as the ATO data match the different tax reporting systems.

Governance processes and documentation can take time to put in place, therefore it is recommended that this occurs prior to receiving the ATO notice.

How can BDO help?

We have helped many clients navigate the audit review process to ensure it is as efficient as possible.

Our family business and tax specialists ensure that large, wealthy family groups have the appropriate governance and documentation in place. Contact us to learn more.