In light of challenging market conditions being experienced by investment portfolios, not-for-profit (NFP) boards, finance audit and risk committees (FARCs), and investment committees have been roused to take an in-depth look at their investment processes.

Our Private Wealth team have been engaged in reviewing numerous investment frameworks for NFPs over the past six months. Throughout this process, we have identified several markers for success. In this article, we emphasise how separating duties within your investment framework can help to strengthen it.

Getting your investment framework basics right

At the foundation of the investment process is the investment framework. One common concern raised by boards relates to the underperformance of certain assets over the past 12 months, particularly those in the ‘defensive’ portion of their portfolios. Overexposure to long-duration assets, such as government bonds, has led to large drawdowns in the face of rising interest rates.

From our experience, implementing a strong investment framework helps mitigate the risk of overexposure to such asset classes. It also demonstrates to stakeholders that the necessary steps have been taken to manage and invest funds effectively. Being able to speak to the investment framework at your Annual General Meeting (AGM), will reflect positively on the FARC and/or board.

We have outlined our recommended approach to setting up a robust investment framework, in our article on investment management for not-for-profits.

How can you separate duties in the investment process?

Being a board member of a NFP can be a demanding yet fulfilling job. It’s common practice for boards and/or FARCs to engage third-party professionals to manage their entity’s funds and assist in the investment function. For large NFPs, best practice would be to divide the investment framework’s strategy review and deployment of funds between an investment consultant and an investment adviser.

Our investment framework diagram below, represents the different roles the investment consultant and the investment adviser would manage in our investment framework process.

The financial industry’s lack of transparency and increasing complexity of investment products being offered to NFPs is providing challenges to boards. Having an independent consultant can provide valuable third-party analysis and help reduce risks to the NFP. Dividing the roles of strategy and deployments of funds between the investment consultant and the investment adviser separates duties and decreases the chance of conflicts of interest arising in your framework. In some instances, it can also save on overall fees for the organisation.

Not all NFPs require the services of third-party consultants. However, as a general guideline (although not an absolute rule), we recommend that NFPs with over $8 million in funds under management seek an ongoing independent review of their investment function. In our experience, with this approximate amount of funds, the cost/benefit makes sense to have both an adviser and consultant assisting with the overall investment process. As funds under advice grow, the cost of a consultant can be negligible and have a minimal effect on the after fee return generated.

The difference between the independent consultant and adviser’s role explained

In the above example, the independent investment consultant would meet with the FARC and/or board, to discuss their medium to long-term mission. They would then tie this in with the organisation’s investment policy statement (IPS) to set investment parameters of the strategy, return targets and benchmarks.

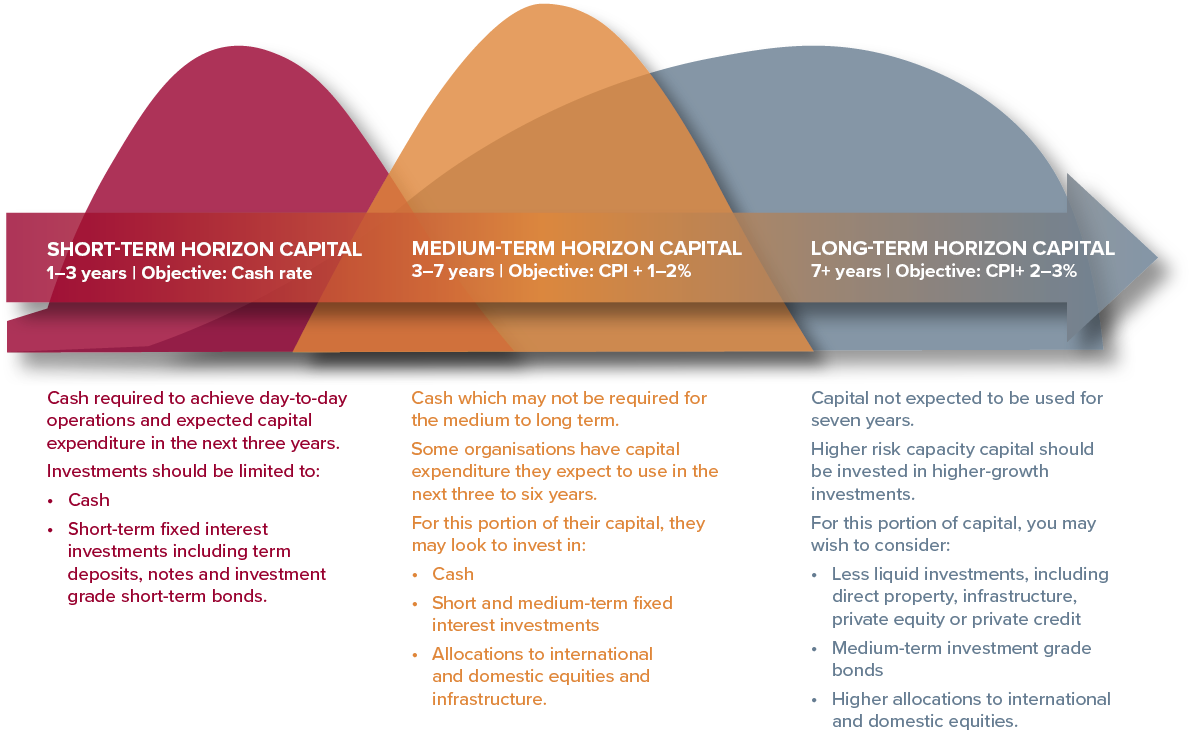

The consultant might set different targets for different strategic objectives, by using a bucket strategy. A bucket strategy refers to the separation of investment objectives according to the different strategic objectives of the NFP. An example of this can be viewed in the diagram below.

Once the investment consultant has helped the organisation create the IPS and tied it to the organisation’s overall objective, it’s time to tender the investment strategy to investment advisers. This process is outlined in the following steps:

- The consultant can help prepare the request for proposal on behalf of the FARC/board, and can review fees, services and portfolios. They will assist the FARC and/or board through the tender process to select one or more advisers for the overall portfolio

- Once chosen, the investment adviser will then physically invest the funds for the NFP and provide an ongoing service to the organisation

- From here, the investment consultant’s role is to ensure the adviser is sticking to the strategy and performing their duties as intended. This includes yearly benchmarking, review of the IPS and portfolio stress testing. This creates an independent framework and reduces the stress and bureaucracy from the FARC and/or board.

BDO’s view on the economy and asset classes

As central bank policy gradually influences global markets, we expect to see further credit crunches. Should wage growth and resulting inflation remain high, interest rates will continue to rise, placing more pressure on credit.

We expect this may result in more downward earnings revisions, and shareholders of underperforming or early-stage companies may face dilution or default. While the consensus among many economists points toward a possible recession in the United States (US) in the midst of the next financial year, a shallow recession could present rare investment opportunities in quality assets.

Having the growth segment of a portfolio invested in companies with strong balance sheets and stable year-on-year earnings growth may provide some protection if we see continued credit stress. On the defensive side, holding a diverse fixed-income portfolio - including allocations to high-quality investment-grade floating and fixed interest rate securities - will also provide some protection should rates remain turbulent.

How can you mitigate risks and ensure the effective management of funds?

The investment and economic landscape is, arguably, as uncertain as ever. The brakes are well and truly on in the US and Australian markets, with many economists predicting a US recession in the next year. A strong governance framework is essential to mitigating risks and ensuring the effective management of funds.

By working with independent investment professionals and utilising third-party consultants where appropriate, NFP organisations can benefit from the knowledge and expertise of the industry while reducing risks.

Upcoming earning seasons across the US and Australia will provide us with a fresh health check on the economy. We remain optimistic about the long-term prospects of a truly diverse portfolio but are also wary of the short-term challenges the global economy may face.

For support in making the right decisions for your NFP’s circumstances and reviewing your investment function, reach out to your local BDO Private Wealth adviser or NFP expert.

Not-For-Profit Webinar Series

In our NFP webinar series, we explore the topic of investments for NFPs, detailing the investment framework and process, while providing examples of how the separation of duties can help strengthen your investment framework. Learn more.