Convertible notes - Are you accounting for these correctly (Part 2)?

In the current economic climate, we continue to see different types of convertible note arrangements, typically entered into by companies needing to offer attractive returns in order to obtain funds from lenders and investors.

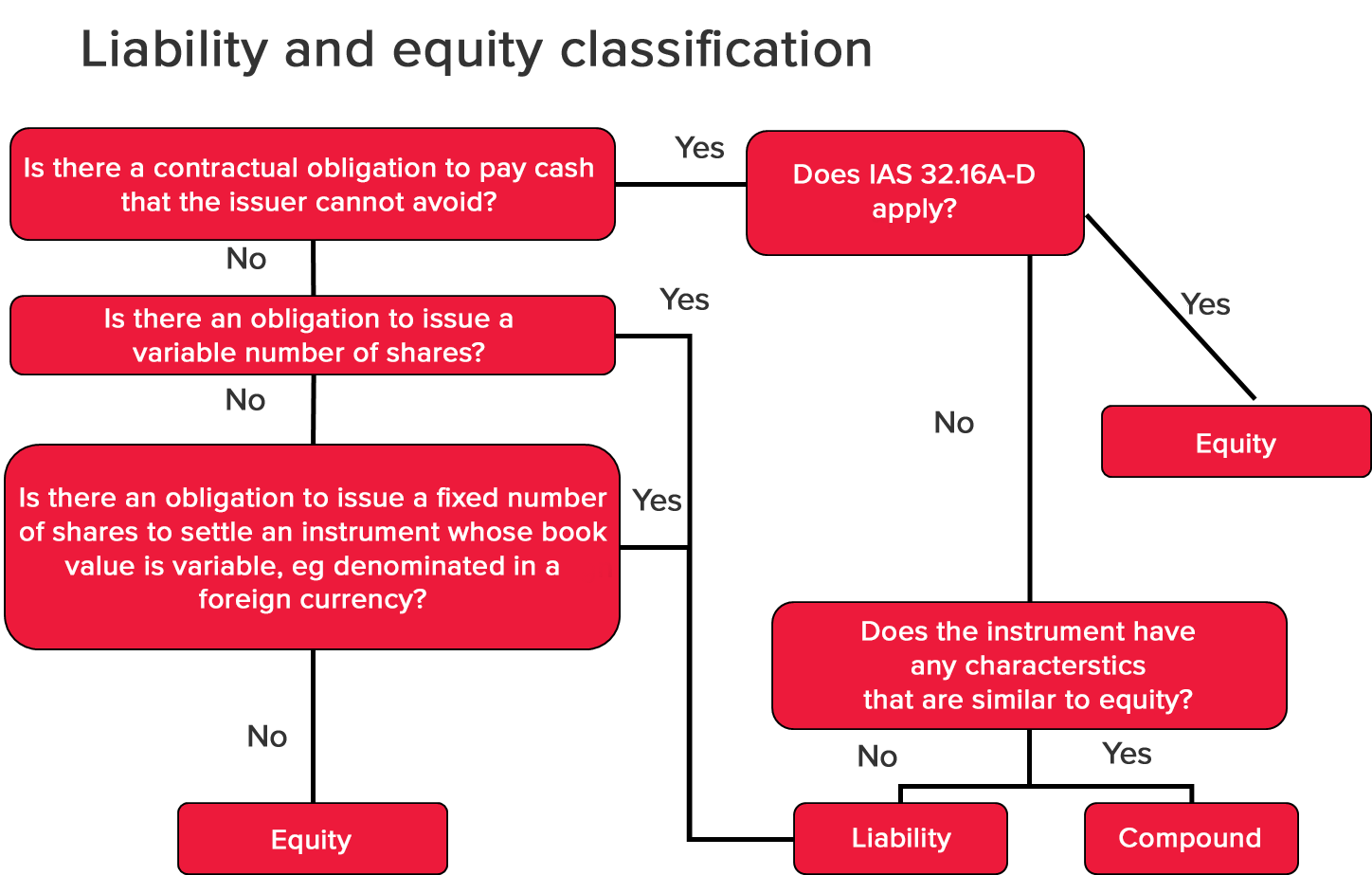

Last month, our Accounting News article summarised the basic requirements for classification of convertible notes by an issuer as either debt (financial liability), equity, or a mixture of both (compound financial instruments).

This month we work through a more detailed example of a convertible note classified as a compound financial instrument (i.e. part debt and part equity). We review the process for classification (using a flowchart), as well as measurement issues and the relevant journal entries.

Example 1 - Facts

Entity A issues a note with a face value of $1,000, maturing three years from its date of issue.

The note pays a 10% annual coupon.

On maturity, the holder has an option either to receive a cash repayment of $1,000 or 10,000 of the issuer’s shares.

The market interest rate for a note without a conversion feature would have been 12% at the date of issue.

Entity A incurred transaction costs of $100 in issuing the convertible note.

The convertible note is denominated in Entity A’s functional currency.

Analysis

The flowchart below illustrates the process Entity A will follow to determine the appropriate classification of this convertible note.

Step one

Starting with the box on the top left hand side of the flowchart above, Entity A has an unavoidable contractual obligation to pay cash because it is required to pay an annual cash coupon of 10%, and could be required to repay the capital amount at the end of three years ($1,000) if the holder chooses not to exercise the conversion option.

This ‘host debt component’ is therefore classified as a financial liability in its entirety because, on a standalone basis, it does not include a feature that is similar to equity.

There is no need for further analysis in the ‘Financial liability’ section of the flowchart because the definition of financial liability has been met.

Step two

When an issuer has an obligation to repurchase financial instruments in certain circumstances, IAS 32 Financial Instruments: Presentation, paragraphs 16A to 16D include exceptions to the usual principles for classifying instruments as financial liabilities. In some cases, such instruments could be classified as ‘equity’, despite an entity having an unavoidable obligation to pay out cash. However, this exception does not typically apply to convertible instruments and is not applicable in this example.

Step three

In Step 3, Entity A considers whether the instrument has any characteristics that are similar to equity. The answer is ‘yes’ because the instrument contains an option to be converted into equity instruments.

This conversion feature is then assessed again on a stand-alone basis using the above flowchart. Starting with the box at the top left hand side of the diagram:

- Entity A has does not have an unavoidable contractual obligation to pay cash. The equity conversion feature can only be settled by Entity A issuing its own equity shares, otherwise it will simply expire unexercised.

- Entity A does not have an obligation to issue a variable number of shares. If exercised, the option will result in Entity A issuing 10,000 shares to the holder.

- There is no foreign currency element because the issuer’s functional currency and the currency of the convertible instrument are the same.

The conversion feature is therefore classified as equity.

Compound financial instrument

The convertible notes issued by Entity A are therefore classified as compound financial instruments because they contain both debt and equity components:

- Debt - Contractual cash flows of 10% annual coupons and a cash repayment of $1,000, and

- Equity - Conversion feature to convert the liability to equity of the issuer.

Entries on initial recognition

As illustrated in the diagram below, the fair value of the debt component (financial liability) is calculated first, and deducted from the fair value of the convertible note to arrive at the amount to be recognised for the equity component (i.e. the equity component is a residual amount). We also noted in Part 1 that in most cases, the fair value of the convertible note equals the transaction price on initial recognition.

| Fair value of convertible note | - | Fair value of the liability1 | = | Equity residual component |

1Discount contractual cash flows using interest rate that would apply to a note without a conversion feature (12%)

The table below illustrates how this calculation is performed in practice.

| Year | Cash flow | Amount | Discount factor at 12 % | Net present value (NPV) of cash flow |

| 1 | Coupon | $100 | 1/1.12 | $89 |

| 2 | Coupon | $100 | 1/1.12^2 | $80 |

| 3 | Coupon and principal | $1,100 | 1/1.12^3 | $783 |

| Fair value of liability component | $952 |

The fair value of the liability component is then deducted from the fair value of the compound financial instrument as a whole, with the balance being taken directly to equity.

| $ |

Transaction price (fair value) | 1,000 |

Less: liability component | 952 |

Equity component (residual) | 48 |

The journal entry on initial recognition is as follows:

| $ | $ | ||

| Dr | Bank | 1,000 | |

| Cr | Financial liability | 952 | |

| Cr | Equity | 48 |

Subsequent recognition

Assume that, at the end of Year 3, the holder elects to receive shares. Entity A derecognises the liability ($1,000) and recognises an increase in equity of the same amount as follows:

| $ | $ | ||

| Dr | Financial liability | 1,000 | |

| Cr | Equity | 1,000 |

No gain or loss is recorded on conversion. Conversely, if the holder elects to receive cash, Entity A simply derecognises the liability of $1,000 and recognises a corresponding decrease in cash of $1,000.

We can see that when the conversion feature is classified as equity, it is not remeasured. Also, even if the conversion option is not exercised, the amount recorded in equity is not reclassified (or ‘recycled’), although it could be transferred from one equity reserve to another. The only item that affects profit or loss is the recognition of interest expense at the effective interest rate for the liability component.

Next month

Next month, in Part 3 we will look at an example of convertible notes with an embedded derivative liability.