Sale and leaseback arrangements under the new leasing standard – IFRS 16

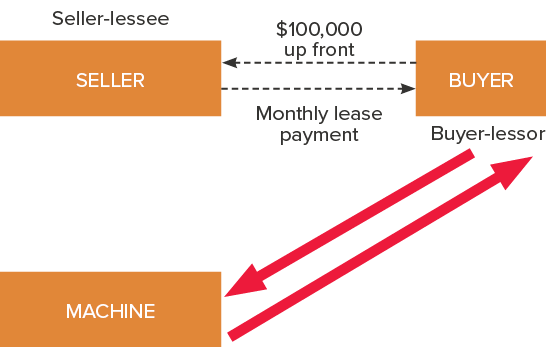

In a sale and leaseback transaction, an entity (the seller-lessee) sells an asset to another entity (the buyer-lessor), which then leases the asset back to the seller-lessee.

As illustrated above, in a sale and leaseback transaction, the machine, owned by the seller, remains on the seller’s premises at all times. The seller receives a lump sum financing amount from the buyer on entering into the sale and leaseback transaction, and the seller (who is now the lessee), makes periodic payments to the buyer (who is now the lessor).

Entering into a sale and leaseback transaction enables the seller-lessee to immediately receive liquid funds from the buyer-lessor from selling the asset, while retaining the right to use the asset. In addition, if the fair value of the asset is greater than its book value, entering into a sale and leaseback transaction can result in an accounting profit being recognised by the seller-lessee.

Accounting for a sale and leaseback transaction under IFRS 16 Leases differs significantly to accounting for a sale and leaseback transaction under IAS 17 Leases.

Treatment under IAS 17

Under IAS 17, the seller-lessee defers the gain on the sale of the transaction if the resulting lease is classified as a finance lease. If the resulting lease is classified as an operating lease, however, the gain is recognised in full if the proceeds of the sale are equal to the asset’s fair value; otherwise the gain is deferred and spread over the lease term.

Treatment under IFRS 16

In order to determine the appropriate accounting treatment under IFRS 16, the sale must first be assessed to determine whether it qualifies as a sale in accordance with the requirements of IFRS 15 Revenue from Contracts with Customers. The required accounting treatments are outlined in the table below:

| Situation | Seller-lessee accounting treatment | Buyer-lessor accounting treatment |

|---|---|---|

| The transfer to the buyer-lessor qualifies as a sale under IFRS 15 |

|

|

| The transfer to the buyer-lessor does not qualify as a sale under IFRS 15 |

|

|

Sale side of the transaction qualifies as a sale under IFRS 15

If the sale side of the transaction qualifies as a sale under IFRS 15, it is necessary to consider whether the sales price as stated in the contract is equal to the asset’s fair value.

In an arm’s length transaction, it is highly likely that the total consideration for the sale and leaseback will be on market terms. However, this does not prevent the consideration received on the sale side of the contract being off-market, with compensating off-market lease payments being made on the leaseback side of the transaction.

IFRS 16 requires the profit or loss on the sale side of the transaction from the seller-lessee’s perspective (and initial measurement of the asset purchased from the buyer-lessor’s perspective) to be determined by reference to the fair value of the asset, not the stated contractual sale price.

Seller-lessees therefore need to determine the fair value of the asset in order to ensure they recognise the correct profit or loss on sale (as do buyer-lessors for the purposes of accounting for the cost of the asset), rather than assuming the asset’s fair value equals the stated contractual sales price.

BDO Comment:

There is uncertainty as to which of the requirements in IFRS a seller/lessee should follow in determining the fair value of an asset subject to a sale and leaseback transaction.

While IFRS 13 Fair Value Measurement is typically the standard that provides guidance on fair value, IFRS 13.6(b) scopes out leasing transactions accounted for in accordance with IFRS 16. Fair value is defined in IFRS 16 itself, however, the definition of fair value in IFRS 16, which is different to the definition of fair value in IFRS 13, is prefaced with ‘for the purpose of applying the lessor accounting requirements in this Standard…’. Therefore, it is unclear which definition of fair value a seller/lessee should apply when applying the sale and leaseback guidance in IFRS 16.

In our view, since IFRS 16 refers to IFRS 15 Revenue from Contracts with Customers in determining whether the transfer of an asset is accounted for as a sale, and IFRS 15 is included in the scope of IFRS 13 for fair value measurement, a lessee should refer to IFRS 13 in applying the sale and leaseback guidance in IFRS 16

If it is determined that the fair value of the asset is less than, or greater than, the contractual sales price, the difference is accounted for by the lessee as an additional borrowing or a prepayment, respectively. Similarly, the lessor accounts for the difference as rents receivable, or deferred rental income, respectively (if the leaseback is classified as an operating lease) or an adjustment to the finance lease debtor (if the leaseback is classified as a finance lease). This is illustrated in the table below:

| Situation | Seller-lessee accounting treatment | Buyer-lessor accounting treatment | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Fair value of asset is < contractual sales price Example:

| Difference accounted for as an additional borrowing

| Difference accounted for as additional rent receivable

| ||||||||||||

Fair value of asset is > contractual sales price Example:

| Difference accounted for as an additional prepayment

| Difference accounted for as deferred rental income

*Deferred income for operating lease and Finance lease debtor for finance lease |

In some cases, when determining the profit or loss on the sale of the asset, it may be easier to compare the contractual leaseback rentals to market rentals (rather than the contractual sales price to the fair value of the leased asset) and IFRS 16 permits this approach to be taken.

Further complication in determining profit or loss on disposal

Finally, as a further complication in the calculation of the lessee’s profit or loss on disposal, it needs to be remembered that a seller-lessee does not transfer control of the whole asset to the buyer-lessor, because it continues to control the same asset during the leaseback period. The seller-lessee is only losing control of the asset subsequent to the leaseback period.

In May 2019 Accounting News, we will include a detailed example to illustrate this concept.

Concluding thoughts

Sale and leaseback transactions enable seller-lessees to free up the funds associated with ownership of an asset, while still being able to utilise that asset. For that reason, sale and leaseback transactions are common in a number of industries.

Accounting for sale and leaseback transactions has become more complex under IFRS 16. To enable a smooth transition to IFRS 16, finance teams should identify sale and leaseback transactions that will still be in effect when IFRS 16 is adopted to ensure that they will be correctly accounted for in the transition process and after adoption.