Implications of expanded significant global entity (SGE) definition – introducing the concept of a notional listed consolidated group

The recent passage of the Treasury Laws Amendments (2020 Measures No. 1) Bill 2020 (the Bill), which received Royal Assent on 25 May 2020, will lead to many more Australian entities being classified as SGEs.

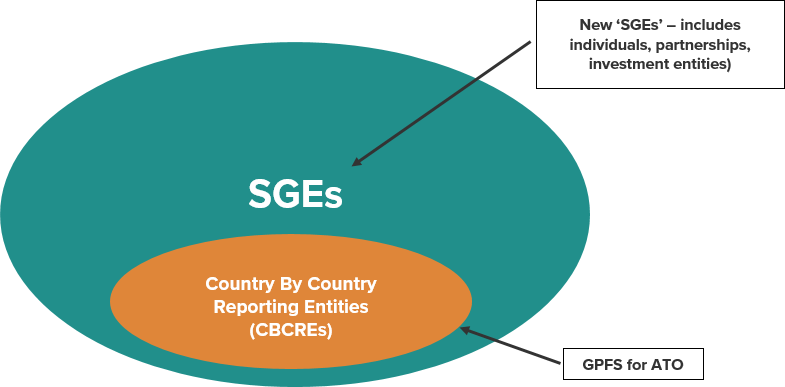

The Bill also introduces a subset of the expanded SGE definition which is broadly aligned to the previous SGE definition. These entities are known as Country by Country Reporting Entities (CBCREs).

While all SGEs will be subject to tax laws aimed at large entities, including substantial penalties for non-compliance with administrative tax matters, only CBCREs will be required to submit general purpose financial statements (GPFS) and Country by Country Reporting related statements to the ATO.What’s changed?

Previously, an entity was only a SGE if it was consolidated for accounting purposes under AASB 10 Consolidated Financial Statements in a group with global income exceeding A$1 billion, and exceptions were provided for entities that were not consolidated due to materiality. The Bill significantly broadens the SGE definition to include a new concept, based on the application of the consolidation rules to a Notional Listed Company Group (NLCG) as shown in the table below.

| Previous definition of SGE | New definition |

A global parent entity or member of a group of entities that is consolidated for accounting purposes and had an annual global income of at least A$1 billion for all members of the group (consolidated). | Includes a notional listed company group (NLCG) which is broadly a group of entities that would be required to consolidate as a single accounting group for accounting purposes, if a member of the group was a listed company, and exceptions to requirements to consolidate were disregarded (including materiality and investment entity exemptions). Note: ‘Entity’ includes individuals, partnerships and trusts |

Country by Country Reporting Entities (CBCREs)

The Bill also introduces a subset of the expanded SGE definition which is broadly aligned to the previous SGE definition. These entities are now known as CBCREs. While all SGEs will be subject to tax laws aimed at large entities, including substantial penalties for non-compliance with administrative tax matters, only CBCREs will be required to submit GPFS and Country by Country Reporting statements to the ATO.

What does this mean for general purpose financial reporting to the ATO?

The requirements for general purpose financial reporting to the ATO is set out in section 3CA of the Taxation Administration Act 1953. Previously, SGEs were defined to include only members of a consolidated group, and therefore only these entities were required to submit GPFS to the ATO. The following types of entities that are excluded from consolidation under AASB 10 were previously excluded from the definition of SGE, and therefore not required to submit GPFS to the ATO:

- Immaterial subsidiaries, and

- Investment entities or subsidiaries of investment entities.

However, due to recent amendments to section 3CA included in the Bill, section 3CA now refers to CBCREs instead of SGEs. It is important to note that CBCREs are a subset of SGEs, which means that not all SGEs will be required to prepare GPFS for the ATO.

The effects of this change mean that the following types of entities must prepare GPFS for the ATO:

- SGEs that previously submitted GPFS because they are part of a group consolidated under AASB 10 Consolidated Financial Statements must continue to prepare and submit GPFS to the ATO because they are now CBCREs, and

- Subsidiaries that were previously exempt from consolidation under AASB 10 Consolidated Financial Statements because they were immaterial to the group are included within the definition of CBCREs and will now be required to submit GPFS to the ATO for years commencing on or after 1 July 2019.

Who will be impacted?

Examples of entities that were not an SGE under the old law but now may be considered an SGE and/or CBCRE under the new law (this is not an exhaustive list) include:

- Entities headed by individuals, partnerships, trusts, private companies and investment companies that are considered an NLCG

- Entities not currently consolidated in global financial statements due to size (materiality), and

- Entities not required by law to prepare financial statements (i.e. privately owned entities or entities owned through trusts) which were therefore not previously part of a consolidated group.

These entities should consider whether they are an SGE or CBCRE and therefore be aware of the particular set of rules that apply to them as a result.

When do the new rules apply?

The new rules apply to income years starting on or after 1 July 2019, so 30 June 2020 year-ends.

More penalties

Failure to lodge penalties

The expanded definition of SGEs may lead to many more Australian entities being SGEs and therefore subject to increased penalties, with base administrative penalties multiplied by a factor of 100 for SGEs. This means that where an entity fails to lodge a taxation document on time, penalties for SGEs will range from $111,000 (28 or less days late) to $555,000 (more than 112 days late), rather than usual penalties which would range from $1,110 to $5,550.

‘Taxation documents’ referred to above include:

- Country by Country Reporting Statements

- Income tax returns

- Business Activity Statements

- FBT returns, and

- General purpose financial statements (for CBCREs only).

Penalties for tax-related adjustments

In addition to increased penalties for late lodgment, SGEs will also be subject to double penalties where there is a tax-related adjustment, ranging from 50% to 150% (rather than 25% to 75%).

Need assistance

Please contact a member of BDO’s Transfer Pricing team of IFRS Advisory team if you require assistance determining whether your entity is an SGE or CBCRE.