Measurement of insurance contracts under IFRS 17

Over the past six months, our Accounting News articles have focused on the features of an insurance contract, and the timing of recognition, i.e. when an entity issuing an insurance contract would recognise the contract in its financial statements. This month we start our journey through the measurement of insurance contracts under IFRS 17 Insurance Contracts.

General measurement model for insurance contracts

All insurance contracts that fall within the scope of IFRS 17 are required to be measured in accordance with the General Model unless they meet the necessary requirements in IFRS 17 to be measured in accordance with either the Premium Allocation Approach or the Variable Fee Approach. For now, we will focus on the General Model.

The General Model comprises the following ‘building blocks’ (identified in paragraph 32 of IFRS 17):

- Fulfilment cash flows, including:

- The insurer’s best estimates of the future cash inflows and cash outflows that relate directly to the fulfilment of the portfolio of contracts, including cash flows relating to any onerous contract liabilities

- An adjustment to reflect the time value of money and the financial risks related to the future cash flows, to the extent that the financial risks are not included in the estimates of the future cash flows, and

- A risk adjustment for non-financial risk, and

- A contractual service margin, which represents the estimated unearned profit the entity will recognise as and when it provides insurance contract services to the policyholder in the future.

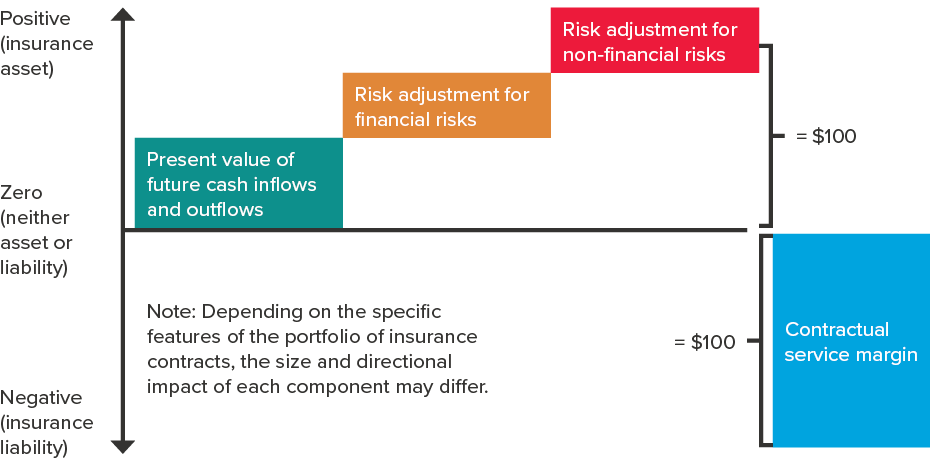

The relationship between these components in the context of a profitable portfolio of insurance contracts can be demonstrated diagrammatically as follows.

GENERAL MEASUREMENT MODEL - PROFITABLE CONTRACTS

Figure 1

As demonstrated in the diagram above, if a portfolio of insurance contracts are determined to be profitable on initial recognition, the contractual service margin is measured at the fulfilment cash flows estimated for the portfolio and initially treated as a reduction in the expected fulfilment cash inflows, the effect of which is to make the initial carrying amount of the portfolio $0 ($100 - $100). This prevents an insurer recognising an asset (and a ‘day-one gain’) in respect to a portfolio of profitable insurance contracts on initial recognition.

Estimates of future cash flows

While developing IFRS 17, the IASB concluded that users of financial statements would be better served by a measurement model that incorporates the current measurement of future cash flows rather a fair value model. The IASB came to this conclusion based on the observation that insurance contracts are typically fulfilled over time by the issuer, rather than transferred to third parties. Accordingly, a key component of the measurement of a portfolio of insurance contracts is the estimated future cash inflows and cash outflows that relate directly to the fulfilment of the portfolio of contracts (as discussed in the June 2021 edition of Accounting News, portfolios of insurance contracts are the principal unit of account under IFRS 17).

IFRS 17 requires all estimates of future cash flows arising from insurance contracts to:

- Incorporate, in an unbiased way, all reasonable and supportable information available (provided that the information is available without undue cost or effort) about the amount, timing and uncertainty of those future cash flows. Consistent with this, entities are expected to estimate the expected value (i.e. the probability-weighted mean) of the full range of possible outcomes (not necessarily every possible scenario)

- Reflect the perspective of the entity, provided that the estimates of any relevant market variables are consistent with observable market prices for those variables, and

- Be current – the estimates are to reflect conditions existing at the measurement date.

The contract boundary

A key concept in identifying these future cash inflows and outflows is the contract boundary.

- Enable the insurer to compel the policyholder to pay the premiums, or

- Impose on the insurer a substantive obligation to provide the policyholder with insurance contract services.

These substantive rights and obligations would be expected to be contained within the contract, but may also arise from law or regulation that applies in conjunction with the contractual terms of the insurance policy.

To further assist entities in identifying the contract boundary of an insurance contract, IFRS 17 clarifies that a substantive obligation to provide insurance contract services ends when:

- The entity has the practical ability to reassess the risks of the particular policyholder and, as a result, can set a price or level of benefits that fully reflects those risks, or

- Both of the following apply:

- The entity has the practical ability to reassess the risks of the portfolio of insurance contracts that contains the contract and, as a result, can set a price or level of benefits that fully reflects the risk of that portfolio, and

- The pricing of the premiums up to the date when the risks are reassessed does not take into account the risks that relate to periods after the reassessment date.

Accordingly, amounts relating to expected premiums or expected claims outside the insurance contract boundary are not included in the measurement of an insurance contract asset or liability as they relate to future insurance contracts.

Cash flows that are normally considered to be within the contract boundary of an insurance contract include:

- Costs incurred to acquire the insurance contract (such as brokerage costs)

- Premiums (including premium adjustments and instalment premiums) specified in the contract

- Policy administration and maintenance costs (such as the costs of premium billing and handling policy changes)

- Incurred claims that are yet to be paid (sometimes referred to as ‘OCR’)

- Incurred claims that are yet to be reported (sometimes referred to as ‘IBNR’)

- Future claims

- Claim handling costs (such as the costs the insurer will incur in investigating, processing and resolving claims under existing insurance contracts)

- Transaction-based taxes (such as premium taxes) and levies (such as fire services levies)

- An allocation of fixed and variable overheads (such as the costs of accounting, human resources, information technology and support) directly attributable to fulfilling insurance contracts, and

- Potential cash inflows from recoveries (such as salvage).

Discounted estimates of future cash flows

As many insurance contracts generate cash flows with substantial variability over a long period of time, IFRS 17 requires the estimates of future cash flows to reflect the time value of money, the characteristics of the cash flows, and the liquidity characteristics of the insurance contracts.

Under IFRS 17, estimates of future cash flows must be reassessed and, if applicable, updated at each reporting date. Consistent with this, IFRS 17 requires that discount rates used to measure the fulfilment cash flows be based on current discount rates as at the measurement date. However, for insurance contracts without direct participation features, interest is accreted on the contractual service margin (discussed below) using the discount rates determined at the date of the initial recognition of the group of contracts.

IFRS 17 permits an entity to use discount rates directly observable in the market if the applicable instrument has the same characteristics as the insurance contracts. However, when observable market rates for instruments with the same characteristics are not available, or observable market rates for similar instruments are available but do not adequately identify the features that distinguish the instrument from the insurance contracts, the entity is required to estimate the appropriate rates. This could be achieved by, for instance, determining the yield curve that reflects the current market rates of return implicit in a reference portfolio of assets that match the expected cash flows of the insurance contracts.

IFRS 17 also requires, to the extent they are not reflected in the estimates of cash flows, the financial risks related to those cash flows. Notwithstanding insurance risks are distinct from financial risks, insurance contracts can expose issuers of such contracts to significant financial risks. For instance, as discussed in our July 2021 edition of Accounting News, the amounts promised under some insurance contracts are linked to investment returns. Payments made under insurance contracts could be linked to other financial variables, such as consumer price indices, cost-of-living indices, share price indices and market interest rates. Nevertheless, where the cash flows of insurance contracts do not vary based on the returns on the assets in a reference portfolio (used to determine appropriate discount rates for the insurance contracts), market risk premiums for credit risk would be excluded from the calculated discount rate.

Risk adjustment for non-financial risk

IFRS 17 requires an entity that issues insurance contracts to adjust the estimate of the present value of the future cash flows of the contracts to incorporate a risk adjustment for non-financial risks. Non-financial risks include:

- Claim development risks (excluding direct inflation index linked risks)

- Lapse and persistency risks (the risk the policyholder will exercise any renewal, surrender, conversion or other option available to them under the policy that changes the amount, timing, nature or uncertainty of the amounts they will receive under the policy), and

- Expense risks (the risk of unexpected changes in costs associated with administering the contract) that are associated with the insurance contracts but are not financial in nature.

Conceptually, the risk adjustment for non-financial risk measures the compensation that the entity issuing the insurance contracts would require to make it indifferent between fulfilling a liability that:

- Has a range of possible outcomes arising from non-financial risk, and

- Will generate fixed cash flows with the same expected present value as the insurance contracts.

Accordingly:

- The measurement of a group of insurance contracts will reflect, on an expected value basis, the insurer’s current estimates of how the policyholders in the group will exercise the options available to them under the policy, and

- The risk adjustment for non-financial risk will reflect the entity’s current estimates of how the actual behaviour of its policyholders, as they impact non-financial variables, might differ from their expected behaviour based on larger and/or more generic populations.

Because the risk adjustment for non-financial risk reflects the compensation the entity would require for bearing the non-financial risk arising from the uncertain amount and timing of the insurance contract cash flows, the risk adjustment for non-financial risk also reflects:

- The degree of diversification benefit the entity includes when determining the compensation it requires for bearing risk, and

- Both favourable and unfavourable outcomes, in a way that reflects the entity’s degree of risk aversion.

Contractual service margin

The contractual service margin (CSM) is a component of the insurance contract asset or liability that represents the estimated unearned profit the entity will recognise as and when it provides insurance contract services to the policyholder in the future.

As demonstrated in Figure 1 above, to avoid an entity recognising an asset (and a ‘day-one gain’) in respect of a portfolio of profitable insurance contracts on initial recognition, the CSM is initially treated as a reduction in the expected fulfilment cash inflows. For portfolios of insurance contracts that have been assessed as loss-making (‘onerous’), the CSM is determined to be zero.

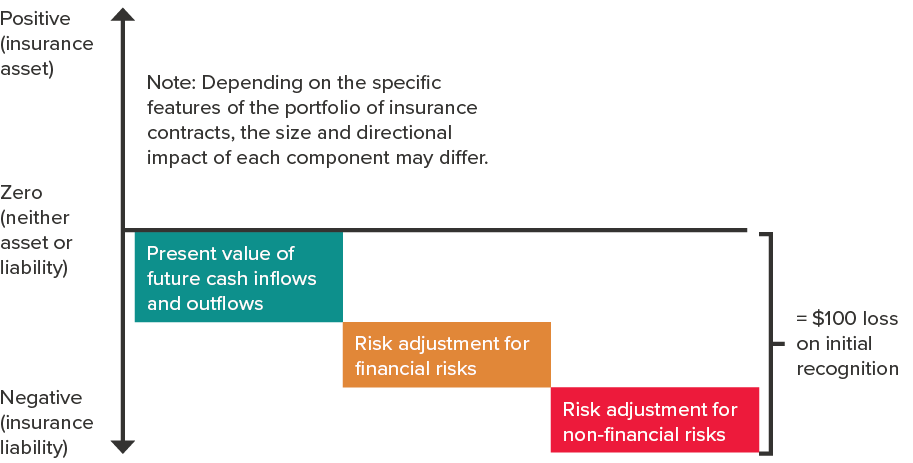

The following diagram demonstrates the relationships between the building blocks when a portfolio of insurance contracts are determined to be onerous on initial recognition.

GENERAL MEASUREMENT MODEL - LOSS-MAKING CONTRACTS

Figure 2

As demonstrated in Figure 2 above, when a portfolio of insurance contracts are determined to be onerous on initial recognition, the portfolio is measured as a liability and a corresponding loss is immediately recognised in profit or loss.

Alternatives to the General Model

As noted earlier, all insurance contracts to which IFRS 17 applies are, in principle, required to be measured using the ‘building blocks’. However, IFRS 17 permits or requires the following alternative measurement models to be applied:

- The Premium Allocation Approach – to be applied to short-term contracts for which the entity reasonably expects that the approach will produce measured amounts that are materially the same as those expected under the General Model, and

- The Variable Fee Approach – to be applied to insurance contracts with direct participation features. For instance, insurance contracts for which, at inception, the contractual terms specify that the policyholder participates in a share of a clearly identified pool of underlying assets and the entity expects to pay the policyholder an amount equal to a substantial share of those underlying assets.

Over the coming months, we will examine in more detail the accounting implications of each of the three measurement methods available under IFRS 17.

More information

For more information about IFRS 17, please refer to our web site or contact a member of BDO’s IFRS Advisory team.