IASB issues guide on selecting and applying accounting policies

On 21 November 2019, the International Accounting Standards Board issued a Guide to Selecting and Applying Accounting Policies – IAS 8 (Guide). The Guide provides a step-by-step walk through of the requirements of the ‘hierarchy’ for selecting and applying accounting policies laid out in paragraphs 10-12 of IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

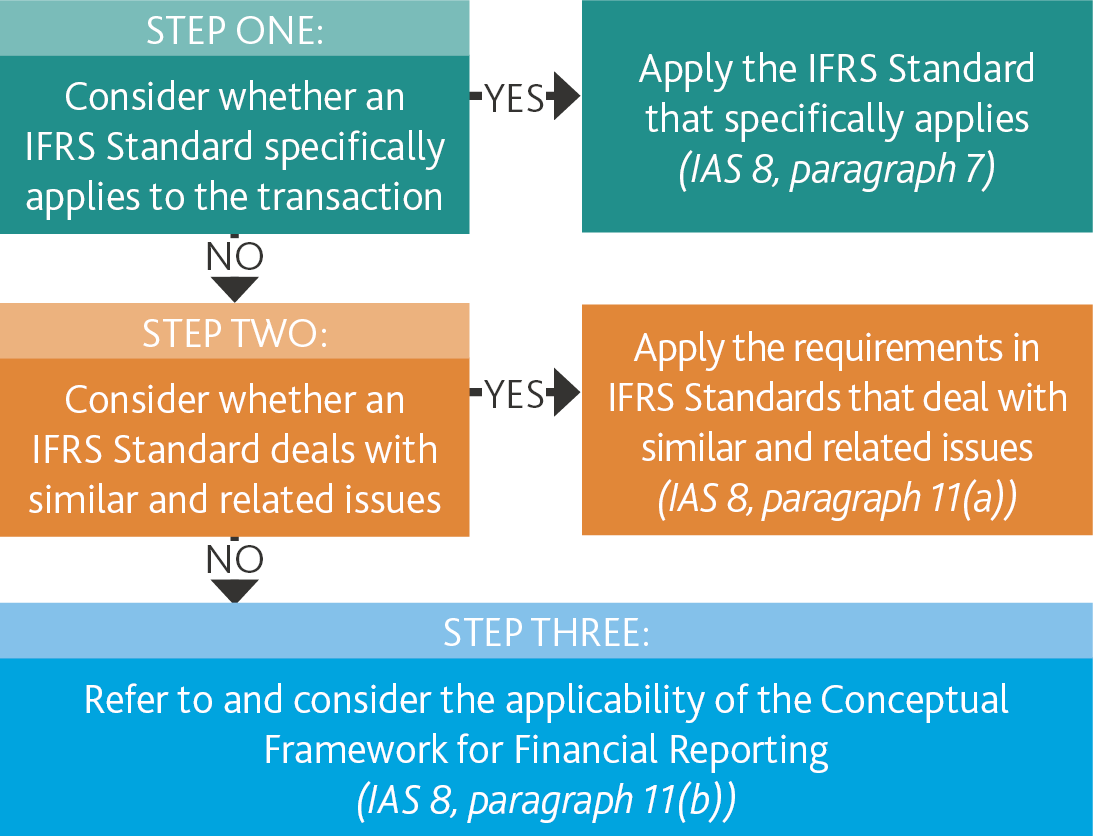

The following flowchart has been extracted from the Guide and summarises the steps for selecting and applying accounting policies for a transaction, event or other condition (transaction).

Step one – Consider whether an IFRS standard specifically applies to the transaction

If there is an IFRS Standard (including Interpretations) that specifically applies to a transaction, other event or condition, the Guide notes that the requirements of that Standard are followed, even if those requirements do not align with the Conceptual Framework for Financial Reporting (Conceptual Framework).

The Guide illustrates this point by using two examples:

- How the timing for recognising a liability to pay a government levy is different if IFRIC 21 Levies (the specific standard) is applied, as compared to the Conceptual Framework, and

- How a financial instrument issued with a ‘dividend blocker’ (i.e. a term specifying that the entity cannot pay an ordinary dividend unless it has paid dividends of a specified amount to holders of the instrument), but no other obligations to pay cash, could be classified differently under IAS 32 (the specific standard), as compared to the Conceptual Framework.

Step two – Consider whether an IFRS standard deals with similar and related issues

Where there are no specific IFRS Standards dealing with a transaction, event or other condition, the Guide notes that the ‘hierarchy’ listed in paragraph 11 of IAS 8 requires preparers to consider IFRS Standards dealing with similar and related issues before consulting the Conceptual Framework for guidance.

The Guide uses an example of back-to-back commodity loans to illustrate this point.

Step three – Refer to and consider the applicability of the Conceptual Framework

The Conceptual Framework is only consulted if both of the following apply, i.e.:

- There is no IFRS Standard that specifically applies to the transaction, event or other condition, and

- There is no IFRS Standard that deals with similar and related issues.

The Guide uses an example of an entity that pays a tax deposit to a tax authority during a tax dispute to illustrate this point. If the outcome of the tax dispute is such that an additional payment is required by the entity, the tax deposit will be used to offset any additional tax liability. If the tax dispute settles in the entity’s favour, the entity will receive a refund from the tax authority. As there are no IFRS Standards that specifically apply to the transaction, nor dealing with similar and related issues, the entity refers to the Conceptual Framework in developing a policy to account for the tax deposit paid.

Other considerations

Recent pronouncements of other standard-setting bodies

In addition to the process outlined in the diagram above, the Guide notes that management is also permitted to consider the most recent pronouncements of other standard-setting bodies (e.g. US GAAP) when selecting and applying accounting policies, but only if all the following apply:

- There is no IFRS Standard (or Interpretation) that applies specifically to the transaction, other event or condition

- That other standard-setting body uses a similar conceptual framework to develop accounting standards, other accounting literature and accepted industry practices, and

- These other sources do not conflict with the Conceptual Framework or with IFRS Standards dealing with similar or related issues.

Disclosures

The Guide highlights that if an entity develops an accounting policy by reference to IFRS Standards dealing with similar and related issues, they also need to consider all the requirements dealing with those issues, including the disclosure requirements.

Disclosure of these transactions is also necessary in order to meet the general presentation and disclosure requirements in IAS 1 Presentation of Financial Statements, including:

- When relevant to an understanding of the entity’s financial position and performance, presenting additional line items in the statement of financial position and in the statement of profit or loss and other comprehensive income

- Disclosing:

- The nature and amount of material items of income and expense

- Information relevant to a understanding of any of the financial statements

- Significant accounting policies, and

- Information about assumptions made about the future, and other major sources of estimation uncertainty.

Where to find the guide

The Guide can be downloaded from the International Accounting Standards Board web site.