Extension of definition of ‘significant global entities’

On 13 November 2019, the Australian Tax Office released an Exposure Draft for consultation that will extend the definition of ‘significant global entities’ (SGEs) and introduce a new concept of a country-by-country (CbC) reporting entity. The changes were originally announced as part of the 2018-2019 Federal Budget.

Current definition of a SGE

Under the current definition, an SGE is a global parent entity or a member of a group of entities that are consolidated for accounting purposes, where the annual global income of all members of the group is at least A$1 billion.

Proposed changes

Under the proposed changes, the SGE definition will continue to apply to proprietary companies, trusts, and partnerships. In addition to this, a new definition of a Notional Listed Company Group (NLCG) has been introduced. Broadly, an NLCG is a group of entities that would have been required to consolidate for accounting purposes if they were part of a listed group and consolidation exceptions (including materiality and investment entity exemptions) were disregarded, where the consolidated annual global income would have been A$1 billion or more.

Once legislated, this revised definition will capture a number of new group structures into the SGE regime. As a result, they will:

- Face increased compliance obligations

- Be subject to new legislative provisions, such as the diverted profits tax

- Be subject to significantly increased administrative and lodgment penalties (for example, the penalties for late lodgment of tax documents can be up to A$525,000).

Example

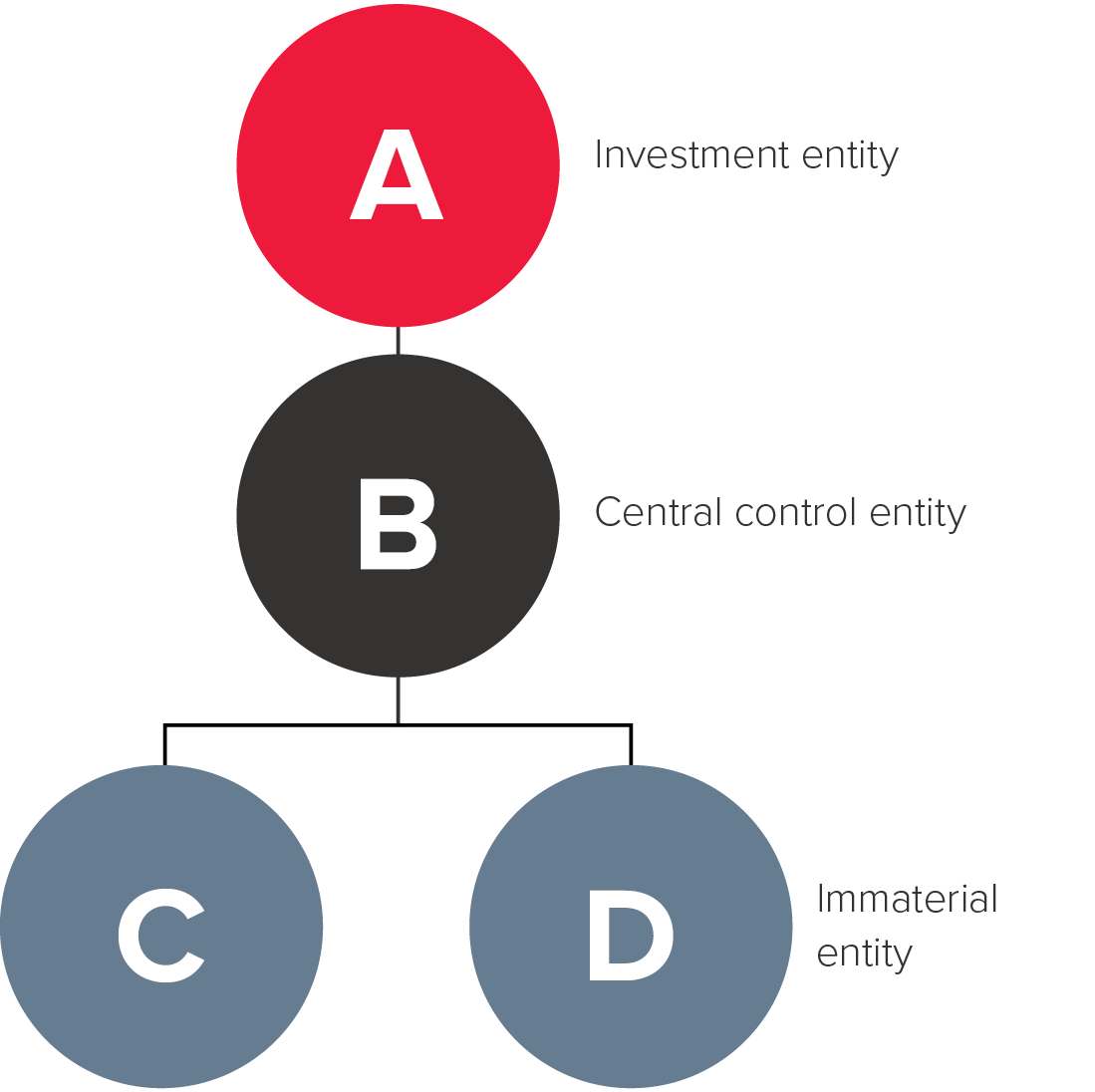

The potential effect is illustrated in the below example.

Current rules

The group in the example will not be an SGE because Company A, an investment entity, will not be required to prepare consolidated accounts due to the Investment Entity exemption.

Proposed changes

The exemption granted to investment entities is removed. As such, if combined annual global income of A, B, C and D exceeds A$1 billion, the group will be classed as an SGE.

Entity D will also be considered an SGE under the new rules because the materiality exemption is also disregarded.

Impact of the change

The broadening of this definition will impact large multinationals who previously fell out of the definition of an SGE due to the way their group was structured.

The new definition (once legislated) will apply from income years starting on or after 1 July 2018, and as a transitional measure, the administrative penalties for non-compliance will apply to income years starting on or after 1 July 2020.

We encourage you to contact BDO’s Transfer Pricing team or your BDO adviser if you think you may be affected by the change, or if you are unsure whether the new changes will apply to your entity.