Not-for-profit entities - What’s new for 31 December 2019 financial reports?

‘Big Bang’

In 2018, unlike the ‘big bang’ experienced by for-profit entities, not-for-profit entities (NFPs) only had one major new standard to implement, AASB 9 Financial Instruments. However, for 31 December 2019 financial statements, NFPs need to implement all of the standards, interpretations and amending standards noted in the article, For-profit entities – What’s new for 31 December 2019, PLUS all the additional ones noted below.

| New standards | |

| AASB 1058 Income of Not-for-Profit Entities | |

| AASB 15 Revenue from Contracts with Customers | |

| New interpretations | |

| Interpretation 22 Foreign Currency Transactions and Advanced Consideration | |

| Amending standards | |

| AASB 2017-1 | Amendments to Australian Accounting Standards – Transfers of Investment Property, Annual Improvements 2014-2016 Cycle and Other Amendments |

| AASB 2018-3 | Amendments to Australian Accounting Standards – Reduced Disclosure Requirements |

| AASB 2018-4 | Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Public Sector Licensors |

| AASB 2018-8 | Amendments to Australian Accounting Standards – Right-of-use Assets of Not-for-Profit Entities |

AASB 1058 Income of Not-For-Profit Entities

AASB 1058 is a new standard which outlines the requirements for income recognition by not-for-profit entities (NFPs). Together with the new revenue standard, AASB 15 Revenue from Contracts with Customers, AASB 1058 is meant to simplify and clarify income recognition for NFPs. While the standard applies for the first time to 31 December 2019 year-ends, the AASB has announced that it will introduce an option for entities receiving research grants to defer this standard until 30 June 2020 year-ends. Refer to article, AASB 1058 and AASB 15 deferred for research grants for more information.

The objective of AASB 1058 is to establish principles for recognising income:

- On transactions where the consideration to acquire an asset is significantly less than fair value principally to enable a NFP to further its objectives, and

- For the receipt of volunteer services.

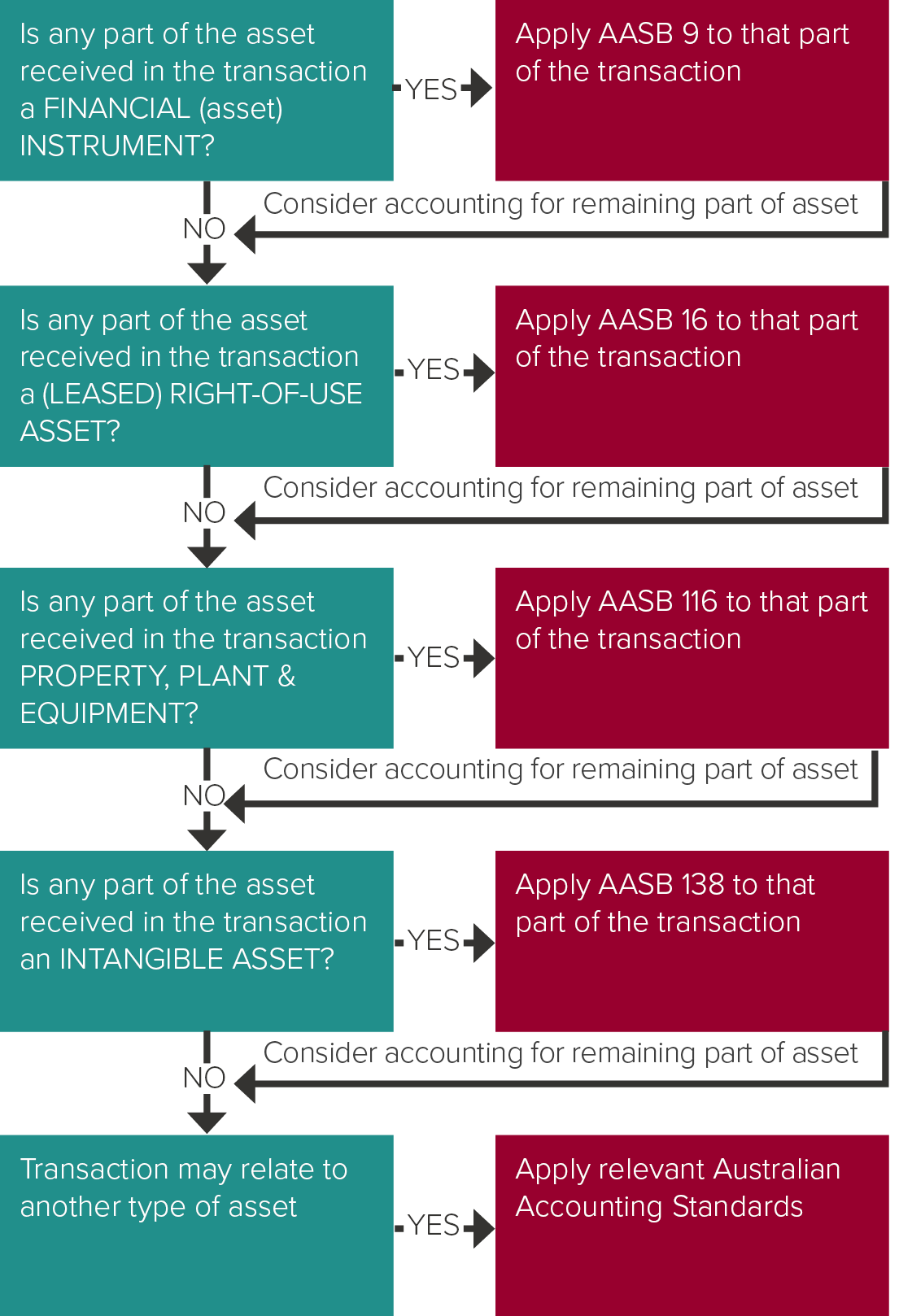

How to recognise and measure the asset acquired

NFPs can still use AASB 1058 as a starting point for recognising assets acquired, even in cases where consideration is not significantly less than fair value, or it is significantly less than fair value but the difference is not principally to enable the NFP to further its objectives. This is because AASB 1058 serves as a roadmap to the relevant Australian Accounting Standard for recognising the asset acquired (debit entry).

Unless a transaction is excluded from the scope of AASB 1058 (e.g. business combinations, share-based payments, etc.), AASB 1058, paragraph 8, requires us to apply the relevant Australian Accounting Standards when recognising an asset acquired or obtained.

Changes have been made to the relevant standards referred to in the diagram above so that assets received at significantly less than fair value in order to enable the NFP to further its objectives are recognised at fair value.

If the asset received by the NFP was on normal commercial terms (i.e. either not significantly less than fair value, and/or not to enable the NFP to further its objectives), then the asset would be measured under the above-mentioned standards at ‘cost’.

The exception to this rule is for ‘peppercorn leases’, where the right-of-use asset is instead measured at ‘cost’ (i.e. present value of actual lease payments), unless the NFP chooses to measure such right-of-use assets at fair value. In line with the requirement to measure other assets at fair value as noted above, the original version of AASB 16 required right-of-use assets resulting from ‘peppercorn leases’ to also be recognised at fair value. However, this requirement was removed in December 2018 when the AASB issued AASB 2018-8 Amendments to Australian Accounting Standards – Right-of-Use Assets of Not-for-Profit Entities, allowing these right-of-use assets to instead be measured at cost. Refer to further discussion on AASB 2018-8 below.

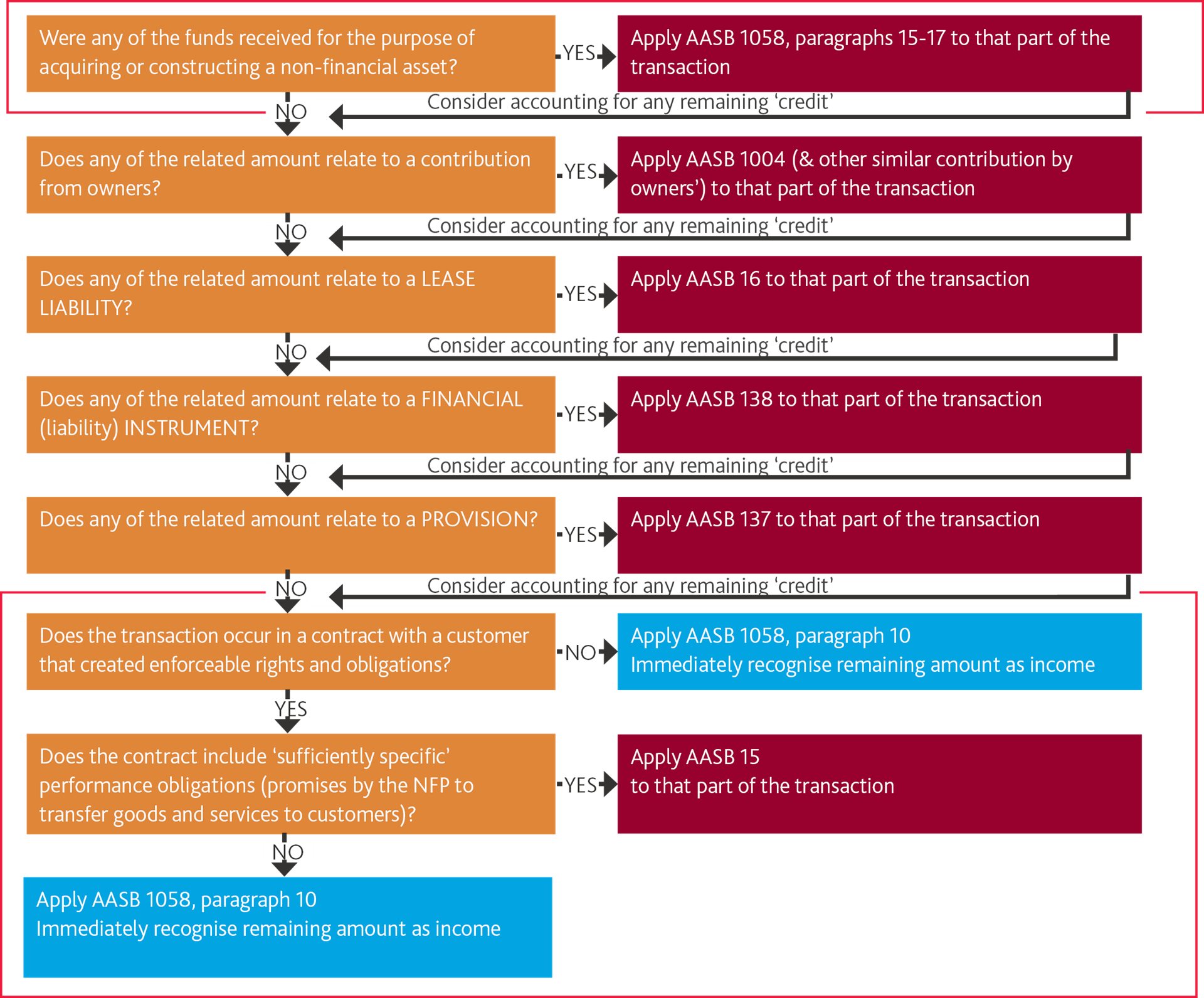

Recognising the credit entry

AASB 1058, paragraph 9 requires that the credit entry is recognised in accordance with other Australian Accounting Standards if/when it meets the criteria to be recognised in accordance with these standards. For example, the credit entry could be recognised as a:

- Contribution by owners (AASB 1004)

- Lease liability (AASB 16)

- Financial instrument (AASB 9)

- Provision (AASB 137 Provisions, Contingent Liabilities and Contingent Assets)

- Revenue or contract liability (AASB 15).

This is illustrated in the decision tree below.

Application of judgement is required to determine which ‘bucket’ the credit entry belongs to.

When all other possibilities for recognising the ‘credit entry’ have been exhausted, NFPs will lastly need to assess whether the transaction can be accounted for as revenue from a contract with a customer under AASB 15. Generally, any excess of the carrying amount of the asset (paragraph 8) over amounts recognised under paragraph 9 is recognised as income immediately in profit or loss (paragraph 10). The exception is when financial assets (e.g. cash) are received to acquire or construct a recognisable non-financial asset (e.g. PPE) that the NFP will control. In such cases, there is no need to proceed down the above decision tree because paragraphs 15-17 will apply to the transaction.

Refer to further discussion at AASB 15 below.

Transition

The ‘date of initial application’ is the beginning of the first annual period in which the entity first applies this standard, i.e. 1 January 2019 for 31 December 2019 year-ends.

AASB 1058 is to be applied either:

- Retrospectively with adjustments to comparatives in accordance with AASB 108 Accounting Polices, Changes in Accounting Estimates and Errors (full retrospective restatement) or

- Retrospectively applying the ‘cumulative catch-up’ approach, with the cumulative effect of initial adjustments recognised in retained earnings on the ‘date of initial application’ (1 January 2019), and no restatement of comparatives.

If the entity applies full retrospective restatement, it need not restate completed contracts or transactions that begin and end within the same annual period, or that are completed contracts or transactions at the beginning of the earliest comparative period (‘opening balance sheet date’, i.e. 1 January 2018), provided it applies this practical expedient to all such contracts.

More information

AASB 15 Revenue From Contracts With Customers

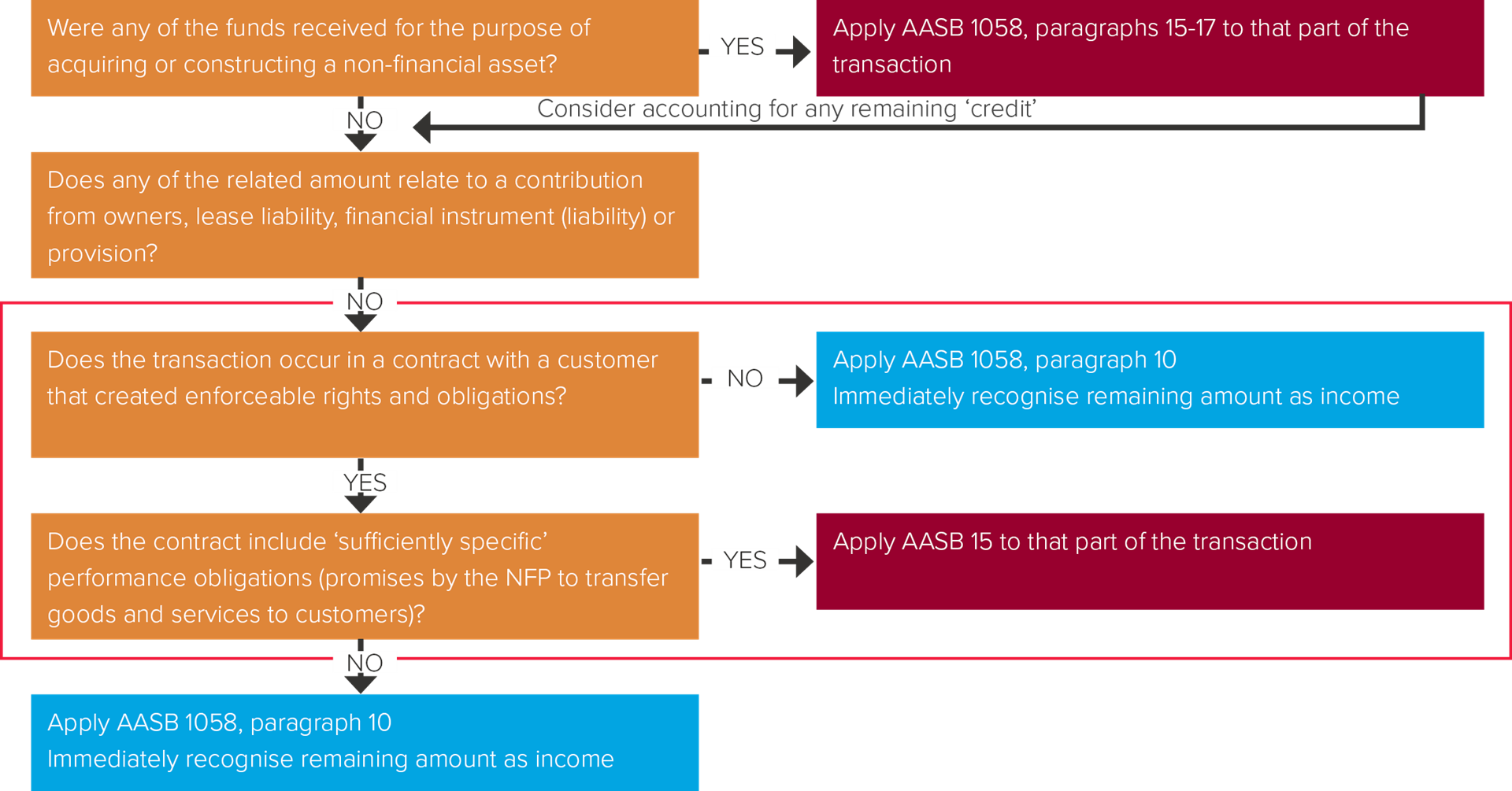

As noted in the discussion for AASB 1058 above, receipt of grants/donations, etc. by NFPs can only be accounted for under AASB 15 if the ‘credit side’ of the entry is not accounted for under another Australian Accounting Standard, and it can be shown that:

- There is an enforceable contract with a customer that creates enforceable rights and obligations, and

- The contract includes promises to deliver goods and services that are ‘sufficiently specific’.

Step one – Is there an enforceable contract with a customer?

AASB 15, Appendix F, paragraphs F5-F19 contain extensive guidance for deciding if:

- There is a customer

- There is a contract, and

- That contract is enforceable.

In a NFP context, the customer is not always the party receiving the goods or services. Donors may typically direct a NFP to provide goods or services to third party beneficiaries.

Step two – Does the contract include ‘sufficiently specific’ performance obligations?

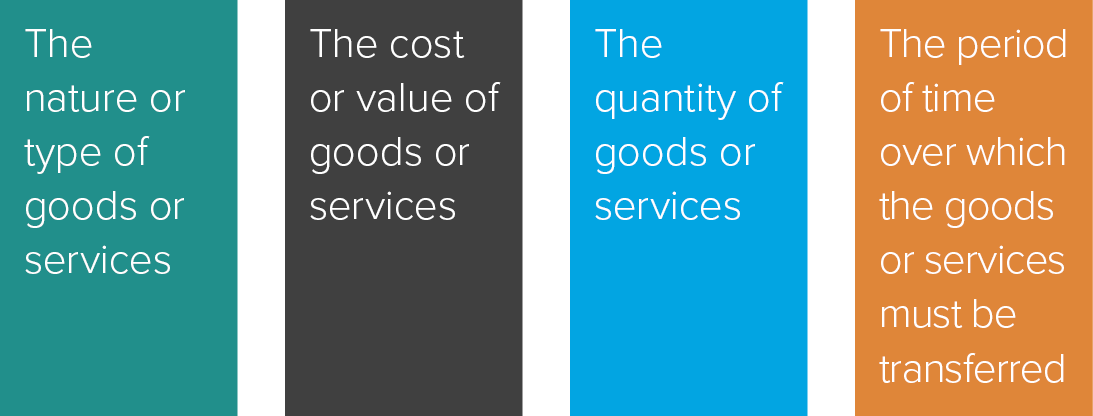

AASB 15, Appendix F, paragraphs F20-F27 also provide detailed guidance on how to determine whether a contract contains ‘sufficiently specific’ performance obligations. In a nutshell, in order for a contract to contain ‘sufficiently specific’ performance obligations:

- The NFP must promise to transfer goods or services to the donor or to other parties on behalf of the donor, and

- That promise must be sufficiently specific such that it can be determined when the NFP has satisfied its obligation to transfer those goods or services.

Judgement is required in this regard, and NFPs would need to consider conditions specified in the arrangement regarding the promised goods or services (both explicit and implicit), such as illustrated below:

More information

AASB 2017-1 Amendments to Australian Accounting Standards – Transfers Of Investment Property, Annual Improvements 2014-2016 Cycle And Other Amendments

Although applying for the first time to NFPs, AASB 2017-1 applied to for-profit entities for annual periods beginning on or after 1 January 2018. Please refer to our March 2017 Accounting News for more information.

AASB 2018-3 Amendments to Australian Accounting Standards – Reduced Disclosure Requirements

AASB 2018-3 sets out the reduced disclosure requirements for AASB 1058 Income of Not-for-Profit Entities. The following disclosures regarding income of not-for-profit entities are not required for entities applying RDR:

- Qualitative information about the entity’s dependence on volunteer services it receives (including those not recognised)

- Qualitative information about the entity’s dependence on inventories held but not recognised as assets during the reporting period

- Explanation of when the entity expects to recognise income from liabilities for unsatisfied performance obligations at the end of the reporting period

- For obligations settled over time, an explanation of why the methods used provide a faithful depiction of the entity’s progress toward satisfying its obligation, and

- Information about externally imposed restrictions that limit or direct the purpose for which resources controlled by the entity may be used.

AASB 2018-8 Amendments to Australian Accounting Standards – Right-Of-Use Assets Of Not-For-Profit Entities

Australian Accounting Standards generally require not-for-profit entities (NFPs) to measure the ‘asset’ side of a grant/donation contract at fair value if the consideration given for the asset is significantly less than fair value in order to enable the NFP to further its objectives. This includes the right-of-use (ROU) asset in a ‘peppercorn lease’ recognised by NFP lessees.

Due to complications in determining fair value for such restricted use assets (e.g. for peppercorn leases), the Australian Accounting Standards Board removed this requirement in December 2018. AASB 2018-8 now requires these ROU assets to be measured at ‘cost’ (i.e. the default measurement under AASB 16 for all entities), but permits a choice to measure them at fair value under AASB 13 Fair Value Measurement.

Additional disclosures where the ‘cost’ option is used

Where NFP lessees use the ‘cost’ option for ROU assets subject to peppercorn leases, the following additional disclosures are required:

- Information about the NFP’s dependence on peppercorn leases, and

- Details of the nature of the leases, including lease payments, the lease term, a description of the underlying asset, and restrictions on the use of the underlying asset specific to the entity.

The above information must be provided individually for each material peppercorn lease.

More information – Free BDO resources

More information on the above amendments is available in our:

- November 2019 webinar, Getting Ready for 31 December 2019.

Need help?

If you require any assistance implementing any changes to your December 2019 financial statements, please contact your engagement partner or a member of our BDO IFRS Advisory team.