More relief proposed in AASB 1 for entities transitioning to Simplified Disclosures

For years ending 30 June 2022 onwards, certain for-profit private sector entities will be required to prepare general purpose financial statements (GPFS). These include entities required by:

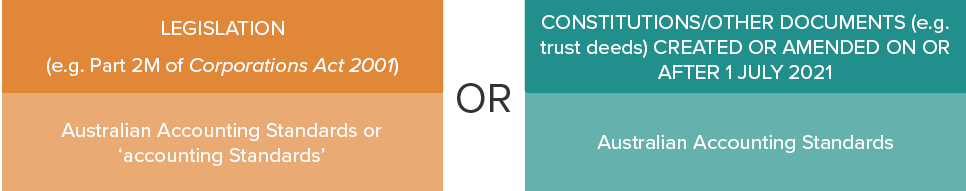

- Legislation to prepare financial statements in accordance with Australian Accounting Standards (AAS) or ‘accounting standards’

- Their constitutions, trust deeds or other documents (such as lending agreements) to prepare financial statements in accordance with AAS, if the document was created or amended on or after 1 July 2021.

The path from special purpose financial statements (SPFS) to GPFS is straight forward if an entity has complied with all the recognition and measurement requirements of AAS (including preparing consolidated financial statements where applicable). However, it can be a complicated and time-consuming process where this is not the case. In creating an ‘opening balance sheet’ at the beginning of the earliest comparative period (transition date) that complies with AAS, the entity will need to navigate, and elect to apply, some of the optional exemptions contained in AASB 1 First-time Adoption of Australian Accounting Standards.

The Australian Accounting Standards Board (AASB) therefore published Exposure Draft ED 315 Extending Transition Relief under AASB 1, proposing two amendments to ease the burden for entities transitioning to GPFS as follows:

Proposed amendments to… | Current requirements | Details of proposed changes | Entities to benefit |

AASB 1, paragraph D16(a) | Where a subsidiary prepares GPFS for the first time (i.e. becomes a first-time adopter) later than its parent, AASB 1, paragraph D16(a) allows the subsidiary to measure its assets and liabilities in its opening balance sheet at the carrying amount that would be included in the parent’s consolidated financial statements, based on the parent’s date of transition to AAS. This assumes that no adjustments are made for:

| ED 315 proposes to extend this optional exemption to situations where the parent prepares IFRS financial statements. | Foreign controlled entities whose parent entity prepared IFRS financial statements (rather than AAS) will be able to apply this exemption. |

AASB 1053, paragraph 20A (added) | AASB 10, paragraph Aus 4.2 exempts the ultimate parent entity in an Australian group from preparing consolidated financial statements if the parent entity or the group is a non-reporting entity. In other words, separate GPFS can be prepared, without consolidation. For periods ending 30 June 2022, this exemption no longer applies. | ED 315 proposes to allow for-profit private sector entities transitioning from unconsolidated Reduced Disclosures (RDR) GPFS to consolidated Simplified Disclosures GPFS to apply AASB 1 when preparing consolidated financial statements for the first time. | Country by country reporting entities that previously prepared separate general purpose financial statements for the Australian Tax Office because it was a non-reporting entity, and therefore exempt from preparing consolidated financial statements. |

Proposed application date

In order to assist these entities preparing their first set of GPFS, or their first consolidated financial statements for Simplified Disclosures, the AASB is proposing that these amendments apply to annual periods ending on or after 30 June 2022, i.e. the first reporting periods to which mandatory GPFS are required.

Comments close

The AASB is seeking comments by 27 January 2022.