Implications of COVID-19 for lessors - Your questions answered

In September 2022, the IFRS Interpretations Committee issued an agenda decision dealing with lessor forgiveness of lease payments. While the content of this article remains applicable and relevant, BDO has withdrawn its publication, IFRB 2020 12 Implications of COVID-19 for Lessors (IFRS 16) because most of the content is contained in the agenda decision.

While recent changes to IFRS 16 Leases include a practical expedient to simplify the accounting by lessees receiving COVID-19-related rent concessions, no similar leniency has been provided for lessors. Further, IFRS 16 provides no specific guidance as to how lessors should account for rent concessions and other implications of IFRS 16 arising from COVID-19.

BDO recently updated International Financial Reporting Bulletin, IFRB 2020 12 Implications of COVID-19 for Lessors (IFRS 16) which answers questions lessors may have when accounting for the impacts of COVID-19. In addition, ASIC’s FAQ 9B How should a landlord account for rent concessions? includes useful guidance on lessor accounting for rent concessions in an Australian context. This article summarises the key points from these resources.

ASIC’s FAQ 9B

The National Cabinet Mandatory Code of Conduct: SME Commercial Leasing Principles (Code), and related State and Territory legislation (which is consistent with the Code), sets out good faith leasing principles to be applied between landlords and tenants of commercial properties that are eligible for ‘job keeper’ government stimulus measures and have turnover up to $50 million. The main principles include that:

- During the COVID-19 pandemic period, landlords should offer tenants proportionate reductions in rent payable in the form of waivers and deferrals of up to 100% of the amount ordinarily payable, on a case-by-case basis, based on the reduction in the tenant’s trade during the COVID-19 pandemic period and a subsequent reasonable recovery period.

- Of the rent reduction noted above:

- At least 50% should be in the form of a waiver, and

- The remaining amount should be deferred and amortised over the greater of the remaining lease term or 24 months, unless otherwise agreed by the parties.

Determining the appropriate date for lessors to account for rent concessions on operating leases is key because it can have a significant impact on their 30 June 2020 financial statements.

ASIC’s FAQ 9B notes that State and Territory legislation by themselves do not change a rent agreement. This is because they do not compel a landlord to agree to rent concessions, they merely embody good faith principles for determining rent concessions. As such, there is only a lease modification to account for when negotiations have taken place between a landlord (lessor) and lessee, and the parties have agreed to vary the lease payments.

Most of the main issues included in FAQ 9B are described in more detail in BDO’s FAQs below. However, FAQ 9B makes the following additional relevant points:

- If the tenant has paid rent for a period of occupancy up to reporting date, there is no receivable against which an expected credit loss (ECL) provision can be made. If the lessor expects to then waive some or all of this rent already paid, the lessor cannot recognise a liability at reporting date because there has been no formal agreement with the lessee. However, the financial statements should include prominent disclosure of material expected waivers to take place after reporting date, including waivers actually approved prior to completion of the financial statements.

- Rent concessions agreed after the reporting date are non-adjusting subsequent events and do not affect lease revenue recognised up to reporting date. However, such agreements may provide additional information relevant to determine ECL on outstanding rental receivables due at reporting date.

BDO’s FAQs

BDO’s updated IFRB 2020 12 Implications of COVID-19 for Lessors (IFRS 16) contains three sections of FAQs as follows:

- Section 1 – Operating lease FAQs

- Section 2 – Operating lease – Modification FAQs

- Section 3 – Finance lease FAQs.

A summary of the FAQs is included below.

BDO’s operating lease FAQs

The table below provides a brief summary of general lessor accounting questions relating to operating leases that are included in IFRB 2020 12 Implications of COVID-19 for Lessors (IFRS 16).

However, where there are alternative approaches, Australian entities should take into account ASIC's views when determining the appropriate accounting treatment.

FAQ | Question | Brief summary of answer (please refer to IFRB 2020 12) for more information |

1.1 | What approaches are permitted for recognising operating lease income when the collectability of lease payments is uncertain? | Approach 1 (BDO’s preferred approach) Continue recognising lease income and test the lease receivable for impairment (see FAQ 1.2 below) Confirmed by ASIC FAQ 9B Approach 2 Only recognise operating lease income to the extent lessor believes it is collectible. Not accepted by ASIC per FAQ 9B Note: Approach 1 is the preferred approach because IFRS 16 does not require a collectability criterion to be met in order to recognise lease income. IFRS 16 contains requirements for income recognition, therefore analogising to other IFRS (e.g. IFRS 15) is not appropriate. |

1.2 | How does a lessor account for operating lease receivables after initial recognition? Updated February 2021 | Lessors may recognise three types of ‘receivables’ in the statement of financial position as a result of operating leases:

Lease receivable

Confirmed by ASIC FAQ 9B Assets from straight-lining operating lease income & lease incentives

|

1.3 | Can lessors change the basis over which they recognise operating lease income where the effects of COVID-19 have caused lessors to restrict access to underlying assets (e.g. from a straight-line basis to another systematic basis that is more representative of the pattern in which the benefit from using the underlying asset is diminished)? |

|

1.4 | Can lessors suspend or modify the basis for depreciating the underlying asset (e.g. a building when tenants are not permitted to access due to government lockdowns)? | Generally ‘no’.

|

1.5 | What is a lease modification | Lease modification

In Australia, Government has not mandated any rent concessions. They have merely suggested that landlords and tenants negotiate rent concessions. Not a lease modification

Note: ‘Force majeure’ clauses need to be examined carefully to determine whether rent concessions granted due to COVID were contemplated in the original lease contract in order to determine if there is a lease modification. |

1.6 | How does a lessor account for a change in consideration that is not a lease modification? |

|

BDO’s operating lease FAQs – Modifications

The table below provides a brief summary of lessor accounting questions relating to modifications of operating leases that are included in IFRB 2020 12 Implications of COVID-19 for Lessors (IFRS 16).

FAQ | Question | Brief summary of answer (please refer to IFRB 2020 12) for more information |

2.1 | How does a lessor account for changes in operating lease payments that are due and receivable where there has been a lease modification? | Approach 1

Confirmed by ASIC FAQ 9B Approach 2 (forgiveness = a modification)

Not accepted by ASIC per FAQ 9B |

2.2 | How does a lessor account for changes in operating lease payments relating to future periods? |

Confirmed by ASIC FAQ 9B |

2.3 | How does a lessor account for unamortised lease incentives at modification date and on a go forward basis? |

|

2.4 | How does a lessor account for a change in timing of lease payments when the nominal cash flows are unchanged? |

|

BDO’s finance lease FAQs

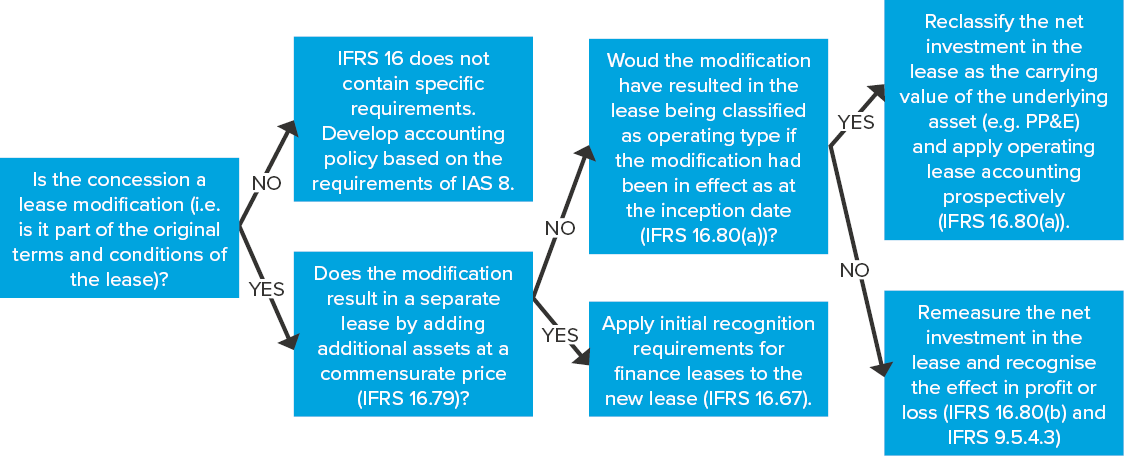

FAQ 3.1 addresses questions of how lessors account for a modification to a finance lease which are summarised on the diagram below.

If the modification is accounted for as a separate lease, the usual requirements for finance lease accounting by lessors will apply (refer IFRS 16, paragraph 67).

However, if a lease modification is not accounted for as a separate lease, then the effect of the lease modification will depend on whether the lease modification would have resulted in the lease still being classified as a finance lease if that modification had been in effect at inception:

- If the lease modification resulted in reduced consideration, and this change would have resulted in the lease being classified as an operating lease at the inception of the lease, then no immediate effect in profit or loss is recorded because the net investment in the lease is reclassified as property, plant and equipment and operating lease accounting commences on a prospective basis.

- If the reduction in consideration would have resulted in the lease remaining as a finance lease, the effect of the lease modification is immediately recorded in profit or loss. This is because IFRS 16 requires IFRS 9, paragraph.5.4.3 to be applied. The gross carrying amount is recalculated based on the present value of the renegotiated or modified contractual cash flows, discounted using the original effective interest rate, and any differences are recognised in profit or loss.

Need help?

If you require assistance determining the appropriate lessor accounting for COVID-19 impacts, please contact BDO’s IFRS Advisory Team.