NFP private sector entities to disclose extent of compliance with recognition and measurement requirements in Australian Accounting Standards

For years ending 30 June 2020, not-for-profit (NFP) private sector entities preparing special purpose financial statements (SPFS) must disclose the extent to which they have complied with the recognition and measurement requirements in Australian Accounting Standards.

New disclosures required

Paragraph 9A has been added to AASB 1054 Australian Additional Disclosures to require the following additional disclosures:

- Disclose the basis on which the decision to prepare special purpose financial statements was made

- Where the entity has interests in other entities – disclose either:

- Whether or not its subsidiaries and investments in associates or joint ventures have been consolidated or equity accounted in a manner consistent with the requirements set out in AASB 10 Consolidated Financial Statements or AASB 128 Investments in Associates and Joint Ventures, as appropriate. If the entity has not consolidated its subsidiaries or equity accounted its investments in associates or joint ventures consistently with those requirements, it shall disclose that fact, and the reasons why, or

- That the entity has not assessed whether its interests in other entities give rise to interests in subsidiaries, associates or joint ventures, provided it is not required by legislation to make such an assessment for financial reporting purposes and has not made such an assessment

- For each material accounting policy applied and disclosed in the financial statements that does not comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128), disclose an indication of how it does not comply; or if such an assessment has not been made, disclose that fact, and

- Disclose whether or not the financial statements overall comply with all the recognition and measurement requirements in Australian Accounting Standards (except for requirements set out in AASB 10 or AASB 128) or that such an assessment has not been made.

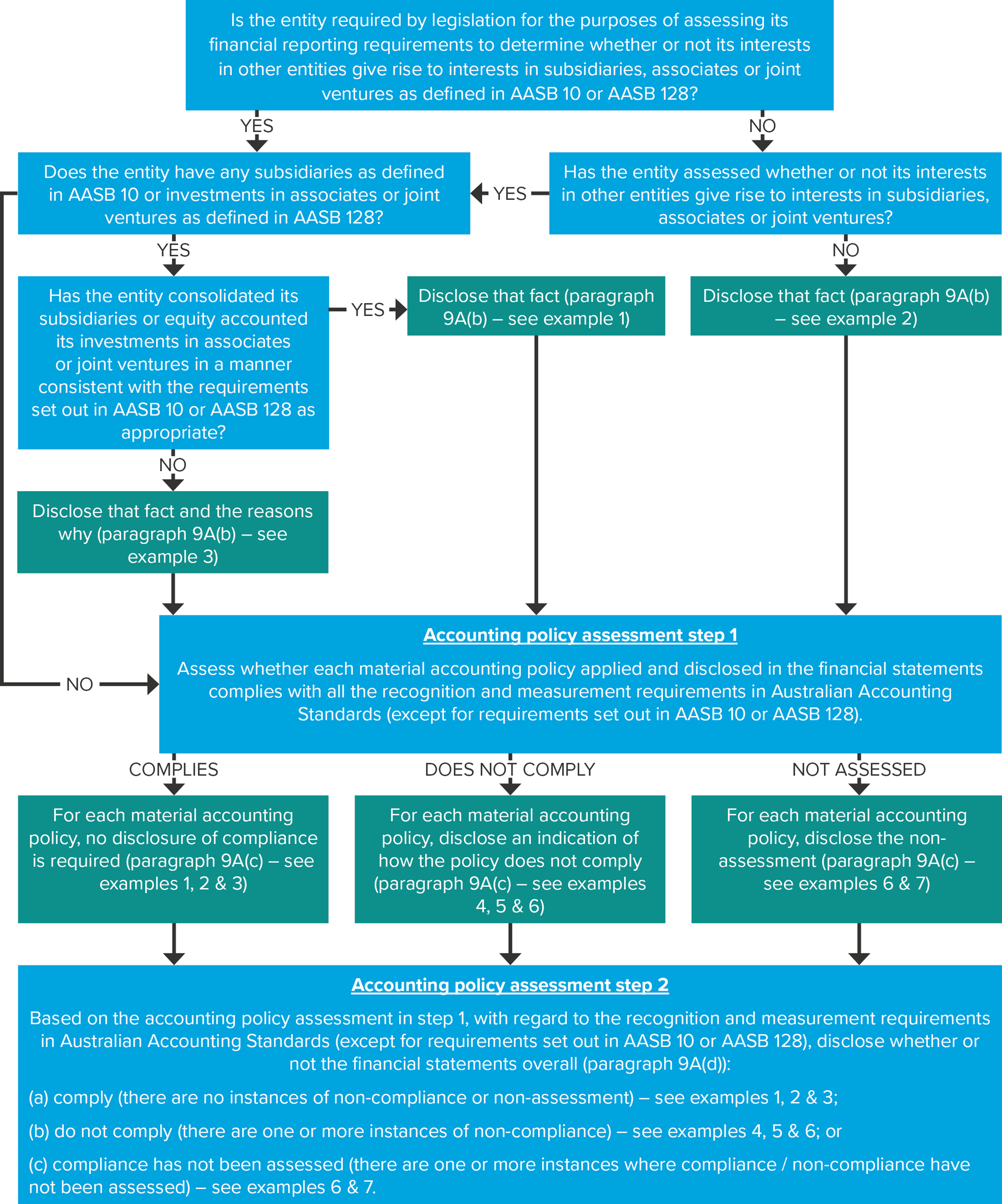

To assist preparers of financial statements, AASB 2019-4 adds Implementation Guidance to accompany AASB 1054, including illustrative disclosure, depending on the NFP’s circumstances. Specifically, Chart 1, extracted below from AASB 2019-4 (page 8), serves as a useful roadmap for preparers to determine the appropriate disclosures.

More information

Please contact your BDO adviser if you require assistance preparing these disclosures.