Accounting for associates

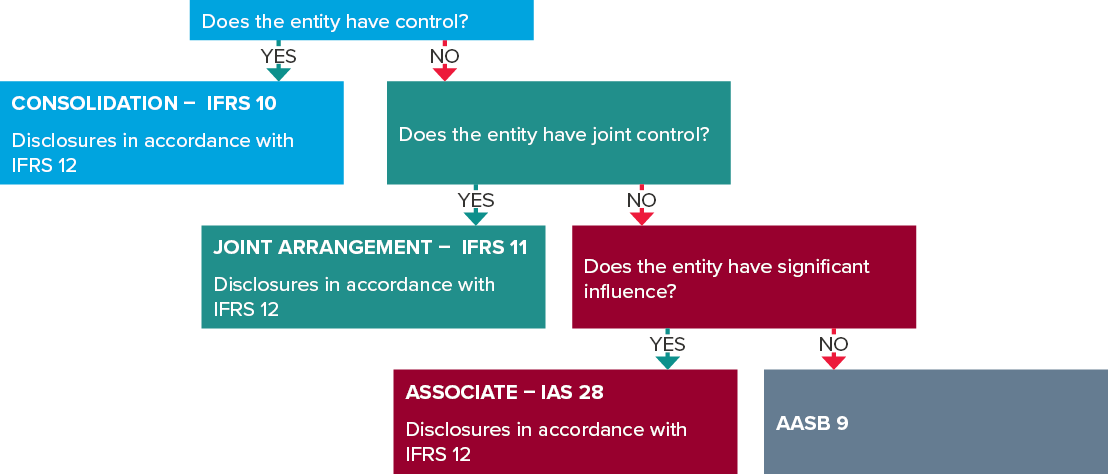

Continuing our series for Getting Ready for General Purpose Financial Statements, this month we look at accounting for associates. If you assess that your investment is not a controlled entity, nor a joint arrangement, you may need to account for it as an ‘associate’.

IAS 28 Investments in Associates and Joint Ventures is the Accounting Standard that deals with accounting for investments in associates.

What is an associate?

An associate is an entity over which the investor has significant influence.

Definition of ‘associate’ in IAS 28

What constitutes significant influence’?

Significant influence is the power to participate in the financial and operating policy decisions of the investee, but is not control or joint control of those policies.

Presumption of significant influence if hold 20% or more of voting rights

There is a presumption that an investor has significant influence if it holds (directly or indirectly) 20% or more of the voting rights of the investee.

Conversely, if it holds less than 20% of the voting rights, it does not have significant influence, unless it can be clearly demonstrated that the investor does have significant influence.

Indicators of significant influence

Significant influence is usually evidenced if one or more of the following are present:

- The investor has representation on the board of directors

- The investor participates in the policy-making process, including decisions about dividend distributions

- There are material transactions between the investor and the investee

- There is interchange of personnel between the investor and the investee, and

- The investor provides essential technical information to the investee.

How does the existence of potential voting rights affect significant influence?

An investee entity may have issued warrants, share call options, or convertible debt or equity that have the potential, if exercised or converted, to give the holder additional voting rights over its financial and operating policies (potential voting rights).

If these potential voting rights are currently exercisable or convertible, they are included by the investor when applying the ‘20% test’ described above to determine if it has significant influence. If they are not currently exercisable or convertible (e.g. they cannot be exercised or converted until a future date or until the occurrence of a future event), they do not get counted as part of the ‘20% test’.

How are associates accounted for?

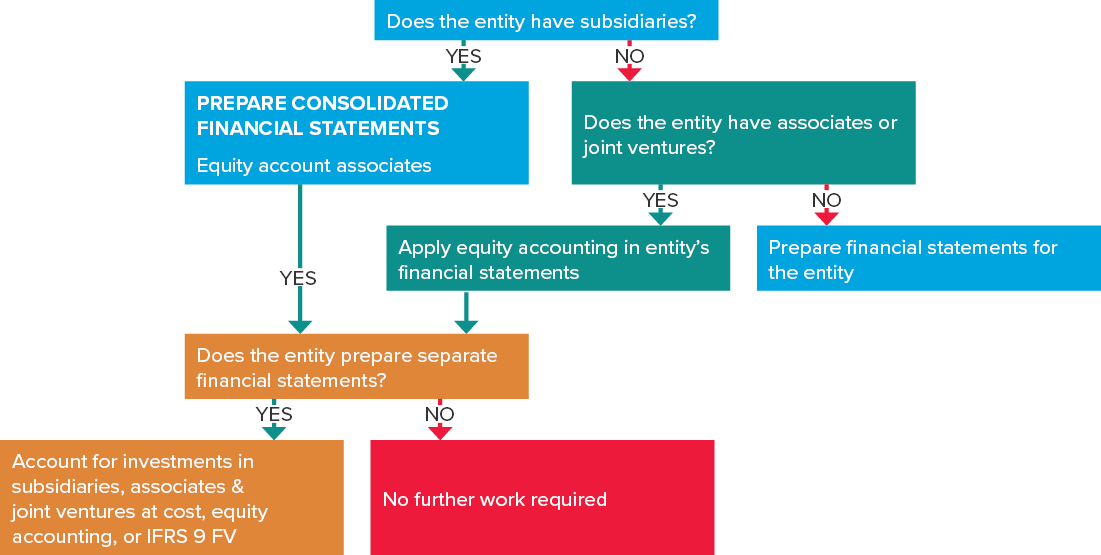

IAS 28 describes the accounting for associates in financial statements that are not separate financial statements. Equity accounting is required for associates in the following circumstances:

- If the associate is part of a consolidated group, in the consolidated financial statements, or

- If the associate is not part of a consolidated group but the investor has an investment in associate, in the financial statements of the investor.

However, if the ‘group’ chooses to prepare separate financial statements in addition to the consolidated or investor financial statements as shown in the diagram above, then there is a choice to account for the investment in associate in the separate financial statements at either:

- Cost

- An equity accounted amount, or

- At amounts in accordance with IFRS 9 Financial Instruments (i.e. at fair value).

How does equity accounting work?

The investor initially records its investments in associates at cost. If there is a difference between the ‘cost’ and the investor’s share of the net fair value of the associate’s identifiable assets and liabilities, it is accounted for as follows:

- If it is an excess, as goodwill (this is included in the ‘cost’ of the investment in associate), or

- If it is a shortfall, as income when determining the investor’s share of profit or loss from associate in the period when the investment is first acquired.

The carrying amount is then increased/decreased to recognise the investor’s share of profits/losses of the investee for each reporting period. If the investor receives dividend distributions from the associate, these are deducted from the carrying amount of the investment in associate.

Example 1

Investor purchased 25% of the shares in StartUp Co with an initial investment of $25,000. In its first financial year, StartUp Co made a profit of $100,000 in its financial statements and paid a dividend to Investor of $5,000.

Investor accounts for this investment using the equity method and the following journal entries:

Dr Investment in associate $25,000

Cr Bank $25,000

Being initial cash investment

Dr Investment in associate $25,000

Cr Profit from associates $25,000

Being 25% X $100,000 profit of StartUp Co

Dr Bank $5,000

Cr Investment in associate $5,000

Being $5,000 dividend distribution

The investor’s share of the investee’s profit or loss is also adjusted for fair value adjustments recognised on initial recognition such as for additional depreciation on property, plant and equipment. Assume in our example that Investor’s initial investment of $25,000 in StartUp Co included a $2,000 fair value adjustment for property, plant and equipment, which has a 10-year life (depreciated on a straight-line basis). Investor would therefore need to recognise the following journal entry on an annual basis to account for the additional depreciation charge:

Dr Profit from associates $200

Cr Investment in associate $200

Being additional depreciation of $2,000 fair value adjustment over 10 years

Adjustments to the carrying amount of the equity accounted investment may also be necessary for changes in the investor’s proportionate share in the associate arising from changes in the associate’s other comprehensive income (for example, if the associate revalues property, plant and equipment). If StartUp Co revalued its property, plant and equipment by $50,000 during the year, recognising a credit in other comprehensive income (OCI) of $50,000, Investor would recognise the following additional entry:

Dr Investment in associate $12,500

Cr Other comprehensive income - associates $12,500

Being 25% X $50,000

When equity accounting its investment, if the associate uses different accounting policies to those of the investor for like transactions and events in similar circumstances, the investor would need to make adjustments to the associate’s accounting policies.

Accounting for equity accounted losses of associates

As noted above, the carrying amount of the investment in associate is either increased or decreased to recognise the investor’s share of profits/losses of the investee each reporting period.

If the share of losses is greater than or equal to the investor’s ‘interest in the associate’, no further share of losses is recognised. That is, the investment is carried at zero and does not go into debit unless the investor has constructive or legal obligations for such amounts.

The ‘interest in the associate’ comprises the:

- Carrying amount of the investment in the associate using the equity method, plus

- Any long-term interests that, in substance, form part of the entity’s net investment in the associate, for example, a loan where settlement is neither planned nor likely to occur in the foreseeable future.

Losses firstly reduce amounts recognised in (a) above until the balance is zero, and are then applied to amounts recognised in (b) above, in reverse order of their seniority.

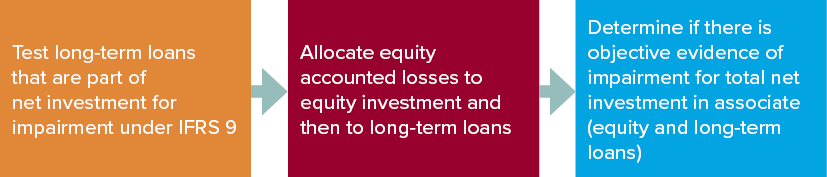

Impairment testing equity accounted investments

The diagram below re-iterates this ‘three-step’ impairment process for investments in associates. Firstly, long-term loans forming part of an investor’s net investment in associate are tested for impairment under IFRS 9. Equity accounted losses are then allocated to the equity investment and any losses remaining are written off against the long-term loans (in reverse order of seniority). Lastly, further impairment write-downs may be required if there is objective evidence of impairment as a result of one or more ‘loss events’ which has an impact on estimated future cash flows from the combined net investment (this includes the carrying amount of the investment as well as the long-term loans).

Objective evidence that the net investment in associate is impaired includes observable data that comes to management’s attention about the following loss events:

- Significant financial difficulty of the associate or joint venture

- A breach of contract, such as a default or delinquency in payments by the associate

- The investor, for economic or legal reasons relating to the associate’s financial difficulty, granting the associate a concession that the investor would not otherwise consider

- It becomes probable that the associate will enter bankruptcy or other financial reorganisation, or

- The disappearance of an active market for the net investment because of financial difficulties of the associate.

In addition, objective evidence of impairment of the net investment includes information about significant changes with an adverse effect that have taken place in the technological, market, economic or legal environment in which the associate operates, and indicates that the investment may be impaired. A significant or prolonged decline in the fair value of an investment in an equity instrument below its costs is also objective evidence of impairment.

What if the investor and the associate have different reporting dates?

The investor uses the most recent available financial statements of the associate when applying the equity method. If the reporting date of the associate is different to that of the investor, the associate prepares financial statements at the investor’s reporting date. If it is impracticable for the associate to prepare these financial statements at the investor’s reporting date, the investor would need to make adjustments for significant transactions and events occurring between the date of the associate’s most recent available financial statements, and the reporting date of the investor.

In any event, there should not be more than a three-month difference between the end of the reporting period of the associate and the investor.

Are potential voting rights included in investor’s share for equity accounting purposes?

No. Only existing ownership interests are included. Although currently exercisable or convertible potential voting rights are included when assessing whether an investor has significant influence of an associate, we do not include them for equity accounting purposes.

Example 2

Investor holds 25% of the voting rights of StartUp Co. It also has currently exercisable in-the-money options, which if converted, would give Investor control over 40% of the voting rights of StartUp Co. Investor only equity accounts 25% of the profits and OCI movements of StartUp Co (not 40%).

How are investments in associates classified in the balance sheet?

Investments in associates are generally classified as non-current assets.

Discontinuing equity accounting

Investors stop applying equity accounting from the date when the investment ceases to be an associate. Accounting from that date will be as follows:

- If the investment becomes a subsidiary – IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements apply

- If the retained interest in the former associate becomes a financial asset – the retained interest is a financial asset measured at fair value under IFRS 9, and the following amount is recognised in profit or loss:

Fair value of retained interest + Proceeds from sale of portion of associate - Carrying amount of investment in associate

- Amounts previously recognised in OCI are accounted for by the investor on the same basis as if the investee (former associate) had directly disposed of the related assets or liabilities to which the OCI relates. Therefore, any OCI amounts for the foreign currency translation reserve would be reclassified to profit or loss in the books of the investor but any OCI amounts for property, plant and equipment revaluations would not.

What if an investment in associate is classified as ‘held for sale’ under IFRS 5?

When an investment in associate meets the criteria to be classified as ‘held for sale’ under IFRS 5, it is no longer accounted for using the equity method. Instead, it will be measured at the lower of its carrying amount and fair value less costs to sell (FVLCTS).

If an investor has a 45% interest in an associate and only classifies 20% as held for sale, the retained portion (25%) could still be classified as an investment in associate if the investor continues to have significant influence, and equity accounting continues for that portion.

Are there any exceptions to applying the equity method?

Yes. Although the above rules require equity accounting in the consolidated financial statements of intermediate parent entities, if the intermediate parent entity is exempt from preparing consolidated financial statements by IFRS 10, then no equity accounting is required in their financial statements.

Venture capital organisations, mutual funds, unit trusts and investment-linked insurance funds also need not apply equity accounting. Instead, they can elect to account for investments in associates at fair value through profit or loss in accordance with IFRS 9.

Additional complex issues

There are further complexities in IAS 28 when dealing with changes in ownership interests, upstream and downstream transactions, contributions of non-monetary assets in exchange for an equity interest, and piecemeal acquisitions. Please contact BDO IFRS Advisory for assistance with some of the more complex aspects of accounting for investments in associates.

Resources – Virtual workshop

If you missed our virtual workshop on IAS 28 – Accounting for associates, and would like to purchase the recorded materials and case studies, please contact Aletta Boshoff.