Navigating the General Purpose Financial Statements (GPFS) transition

If you currently complete Special Purpose Financial Statements (SPFS), you might need to consider moving to GPFS. By 30 June 2022, many Australian organisations need to shift from SPFS to GPFS. While the mandatory compliance date is the end of the 2022 financial year, there are incentives for organisations to transition early, by way of ‘transitional relief’. Therefore, the 2021 financial year is the last year for organisations to benefit from these shortcuts.

The road to a successful GPFS transition is neither straight nor uncluttered. Successful navigation requires you to make deliberate, informed decisions along the way. Failure to do so could compromise your relationship with the regulator and other stakeholders, which could in turn erode shareholder value.

Finding the right timing might be your first fork in the road. Mapping out an early transition presents a unique opportunity for your organisation to assess and address your compliance to date with the recognition and measurement requirements (including consolidation and equity accounting, when relevant) in applicable International Financial Reporting Standards (IFRS) as well as Australian Accounting Standards (AAS).

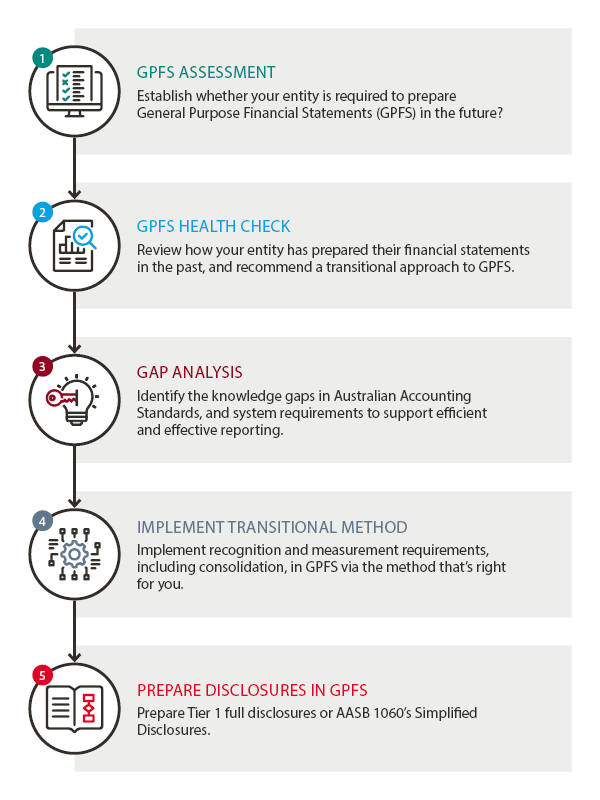

Five steps to successful GPFS transition

Following these five simple steps can help to ensure you avoid unnecessary speed bumps in your GPFS transition journey.

You can read more about each step at GPFS Ready page on our website.

BDO has a range of ways we can help your team to develop the skills you need for GPFS transition:

- WEBINARS | Join our monthly, complimentary IFRS webinars focused on the latest developments in financial reporting. You can sign up for one of these popular webinars, or the whole series.

- WORKSHOPS | Our new GPFS Ready Virtual Workshops are specially designed to upskill your team in readiness for GPFS reporting. Starting on 20 April 2021, this online series delivers the practical knowledge you need on a different topic each week.

- E-LEARNING HUB | Online materials that demonstrate how IFRS and AASB principles apply in practice, including summaries of recent agenda decisions of the IFRS Interpretations Committee (IFRIC).

Our team of IFRS specialists across Australia can help you take the wheel, and guide your entity to its destination.