For the purposes of IFRS 17, what is an insurance contract?

In the past many non-insurance entities may have simply dismissed insurance accounting as something that doesn’t impact them because they are not in the insurance business. However, with the new accounting standard on insurance contracts on the reporting horizon, non-insurers should be satisfying themselves that they aren’t inadvertently issuing insurance contracts that are subject to the new reporting requirements.

What is an insurance contract?

An ‘insurance contract’ is defined in IFRS 17 as:

A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder.

Let’s now look at each of the definitional features in more detail.

What is a contract?

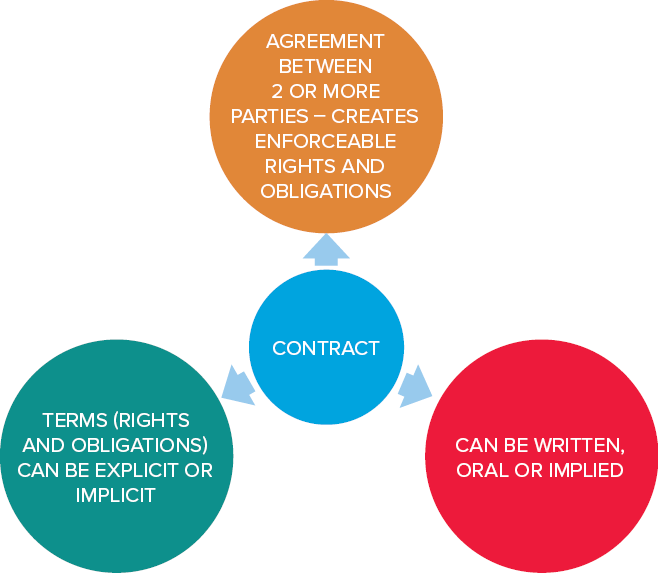

IFRS 17 clarifies that a contract:

- Is an agreement between two or more parties that creates enforceable rights and obligations

- Can be written, oral or implied by an entity’s customary business practices. The practices and processes for establishing contracts with customers can vary across legal jurisdictions, industries and entities. In addition, they may vary within an entity. For instance, they may depend on the class of customer or the nature of the promised goods or services, and

- Will contain terms (rights and obligations) that are either explicit or implied. Implied terms in a contract include those imposed by law or regulation. Enforceability of the terms (rights and obligations) in a contract is a matter of law.

Disregard terms that have no commercial substance

IFRS 17 also clarifies that when assessing whether an arrangement is a contract, an entity should disregard any terms that have no commercial substance, which are contractual terms that have no discernible effect on the economics of the contract.

Statutory requirements are not contracts

Although not specifically addressed in IFRS 17 (but addressed in other Standards that deal with contracts, such as IAS 32 Financial Instruments: Presentation), arrangements that arise because of statutory requirements imposed by a government on an entity are not contractual in nature. Examples of non-contractual arrangements include income taxes and government levies. Accordingly, a statutory arrangement that requires one party to accept significant insurance risk from another party by agreeing to compensate the other party if a specified uncertain future event adversely affects the other party is not an insurance contract, as defined in IFRS 17, because it is a non-contractual arrangement.

Insurance contracts may arise as a result of linked contracts

IFRS 17 also anticipates that an entity may need to consider whether, as a consequence of entering into two or more contracts with the same or related counterparties, the entity has issued an insurance contract. Accordingly, an ‘insurance contract’ is not limited to individual legal arrangements between parties. Taking such an approach, however, may also result in an entity concluding it has not issued an insurance contract when, for instance, the rights and obligations in one contract entirely negate the rights and obligations in another contract entered into at the same time with the same counterparty.

What relationship, if any, is there between the issuer and the policyholder?

While the definition of an insurance contract does not require the issuer and the policyholder to be unrelated parties, IFRS 17 does clarify that:

- Self-insurance – that is, retaining a risk that could have been covered by insurance – is not an insurance contract because there is no agreement with another party, and

- Insurance contracts between group entities are, at the consolidated level, self-insurance arrangements. Accordingly, such arrangements might be accounted for in the individual or separate financial statements of the group entities as insurance contracts, but not at a consolidated level.

What is insurance risk, and when would it be regarded as ‘significant’?

IFRS 17 defines ‘insurance risk’ and ‘financial risk’ as follows.

Insurance risk - Risk, other than financial risk, transferred from the holder of a contract to the issuer. |

Financial risk - The risk of a possible future change in one or more of a specified interest rate, financial instrument price, commodity price, currency exchange rate, index of prices or rates, credit rating or credit index or other variable, provided in the case of a non-financial variable that the variable is not specific to a party to the contract. |

The main reason for distinguishing insurance risk from financial risk is that arrangements that give rise to financial risk are typically accounted for as financial instruments under IFRS 9 Financial Instruments. It is relevant to note, however, that some arrangements (such as some life insurance products) give rise to both financial and insurance risks. In circumstances where the insurance risk component is significant (which is discussed further below), the arrangement would be considered to be an insurance contract.

For non-insurers, a key issue to consider when assessing whether a particular arrangement gives rise to insurance risk is whether the entity will be required to compensate the counterparty for a change in one or more non-financial variables that are specific to the counterparty. This is best demonstrated by way of examples:

Example 1:

If a non-insurer agrees to compensate a counterparty for any loss in the residual fair value of a vehicle belonging to the counterparty as a consequence of the vehicle being damaged by fire, the non-insurer is exposed to insurance risk.

Example 2:

In contrast to Example 1, if a non-insurer agrees to compensate the same counterparty for any loss in the residual fair value of the same vehicle, but excluding changes in fair value attributable to changes in the physical condition of the particular vehicle (due to, for instance, fire), the non-insurer is exposed to financial risk.

Notwithstanding that in both of the foregoing examples the non-insurer is on risk to compensate the counterparty for changes in the residual fair value of the vehicle, the event that triggers the payment of compensation (and potentially the amount of compensation paid) will differ. In the first example, the event is a fire that damages or destroys the specific vehicle, whereas in the second example the event is a change in the mean or median residual fair value of all vehicles in the same class, ignoring the impact of changes in the physical condition of any specific vehicles.

These examples also demonstrate another necessary feature of an insurance risk – it must be a risk to which the counterparty was already exposed prior to entering into the arrangement with the non-insurer. If an arrangement permits a counterparty to, for instance, avoid paying a fee to the non-insurer in respect to an arrangement in the event that the counterparty enters into bankruptcy, this feature (the obligation to pay the fee) is not regarded as an insurance contract because it is not a risk to which the counterparty was already exposed prior to entering the arrangement.

Is the insurance risk significant?

Having established a contractual arrangement exposes a non-insurer to insurance risk, the next step for the non-insurer is to assess the significance of the insurance risk.

Accordingly, if an insured event could require the non-insurer to pay additional amounts in any scenario that has commercial substance, the insurance risk might be considered significant, despite the:

- Insured event being extremely unlikely

- Expected (probability-weighted) present value of the contingent cash flows representing a small proportion of the expected present value of the remaining cash flows from the contract

- Non-insurer transferring substantially all of the significant risks to a reinsurer, and/or

- Non-insurer expecting to make no overall loss on the portfolio of contracts to which the insurance contract belongs.

What constitutes compensation?

Most insurance contracts promise the policyholder a cash payment as compensation. However, compensation can take various forms, including:

- Payments in kind, such as the provision of replacement goods (including ‘new for old’) or repair services

- Relief from the obligation to pay the counterparty, or

- Relief from the obligation to pay a third party.

What constitutes an uncertain future event?

A future event is considered uncertain if at least one of the following is uncertain at the inception of the contract:

- The likelihood of the insured event occurring

- When the insured event will occur, or

- How much the non-insurer will need to pay if the insured event occurs.

Accordingly, a contract that pays a fixed amount in the event that the policyholder becomes deceased is potentially an insurance contract because at the inception of the contract it is uncertain when the insured event will occur (not because there is any uncertainty about the likelihood of the insured event occurring).

What is considered to adversely affect the policyholder, and why is it a necessary condition for an insurance contract?

Policyholders buy insurance to reduce their risk of loss, particularly financial loss. Accordingly, events that, in the absence of insurance coverage, would cause the policyholder to suffer a (financial) loss would be expected to adversely affect the policyholder. Such events include:

- Theft of, or damage to, personal property, such as vehicles, equipment, land or buildings

- Death or disablement

- Hospitalisation

- Legal proceedings arising from product, professional or public liability, or

- The purchase of a defective product.

In each of these cases, the compensation would normally take the form of a cash payment or payment in kind. However, as noted above, compensation can also take the form of the policyholder being relieved of a pre-existing obligation.

- A loan contract that waives repayment of some or all of the principal and/or interest payments in the event the borrower becomes deceased

- A lifetime (‘reverse’) mortgage contract under which the policyholder is not required to make up any shortfall of the proceeds received from the sale of the underlying property over the carrying amount of the mortgage on the date the property is sold, and

- A contractual agreement to be relieved of the obligation to pay the legal costs of the other party to a legal dispute in the event of unsuccessful court proceedings.

While it may seem incongruous, payments made in respect to life-contingent annuities and pensions – contracts that provide compensation in the event that the policyholder survives – are also regarded as compensation paid for an insured event that adversely affects the policy holder. Life-contingent annuities and pensions insure the policyholder against the financial loss of remaining alive. Accordingly, compensation paid in respect to such policies provide the annuitant or pensioner with a level of income that would otherwise be adversely affected by his or her survival.

Why must an insured event adversely affect the policyholder?

If this principle was absent from the definition of an insurance contract, the definition would capture arrangements we generally regard as being in the nature of insurance contracts (such as life insurance and home and car insurance policies) and as well as gambling contracts.

The IASB considered gambling contracts to be significantly different from insurance contracts, and therefore was unconvinced of the merits of requiring both types of contracts to be accounted for under the same standard. In addition, the IASB noted that in the absence of the reference to the insured event adversely affecting the policyholder, the definition of an insurance contract might also capture prepaid contracts to provide services whose cost is uncertain. Again, the IASB concluded that it was unlikely to be cost-beneficial for entities to account for such contracts as insurance contracts.