Consolidated financial statements – when are they required?

Parent entities that ‘control’ other entities must prepare consolidated financial statements. ‘Investment entities’, however, do not prepare consolidated financial statements, but rather measure all controlled entities in their financial statements at fair value through profit or loss (FVTPL).

When does a parent entity ‘control’ another entity?

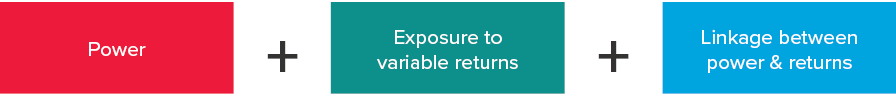

IFRS 10 Consolidated Financial Statements defines when one entity controls another. An investor controls an entity (investee) if the investor has all of the following:

- Power over the investee

- Exposure, or rights, to variable returns from its involvement with the investee, and

- The ability to use its power over the investee to affect the amount of the investor’s returns.

If two or more investors collectively control the investee, then no one investor has control and each would account for their investment under other relevant standards, e.g. IFRS 11 Joint Arrangements if they have joint control, IAS 28 Investments in Associates and Joint Ventures if they have significant influence or otherwise IFRS 9 Financial Instruments.

When does an investor have power?

Existing rights

Power arises from existing rights (substantive, not protective) which usually stem from having the majority of voting rights relating to the investee’s equity instruments. However, sometimes an investor may have existing rights by other means, for example:

- Having potential voting rights such as in-the-money options that can be converted into equity instruments which, if exercised, would give it the majority shareholding

- Having de facto control, even though it owns less than 50% of the equity instruments in the investee because the remaining shareholders are widely spread

- Having the right to appoint, reassign or remove key management personnel of the investee who direct the relevant activities

- Having the right to appoint or remove another entity that directs the relevant activities

- Being able to dominate the board appointment process

- Having other rights, such as in management contracts, that give the holder the ability to direct the relevant activities, or

- The investee’s key management personnel are related parties of the investor, e.g. having the same CEO.

Determining whether rights are substantive requires judgement. IFRS 10, paragraphs B14-B54 include extensive guidance and examples to assist in determining whether an investor has existing rights.

Relevant activities

Relevant activities’ are activities that most significantly affect the investee’s returns and could include, for example (this list is not exhaustive);

- Selling goods and services

- Managing financial assets/investments

- Selecting, acquiring and disposing of assets

- Researching and developing new products

- Determine a funding structure or obtaining funding.

Working out who directs the relevant activities often involves looking at how decisions are made about relevant activities, and then determining who controls that decision-making process. For example, if decisions about the above-mentioned activities are made by the board via approval of the annual operating budgets, and the investor controls the board and has a majority shareholding, we may conclude that the investor directs the relevant activities.

Exposure, or rights, to variable returns from its involvement with the investee

‘Variable returns’ are not fixed and have the potential to vary as a result of the performance of an investee. They can be only positive, only negative, or both positive and negative.

In determining whether an investor is exposed, or has rights, to variable returns, they would need to assess whether returns are variable, and how variable those returns are on the basis of the substance of the arrangement and regardless of the legal form of the return.

Examples of variable returns include dividends and other forms of distributions, remuneration for servicing an investee’s assets or liabilities (e.g. fund management fees), fees and exposure to loss from providing credit or liquidity support, residual interests in the investee’s assets and liabilities on liquidation of that investee (e.g. shareholdings), tax benefits, access to future liquidity that an investor has from its involvement with an investee, and returns that are not available to other interest holders (e.g. the ability to use its assets in combination with the assets of the investee).

Link between power and returns

In addition to an investor having power over the investee, and exposure or rights to variable returns, it must also have the ability to use its power to affect returns from its involvement with the investee.

Investors therefore need to assess their decision-making rights to determine if they are acting as principal or agent because if acting as ‘principal’ they would control the investee, but if acting as agent they would not.

The ‘linkage’ assessment between power and returns may be relatively straight-forward for an investor that owns 100% of the equity instruments of an investee, with no other factors present that could give power to another party. This is because the investor would have power, be exposed to variable returns via dividends and capital returns on liquidation, and have the ability to use its power to affect returns because it is acting as principal.

However, this linkage assessment is more complex, and requires significant judgement in other cases, for example, where an investment fund manager holds a sizeable equity interest in the fund it is managing. As decision-maker over investment decisions, the fund manager has the power to direct the relevant activities and is also exposed to variable returns via its investment in the fund as well as the remuneration it receives for managing the fund. There would only be a linkage between power and exposure to returns if the fund manager is acting as principal. If the fund manager could be removed without cause by a single party, it is acting as agent. However there are other factors to consider before reaching a conclusion, including remuneration arrangements and whether these are at market rates or not (If at market this is indicative of acting as agent).

IFRS 10, paragraphs BB58-B75 includes extensive guidance and examples to assist in this analysis.

Need assistance?

If you missed our virtual workshop on IFRS 10 – Preparing financial consolidated financial statements, and would like to purchase the recorded materials and case studies, please contact Aletta Boshoff.