Expansion of Government’s SME loan guarantee scheme may impact the accounting for your financial liabilities (borrowings)

As part of the Australian Government’s second economic stimulus package in response to COVID-19, it established the ‘Coronavirus SME Guarantee Scheme’ (Scheme) to support SMEs to get access to working capital. To enhance the willingness and ability of banks to provide credit to SMEs, the Government initially guaranteed 50% of new loans up to a maximum of $250,000 issued by eligible lenders to SMEs. The scheme has been extended twice and now applies to loans of up to $5 million, with the Government guaranteeing 80% of the loan if certain eligibility criteria are met. Loan terms have also been extended from 5 to 10 years with an optional repayment holiday for up to 24 months.

What is a ‘substantial’ modification?

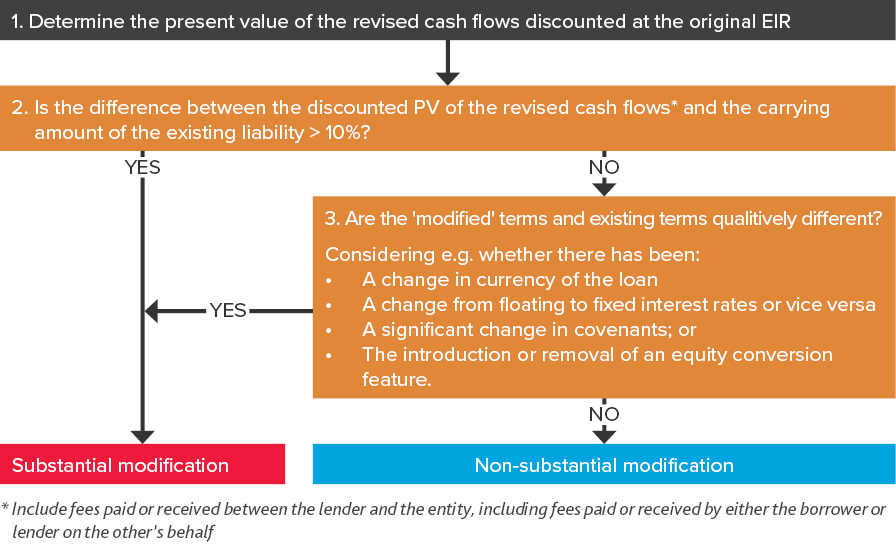

A ‘substantial’ modification occurs where either:

- The difference between the discounted presented value (PV) of the revised loan cash flows* (discounted at the original effective interest rate) and the carrying amount of the existing liability is greater than 10%, or

- If the above difference is less than 10%, the modified terms are qualitatively substantially different to the original terms, e.g. if there is a change in currency of the loan, a change from fixed to floating interest rates or vice versa, significant changes in loan covenants, or the introduction or removal of an equity conversion feature).

*Includes fees paid/received between the lender and the entity, including fees paid/received by either borrower or lender on the other’s behalf

The assessment of whether a modification is ‘substantial’ or ‘non-substantial’ may involve significant judgement, which may require specific disclosure under IAS 1 Presentation of Financial Instruments, paragraph 122.

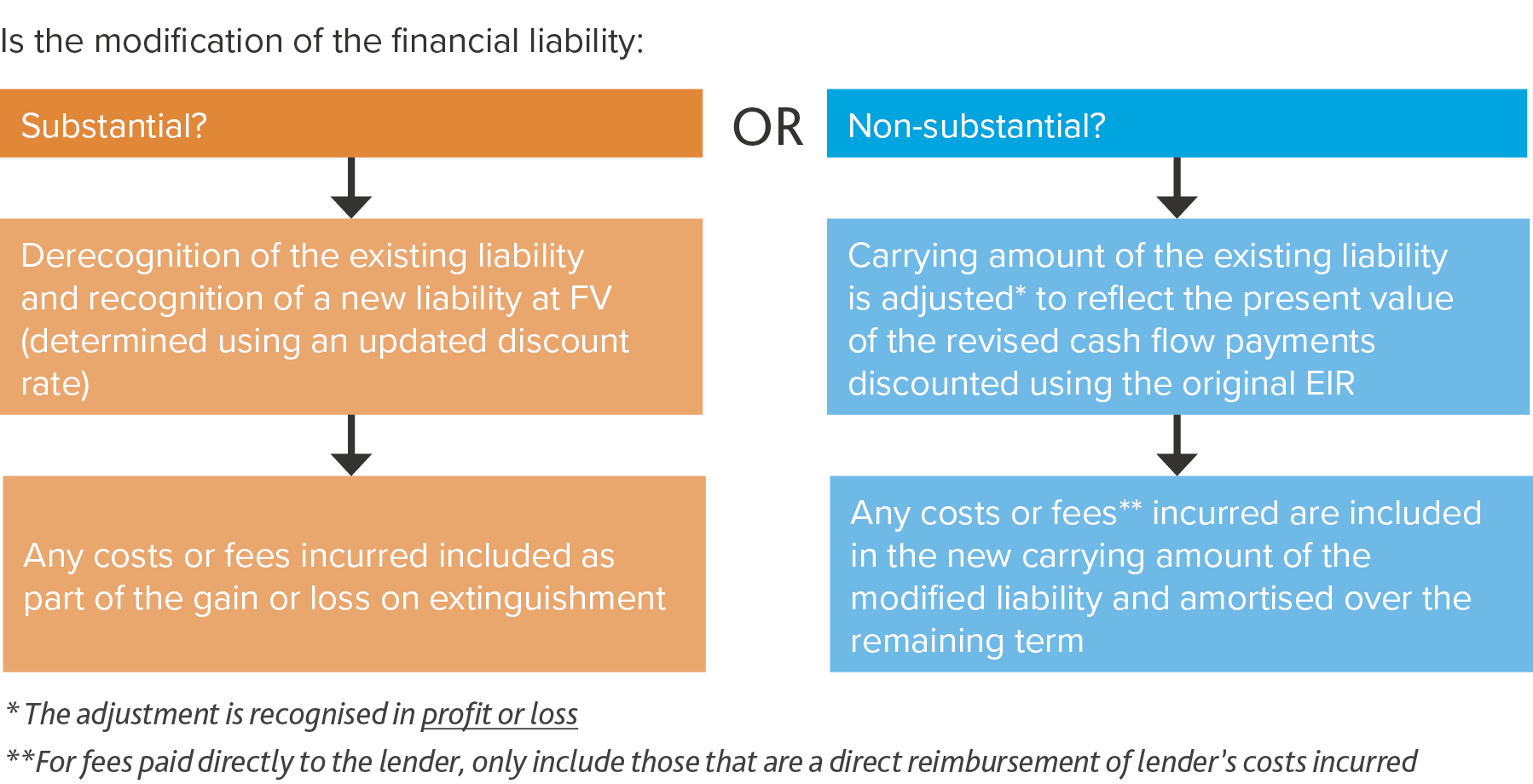

Difference in accounting for ‘substantial’ and ‘non-substantial’ modifications

It is important to correctly determine whether a modification to a loan is substantial or not because the accounting is different as shown in the diagram below.

Modifications to financial assets and liabilities (IFRS 9)

An added complexity - Accounting for the benefit of the SME loan guarantee as a government grant

In addition to difficulties assessing whether the loan modification is substantial or not, and the accounting that follows, an added complexity is that we also need to overlay and assess whether there are any additional accounting impacts when accounting for changes to the Government’s loan guarantee scheme. Our Accounting News article (August 2020) summarises two different approaches when accounting for the benefit of the ‘free’ Government guarantee.

The following changes to the SME loan guarantee scheme could impact on the accounting because the fair value of the loan changes if:

- The loan term is extended

- The loan amount is increased, or

- The guaranteed portion of the loan increases.

Need help?

Modification of liabilities and accounting for the SME loan guarantee are both complex areas of accounting. Please contact BDO’s IFRS Advisory team if you require assistance.