How will the new revenue standard (AASB 15) impact NFPs?

Most not-for-profit entities (NFPs) are aware that there is a new income recognition standard, AASB 1058 Income of Not-for-Profit Entities that applies to annual periods beginning 1 January 2019. However, not all are aware that the new revenue standard, AASB 15 Revenue from Contracts with Customers, also applies from this date, and also applies to NFPs. NFPs therefore need to consider both these standards to ensure that income and revenue are recognised at appropriate amounts, and in the appropriate accounting periods, post 1 January 2019.

This article summarises:

- When ‘income’ received by NFPs is accounted for under AASB 1058 and AASB 15 respectively, and

- What features are necessary to meet the ‘enforceable contract’ criterion for revenue recognition under AASB 15 by NFPs.

Scope of AASB 1058

This means that AASB 15, rather than AASB 1058, could apply to transactions of NFPs if the consideration to acquire an asset is:

- Less than fair value, but for some reason other than to enable the NFP to further its objectives

- At fair value, or

- Less than fair value principally to enable a NFP to further its objectives, but comes with performance obligations attached.

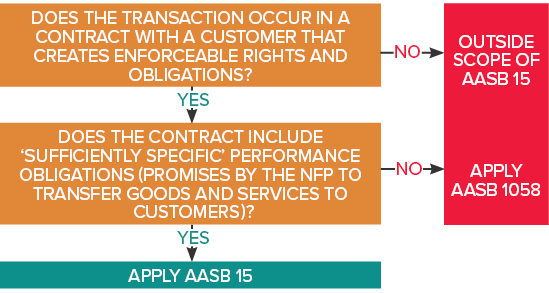

Scope of AASB 15

The above-mentioned transactions have features of commercial transactions whereby the NFP would be required to satisfy performance obligations as consideration for the asset received.

However, these would only fall within the scope of AASB 15 if the performance obligations are required by an enforceable contract, and they are ‘sufficiently specific’ to enable the NFP to determine when they have been satisfied.

If these conditions are not met, AASB 1058 applies, and if there is nowhere else to post the credit entry (e.g. financial instruments under AASB 9 Financial Instruments, lease liability under AASB 16 Leases, etc.), income is recognised immediately under AASB 1058.

AASB 15 is essentially designed for the recognition of revenue by for-profit entities. Appendix F has been added to AASB 15 to assist NFPs in applying the five-step revenue recognition model in a not-for-profit context. This article looks at the additional guidance in paragraphs F5 – F19, which assist in determining whether there is a contract with a customer that creates enforceable rights and obligations.

Is there a contract?

AASB 15 defines a ‘contract’ as an agreement between two or more parties that creates enforceable rights and obligations. Appendix F notes that in a NFP context, ‘agreements’ would include arrangements entered into under the direction of another party, such as when assets are transferred to an entity with a directive that they be used to provide specified services.

AASB 15, paragraph 10 includes contracts that are implied by an entity’s customary business practices. Appendix F notes that in a NFP context, customary business practices would refer to the NFP's customary practices in performing its activities.

Is there a customer?

AASB 15 defines a ‘customer’ as a party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities, in exchange for consideration.

In a for-profit context, it is common for the customer to be the party receiving the goods or services, although sometimes it may direct the vendor to deliver them to third party beneficiaries. Despite this redirection, the customer is the party that entered into the contract and is obligated to settle the consideration. It is not the party that receives the goods or services.

In a NFP context, these three-way arrangements are common. For example, a NFP entity may receive consideration from the government to provide first-aid training free of charge to members of the community. In this case, the government, rather than the community, is the customer because it is the party that has contracted with the NFP to provide the first-aid training.

Is the contract enforceable?

In order to pass Step 1 of the new revenue recognition model, entities must establish that there is a contract with a customer, and that the contract is enforceable.

In order for a contract (agreement) to be enforceable, the following points are pertinent:

- Only some, but not all, of the promises in the agreement need to be enforceable.

- It is desirable for the agreement to be in writing and include ‘sufficiently specific’ requirements, although oral agreements may also be enforceable.

- Terms of the agreement, as well as additional terms agreed between the parties as a result of further actions/discussions are considered to determine if it is enforceable. Examples of terms that could result in an enforceable agreement include:

- A refund if agreed specific performance has not occurred

- The customer, or another party acting on its behalf, has the right to enforce specific performance or claim damages

- The customer has the right to take a financial interest in assets purchased or constructed by the entity with resources provided under the agreement

- The parties to the agreement are required to agree on alternative uses of the resources provided under the agreement.

- The agreement itself need not include refund or other enforcement provisions because Australian law generally provides remedies for performance or damages for breach of the agreement.

- A separate party must be able to able to enforce it through legal or equivalent means (i.e. a mechanism outside the legal system that gives the separate party the right to oblige the entity to act in a certain way or face consequences). There does not need to be a history of enforcement of similar agreements. Nor does there need to be intention by the customer to enforce its rights.

- Some enforcement mechanisms may arise from administrative arrangements, such as a directive given by a Minister or government department to a public sector entity under its control. This would be considered sufficient for an agreement to be considered enforceable by a separate party through legal or equivalent means.

- Agreements can still be legally enforceable even if they are not in the form of a formal contract, such as Memoranda of Understanding, Heads of Agreements and Letters of Intent.

However, the following would not necessarily result in an agreement being enforceable by another party through legal or equivalent means:

- A transferor being able to withhold future funding to which the entity is not presently entitled. This is in contrast to having refund rights or the capacity to impose a severe penalty in the event of non-performance.

- A NFP publishing a statement to spend money in a particular way, because it does not identify parties who could enforce the statement. This is in contrast to a letter of intent which is typically an agreement between specifically identified parties.

Commercial substance

Lastly, AASB 15, paragraph 9(d) requires that the contract must have commercial substance (i.e. the risk, timing or amount of the entity’s future cash flows is expected to change as a result of the contract). Appendix F also clarifies that in a NFP context, contracts may have ‘commercial substance’, even though they may be ‘non-commercial’ (e.g. goods or services provided are subsidised or on a cost-recovery basis). This is because they could still result in a change in the ‘risk, timing or amount of the entity’s future cash flows’.

Concluding thoughts

Many NFPs defer recognition of a variety of income streams because there is a lack of clarity in the current accounting requirements for income of NFPs. However, from 1 January 2019, this situation is about to change. NFPs will need to undergo a formal assessment of all income streams to assess whether recognition under AASB 1058 or AASB 15 is appropriate. Importantly, revenue can only be recognised if there is an enforceable contract with a customer. Management should therefore already be undertaking a detailed review of all contracts and agreements to assess whether these Step 1, AASB 15 criteria have been met.