IASB amends definition of a ‘business’ in IFRS 3

After considering feedback from its post-implementation review of IFRS 3 Business Combinations, the International Accounting Standards Board (IASB) recently made amendments to the definition of a ‘business’ in IFRS 3 by issuing Definition of a Business (Amendments to IFRS 3).

When do the amendments apply?

The new definition must be applied to acquisitions occurring on or after the beginning of the first annual reporting period that begins on or after 1 January 2020, but can be applied early (once adopted by the Australian Accounting Standards Board).

Entities with December year-ends will therefore apply the new definition to acquisitions occurring on or after 1 January 2020, and those with June year-ends will apply it to acquisitions from 1 July 2020 onwards.

What changes have been made?

In summary, Definition of a Business (Amendments to IFRS 3) makes the following changes:

- Narrows the definition of ‘outputs’ and a ‘business’ to focus on returns from selling goods and services to customers, rather than on cost reductions.

- Amends guidance on inputs, processes and outputs in paragraph B7 to align with the new definition.

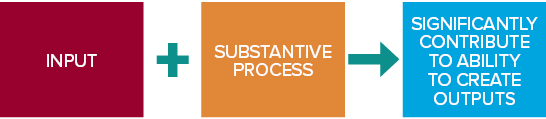

- Clarifies that to be considered a business, an acquired set of activities and assets must include, as a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs.

- Provides extensive guidance on what is meant by a ‘substantive process’.

- Adds an optional ‘concentration test’ as a short-cut way of concluding that certain types of acquisitions are not business combinations.

These changes are discussed in more detail below.

Changes to the definition of ‘outputs’ and a ‘business’

The definition of a ‘business’ and ‘outputs’ in IFRS 3 currently focus on returns, which can be in the form of dividend income, lower costs, or other economic benefits to investors and owners.

The amendments narrow these two definitions to exclude returns in the form of lower costs, and other economic benefits provided directly to investors and owners.

| IFRS 3 (current version) | Amendments to IFRS 3 (2018) | |

| Definition of a ‘business’ | An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners, members or participants. | An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities. |

| Definition of ‘outputs’ | The result of inputs and processes applied to those inputs that provide or have the ability to provide a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners, members or participants. | The result of inputs and processes applied to those inputs that provide goods or services to customers, generate investment income (such as dividends or interest) or generate other income from ordinary activities. |

Amended guidance on inputs, processes and outputs in paragraph B7 to align with the new definition of a ‘business’

To support the new definition of a ‘business’, the application guidance contained in IFRS 3, paragraph B7 has been amended so that:

- Inputs and processes no longer need to have the ability to create outputs. Instead, they merely need to have the ability to contribute to the creation of outputs.

- The intellectual capacity of an organised workforce having the necessary skills and experience in following rules and conventions may provide the necessary processes applied to inputs to create outputs.

- The focus on outputs is on returns from goods and services provided, investment income, and other income from ordinary activities.

Need a minimum of an input and a substantive process to be considered a business

The amendments clarify that to be considered a business, an acquired set of activities and assets must include, as a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs.

The amendments also clarify that:

- Outputs are not necessarily required for an integrated set of activities and assets to qualify as a business

- A business need not necessarily include all inputs and processes used by the seller in operating the business, and

- If an acquired set of activities and assets has outputs, continuation of revenue (e.g. a recurring revenue stream) does not by itself indicate that both an input and a substantive process have been acquired.

What is a ‘substantive process’?

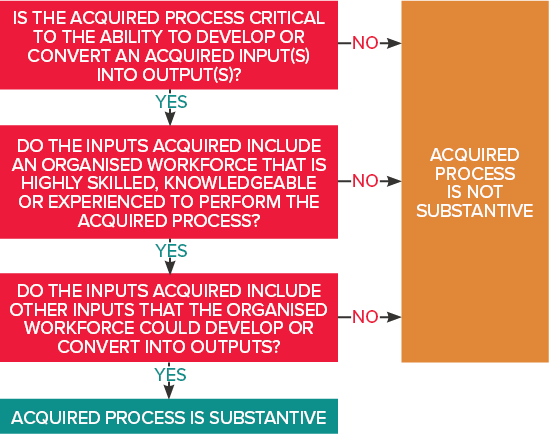

Extensive guidance has been added to IFRS 3 as part of these amendments to assist in determining whether an acquired process is ‘substantive’.

No outputs at acquisition date

If a set of activities and assets do not have outputs at acquisition date, an acquired process is only considered ‘substantive’ if:

- It is critical to the ability of the entity to develop or convert an acquired input(s) into outputs, and

- The inputs acquired include both an organised workforce that has the skills, knowledge or experience to perform that process, as well asother inputs that the organised workforce could develop and convert into outputs, for example:

- Intellectual property that could be used to develop a good or service

- Other economic resources that could be developed to create outputs, or

- Rights to obtain access to necessary materials or rights that enable the creation of future outputs.

Examples of inputs in (a) to (c) above include technology, in-process R&D projects, real estate interests and mineral interests.

This means that there would be no substantive process, and therefore no business where an entity acquired:

- A process with inputs, but a workforce that is not sufficiently skilled, or

- A process and a skilled workforce but no other inputs to develop and convert into outputs.

Outputs at acquisition date

If a set of activities and assets does have outputs at acquisition date, an acquired process is only considered to be ‘substantive’ if, when applied to an acquired input, it:

- Is critical to the entity’s ability to continue producing outputs, and the inputs acquired include an organised workforce that has the skills, knowledge or experience to perform that process, or

- Significantly contributes to the ability to continue producing outputs and is considered unique, or cannot be replaced without significant cost, effort or delay in the ability to continue producing outputs.

What is the optional ‘concentration test’?

The ‘concentration test’ added to paragraphs B7A – B7C, allows a simplified assessment of whether an acquired set of activities and assets is not a business. In other words, this is a short-cut way of concluding that the acquisition is not a ‘business’, without having to conduct the detailed assessment required by IFRS 3.

In applying the concentration test, paragraph B7B includes extensive guidance about what can be considered a single identifiable asset or similar assets. The concentration test is optional, and it can be applied to some acquisitions and not others (i.e. separate election for each acquisition can be made).