When is a lease not a lease – Is there an identified asset?

In the April 2018 edition of Accounting News we noted that IFRS 16 Leases, which comes into effect for financial reporting periods beginning on or after 1 January 2019, will fundamentally change the manner in which lessees account for leases, by requiring lessees to recognise lease liabilities and associated right-of-use assets for the leases that they enter into (with some very limited exemptions).

- When does an ordinary contract contain a ‘lease’, and

- When is a lease not a ‘lease’?

Except for entities with ‘finance leases’ under IAS 17 Leases, in the past, there was little necessity for entities to analyse in detail whether they had a ‘lease’ (i.e. operating lease). This is because rental and similar types of arrangements would, in many cases, result in an accounting treatment not dissimilar to expensing operating leases under IAS 17 where the impact of straight-lining an operating lease was not material.

What is a ‘lease’?

A ‘lease’ is defined in IFRS 16 as follows:

A contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration.

Definition of a ‘lease’ in IFRS 16

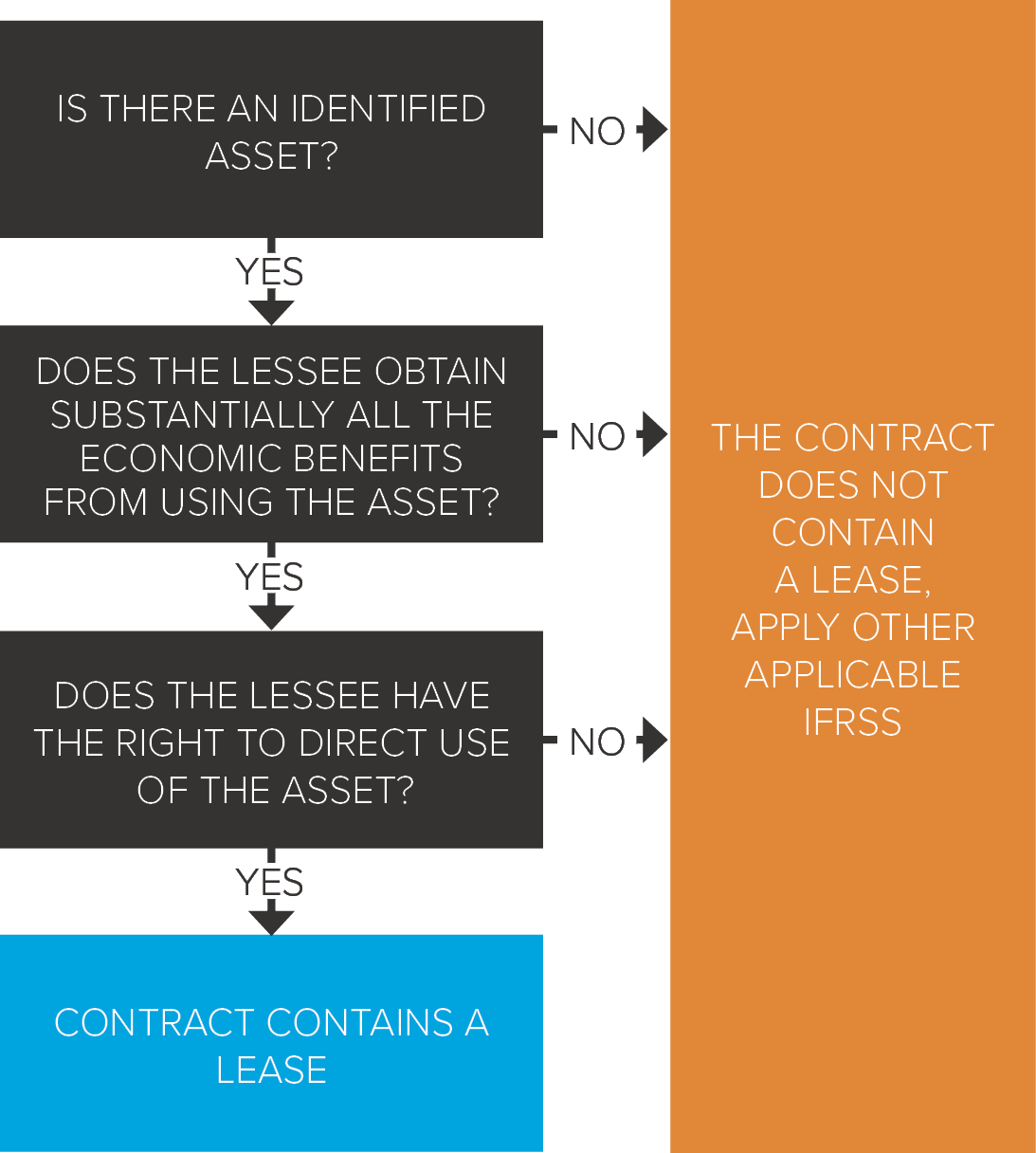

IFRS 16, paragraph 9 then says that a contract is, or contains, a ‘lease’ if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. This means that there are two key matters that require consideration in assessing whether a contract is, or contains, a ‘lease’:

- Whether there is an identified asset, and

- Whether the contract conveys the right to control the use of the identified asset.

In regards to the second key matter identified above, IFRS 16, paragraph B9 notes that in order for a contract to convey the right to control the use of the identified asset, the customer must have both of the following:

- The right to obtain substantially all of the economic benefits from the use of the identified asset, and

- The right to direct the use of the identified asset.

This is illustrated in the diagram below.

The above requirements are discussed in more detail in our July 2018 Accounting News article.

Is there an identified asset?

An asset is typically identified by being explicitly specified in a contract, for example by specifying the registration number of a car, as well as the manufacturer and model type. However, an asset can also be identified by being implicitly specified at the time that it is made available for use by the customer.

Portions of assets

A capacity portion of an asset is an identified asset if it is physically distinct (for example, a floor of a building). However, a capacity or other portion of an asset that is not physically distinct (for example, a capacity portion of a fibre optic cable) is not an identified asset, unless it represents substantially all of the capacity of the asset and thereby provides the customer with the right to obtain substantially all of the economic benefits from using of the asset.

Example 1 – Fibre optic cable

A customer enters into a 15-year contract with a supplier for the right to use a specified amount of capacity within a cable connecting Hong Kong and Tokyo.

The specified amount is equivalent to the customer having the full capacity of three fibre strands within a 15-strand cable.

The supplier makes decisions about the transmission of data (i.e. which fibres are used to transmit the lessee’s data).

Assessment

The contract does not contain a lease because the capacity specified is not physically distinct and it does not represent substantially all of the underlying asset (i.e. the capacity is only 20% of the total capacity of the cable).

If the contract specified an amount of capacity equivalent to say 14 fibre strands of the total cable, the contract would contain a lease because this represents substantially all (approximately 94%) of the cable’s capacity.

Example 2 – Fibre Optic Cable (specific strands)

A customer enters into a 15-year contract with a supplier for the right to use three of 10 specific strands of fibre optic cable connecting Paris and London.

The customer has the exclusive right to use these strands to transfer their data.

Assessment

The contract does contain an identified asset because the strands of fibre optic cable are distinct from one another and the vendor does not have the right to substitute the strands for others in the same cable.

Despite the number of strands not being substantially all of the cable’s total capacity, the strands are identified (physically distinct), therefore the contract provides a specified asset to the customer.

BDO comment:

The requirement that a portion of an asset can meet the identifiability criterion can be seen as a potential ‘anti-avoidance’ provision of the standard. Without this provision, a contract could exclude an insignificant portion of an asset’s capability, and not meet the identifiability criterion.

Although IFRS 16 makes reference to a capacity portion that is ‘physically distinct’, in our view this approach also applies when a capacity portion is technologically distinct. For example, a lease could be of all of the light blue colour capacity of a fibre optic cable. In that case, the light blue component would be an identified asset for the purposes of IFRS 16.

Example 3 – Sub-surface rights (extracted from IFRIC agenda decision – June 2019)

A pipeline operator (customer) obtains the right to place an oil pipeline in underground space for 20 years in exchange for consideration.

The contract specifies the exact location and dimensions (path, width and depth) of the underground space within which the pipeline will be placed.

The landowner retains the right to use the surface of the land above the pipeline, but it has no right to access or otherwise change the use of the specified underground space throughout the 20-year period of use.

The customer has the right to perform inspection, repairs and maintenance work (including replacing damaged sections of the pipeline when necessary).

IFRIC agenda decision

As this contract did not meet one of the scope exceptions in IFRS 16, the pipeline operator would need to consider whether the contract contains a lease as defined in IFRS 16.

The Committee observed that IFRS 16.B20 states that a ‘capacity portion of an asset is an identified asset if it is physically distinct’, subject to the lessor not having substantive substitution rights.

In the fact pattern described, the specified underground space is physically distinct because the contract specifies the path, width and depth of the pipeline.

The fact that the space is underground and therefore does not include the surface area of the land is not relevant. This space is physically distinct in the same way that a portion of land on the surface may be physically distinct. Therefore, as no substitution rights exist, the Committee concluded that an identified asset does exist.

Substitution rights

Even if an asset is specified, a customer does not have the right to use an identified asset if the supplier has the substantive right to substitute the asset throughout the period of use.

A supplier’s right to substitute an asset is substantive only if both of the following conditions exist:

- The supplier has the practical ability to substitute alternative assets throughout the period of use, and

- The supplier would benefit economically from the exercise of its right to substitute the asset.

BDO comment:

It is important to note that both of the above criteria must be satisfied for a supplier’s substitution right to be substantive. In some instances, contracts contain clauses that give the lessor the right to substitute an asset; however, unless the lessor has a compelling reason to exercise that right, it is not substantive.

In addition, IFRS 16 requires the substitution right to exist throughout the period of use. If a substitution right were to only be exercisable upon the occurrence of a specific event, after a period of time had elapsed, or on a specific date, the substitution right would not be substantive for the purposes of IFRS 16 as it was not present throughout the period of use.

In situations where the asset is located at the lessee’s premises or elsewhere away from the lessor, the cost to substitute the asset may outweigh any perceived benefit to the lessor. In addition, a supplier’s right to substitute an asset for the purposes of repairs or maintenance (if the asset is not operating properly) or to be upgraded when a technical update becomes available, does not mean the lessor has a substantive right of substitution.

In situations where it is not readily determinable whether a supplier has substantive substitution rights, a lessee must presume that any substitution right is not substantive. This means that, in situations of doubt, lessees should assume that the contract contains a lease.

Example 4 – Lease of rail cars

A contract between Customer and Supplier requires Supplier to transport a quantity of goods by using a specified type of rail car in accordance with a stated timetable for a period of five years.

The timetable and quantity of goods specified are equivalent to Customer having the use of 10 rail cars for five years.

Supplier provides the rail cars, driver and engine as part of the contract.

The contract states the nature and quantity of the goods to be transported (and the type of rail car to be used to transport the goods).

Supplier has a large pool of similar rail cars that can be used to fulfil the requirements of the contract. Similarly, Supplier can choose to use any one of a number of rail cars to fulfil each of Customer’s requests, and a rail car could be used to transport not only Customer’s goods, but also the goods of other customers.

The cars are stored at Supplier’s premises when not being used to transport goods.

Assessment

Supplier’s substitution rights in this example are substantive because it:

- Has the practical ability to substitute the rail cars throughout the period of use, and

- Would benefit economically from substituting the rail cars because there is a large pool of them available and they are stored at its premises. Potential benefits to Supplier are deploying the rail cars to a nearby location for use in other contracts, or to use any of the 10 rail cars that are sitting idle for other purposes because they are not currently being used by Customer.

Therefore, although the contract makes use of identified assets (the rail cars), the contract does not contain a lease of those rail cars because Supplier has substantive substitution rights.

More examples

The examples below illustrate both the above principles, i.e. there must be an identified asset and no substitution rights.

Example 5 – Cloud-based storage solutions

Company A entered into an agreement with Software Co for use of cloud-based storage solutions for various business units.

The term of the agreement is for three years, where Company A will pay $12,500 per month to Software Co.

The amount of computing power and storage capacity is for 10 tower server units whose serial numbers are specified in the agreement.

Any replacement of infrastructure must still satisfy minimum system specifications as noted in the contract between Company A and Software Co.

Assessment

The assets (servers) are specified in the arrangement because specified serial numbers for the servers are provided. The assets are explicitly noted in the contract.

While Software Co has the contractual right to substitute the assets, the replacement ones would have to meet minimum system specifications, and it is unlikely that Software Co would benefit economically from replacing the servers. As such, the substitution rights do not appear to be substantive.

Example 6 – Asset in a remote location

Company B’s mining subsidiary needs electricity in a remote location, and has entered into a contract with Energy Co to purchase substantially all of the energy produced by its hydro-electric dam for a period of 10 years (the expected timeframe to exhaust the mine).

The electricity could be produced from other sources, but Energy Co would have no realistic alternative source to produce the power given it is in such a remote location.

Company B will pay Energy Co $25,000 per month over the 10-year period.

Assessment

The power plant is explicitly specified in the contract.

Energy Co can provide the power from alternative assets, however, the location is so remote that it would have no economically beneficial reason to substitute the asset for something else. The substitution rights are therefore not substantive.

Therefore, there is an identified asset in the contract.

eLearning Materials

For more information, please refer to our IFRS 16 eLearning materials which can be found on our website, specifically Identifying a lease.

Concluding thoughts

Determining whether a contract is, or contains, a lease, is usually a straightforward matter. However, in practice, complex situations may arise that require the application of considerable professional judgement, particularly with respect to determining whether there is an identified asset. To enable such judgements to be made, finance teams will need to ensure that they are able to access all underlying contracts. If such contracts are not currently centrally stored, finance teams should commence the process of ensuring that all contracts are available for analysis well prior to the adoption of IFRS 16.