Accounting for accrued income on partially performed grant activities under AASB 1058

On 29 October 2020, the Staff of the Australian Accounting Standards Board (AASB) added new FAQ No. 13 to assist with the accounting for accrued income where a not-for-profit entity (NFP) has only partially performed activities required under grant agreements within the scope of AASB 1058 Income of Not-for-Profit Entities. In practice, this may occur where a NFP has partially performed activities, but has not yet received cash from the grantor.

For partially performed performance obligations under AASB 15 Revenue from Contracts with Customers, this ‘problem’ is dealt with by recognising a ‘contract asset’, however for AASB 1058, the issue of whether and when to recognise an asset and accrued income is not as clear cut.

FAQ No. 13 therefore address the question as to whether the NFP should recognise an asset representing the right to receive the asset (e.g. cash) and the associated grant income:

- In full at the outset

- On a pro rata basis or other basis over time as the terms of the agreement are fulfilled, or

- Only when all eligibility criteria of the agreement are met for the transaction as a whole.

FAQ No. 13 concludes that the second option above is the correct means for accounting for partially performed grant activities. That is, grant income is recognised on a pro rata basis or other basis over time as the terms of the agreement are fulfilled.

Why not a ‘contract asset’?

FAQ No. 13 notes that it is not appropriate for a NFP to recognise the equivalent of a AASB 15 ‘contract asset’ when it has a contractual right to receive the asset (i.e. all eligibility criteria have been satisfied, and there is no performance risk but there may be some refund risk). This is because the AASB 15 ‘contract asset’ is subject to performance risk (uncompleted performance obligation) whereas the partially completed activity under AASB 1058 is not.

Another type of financial asset

FAQ No. 13 notes that the NFP can recognise another type of asset such as a financial asset where it has an unconditional right to receive the asset (e.g. cash), even if that right is subject to refund risk.

How much to recognise and when?

When the NFP has an unconditional right to recognise the financial asset, it is only recognised for a proportion of the transaction/activities completed because that is the amount for which the NFP is eligible which is no longer subject to performance risk.

Accounting entries

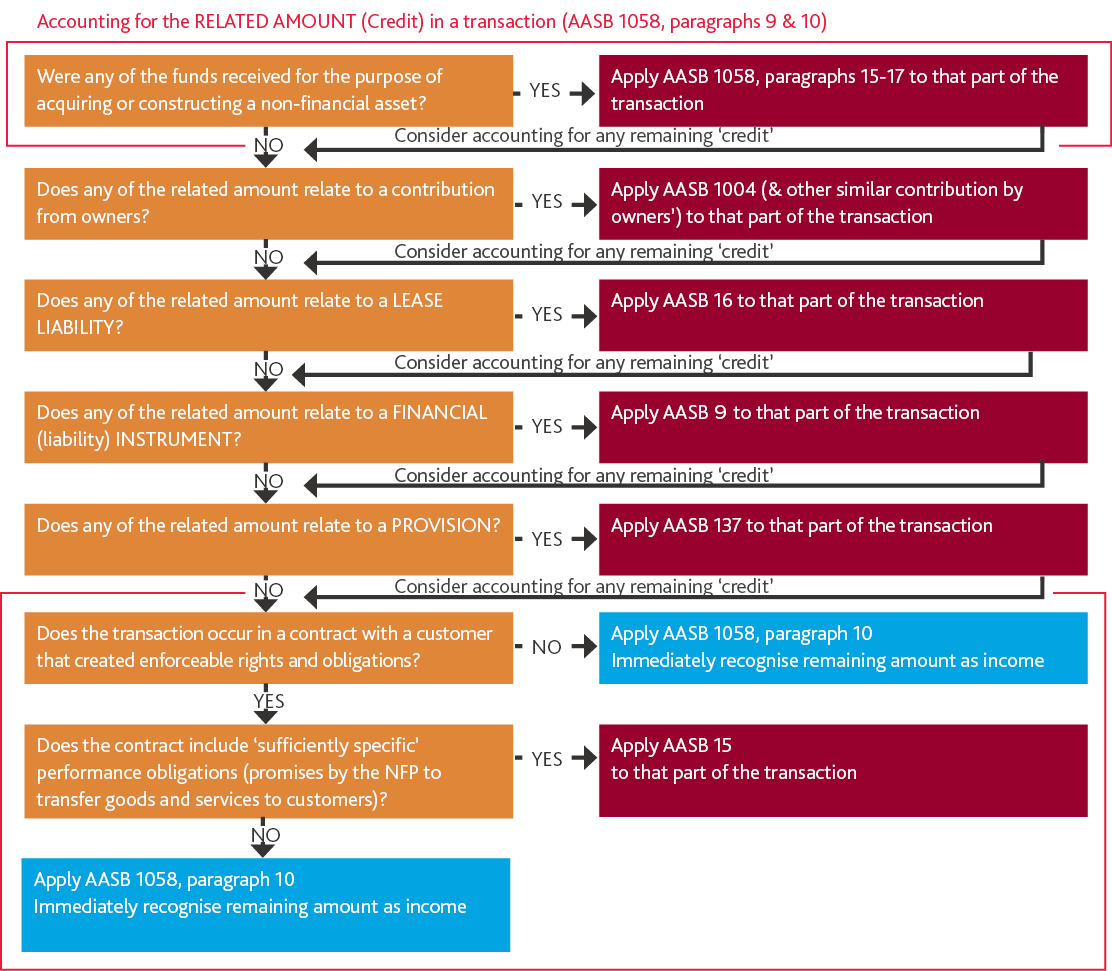

The debit side of the transaction (right to receive the financial asset) is recognised under AASB 9 Financial Instruments (refer AASB 1058, paragraph 8(a)). The decision tree below illustrates that the credit side is recognised under either AASB 1058, paragraphs 15-17 for capital grants, or paragraph 10 for non-capital (revenue) grants.

Examples

FAQ No. 13 includes two examples to illustrate the above discussion. These are extracted and summarised below. Please refer to FAQ No. 13 for the full text of the FAQ and related examples.

Example – Non-capital grant (summary details extracted from FAQ 13 Scenario 1a)

Fact pattern

On 1 April 2020, NFP is awarded a grant of $90,000 to help it meet the increased demand for counselling services expected to arise from COVID-19 during the remainder of the calendar year.

The agreement is enforceable in accordance with paragraphs F11-F18 of AASB 15, however, the agreement does not meet the ‘sufficiently specific’ criterion described in paragraphs F20-F26 of AASB 15. The agreement therefore falls within the scope of AASB 1058 (and not within AASB 15).

According to the agreement, NFP can claim a pro rata amount of the grant after the end of each quarter. Claims are to be made on a straight-line time-transpired basis unless NFP can demonstrate in any one quarter that another basis can be justified (e.g. because it develops an online support package in one quarter that will be self-sustaining in later quarters). Once a claim is assessed and paid, it is non-refundable.

Up to the 30 June 2020 reporting date, NFP has conducted COVID-19 related counselling sessions and is in the planning stages of developing a smartphone app. It therefore intends to submit a claim of $30,000 for the quarter ending 30 June 2020 on a simple time-transpired basis.

NFP expects the claim to be accepted by the grantor. NFP also expects to continue to provide COVID-19 related support services at least for the remainder of the calendar year.

Accounting treatment – The debit

When the grant agreement is first entered into on 1 April 2020, no asset (or liability or income) is recognised by NFP because at that point the agreement is equally proportionately unperformed (see paragraph 91 of Framework for the Preparation and Presentation of Financial Statements).

NFP applies AASB 1058, paragraph 8(a) at 30 June 2020 and determines that under AASB 9, it has a contractual right to receive a portion of the total grant because:

- It has conducted COVID-19 related support services prior to 30 June 2020

- It has satisfied the eligibility criteria of the grant agreement to the extent of $30,000 and therefore has a receivable representing its unconditional contractual right to receive cash in the future (paragraph AG4 of AASB 132), and

- It has already performed under the contract, i.e. the contract is no longer equally proportionately unperformed.

NFP therefore recognises a financial asset of $30,000, described appropriately for example as ‘non-capital grants receivable’, in its statement of financial position.

Accounting treatment – The credit

When recognising the ‘Non-capital grants receivable’ of $30,000 on 30 June 2020, NFP applies AASB 1058, paragraph 9 (refer decision tree above) and determines that there is no ‘related amount’ to be recognised (including revenue under AASB 15). Therefore in accordance with paragraph 10 of AASB 1058, NFP recognises $30,000 income in its statement of financial performance for the year ended 30 June 2020.

Example – Capital grant (summary details extracted from FAQ 13 Scenario 1b)

Fact pattern

On 1 March 2020, NFP (a NFP that operates community health centres) enters into an enforceable grant agreement to construct a community health centre in a new regional area that it will control during construction and continue to control and operate after completion.

The centre is to be fully funded by the grantor to a cost of $1.2m. Under the agreement NFP has the right to claim for eligible construction expenditure incurred each quarter and will receive the funds once the claim is submitted and the costs assessed by the grantor to be eligible.

If NFP fails to complete the construction within 12 months of the agreement being entered into, the work in progress must be handed over to the grantor.

The grant agreement is limited to providing a transfer of a financial asset to construct a recognisable non-financial asset that NFP is to control, and meets all the criteria in AASB 1058, paragraph 15.

At 30 June 2020 reporting date, costs of $400,000 have been incurred by NFP and recognised as an asset ‘building – work in progress’. Although NFP has not yet submitted the $400,000 claim to the grantor, it does not expect it to be rejected. NFP also expects to complete the construction on time.

Accounting treatment – The debit

When the grant agreement is first entered into on 1 March 2020, no asset (or liability or income) is recognised by NFP because at that point the agreement is equally proportionately unperformed (see paragraph 91 of Framework for the Preparation and Presentation of Financial Statements).

The contract is not accounted for under AASB 15 because it is not a ‘contract with a customer’, i.e. the community health centre is to be controlled by NFP, and therefore there is no transfer of goods or services to an external party.

NFP applies AASB 1058, paragraph 8(a) at 30 June 2020 and determines that under AASB 9, it has a contractual right to receive a portion of the $1.2 million grant because:

- It has satisfied the eligibility criteria of the grant agreement to the extent of the construction work completed to 30 June 2020 of $400,000, and

- It has already performed under the contract, i.e. the contract is no longer equally proportionately unperformed.

NFP therefore recognises a financial asset of $400,000, described appropriately for example as ‘capital grants receivable’, in its statement of financial position.

Accounting treatment – The credit

When recognising the ‘Capital grants receivable’ of $400,000 on 30 June 2020, NFP applies AASB 1058, paragraph 9 (refer decision tree above) and determines that there is no ‘related amount’ to be recognised.

Therefore, in accordance with AASB 1058, paragraph 16, after NFP determined that it has satisfied its obligations under the agreement to the extent of the construction costs of $400,000 (and therefore there is no liability outstanding as at the reporting date), NFP recognises income of $400,000 in its statement of financial performance for the year ended 30 June 2020.