Ongoing management and reporting of leases – Do you need help?

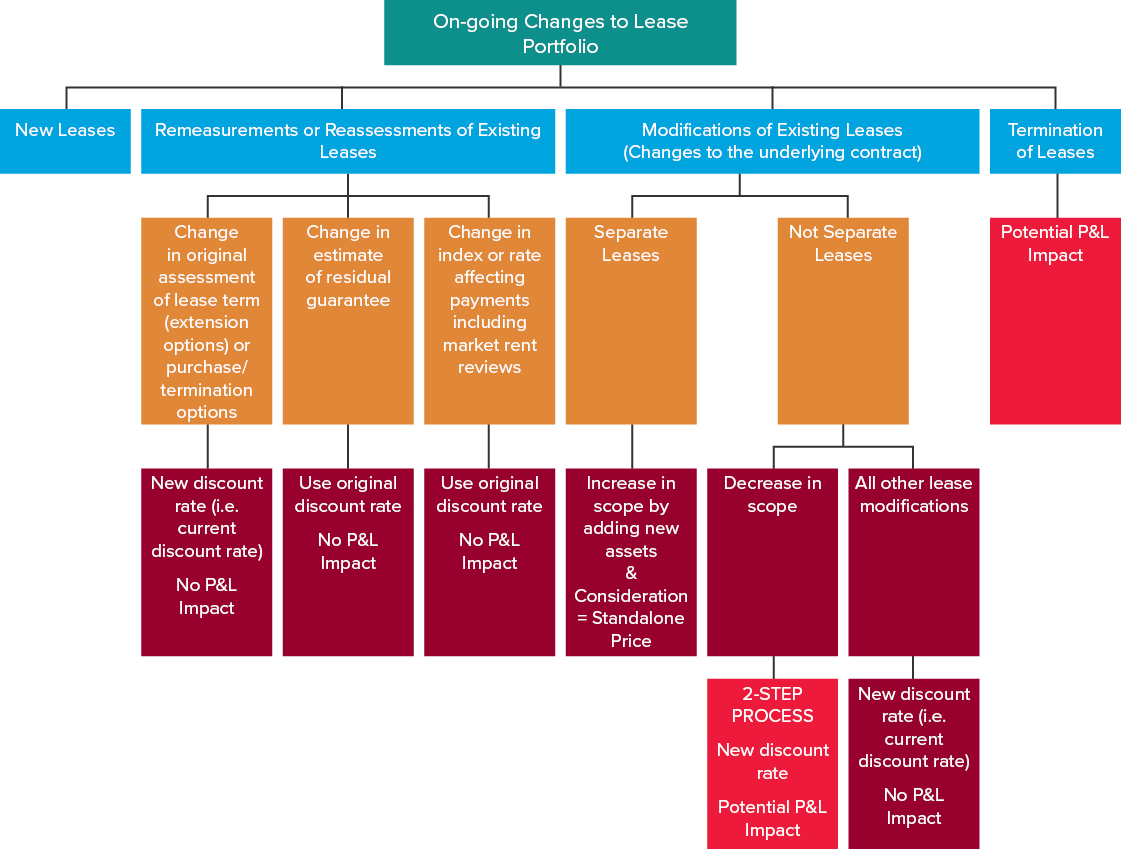

Australian entities have now implemented the new IFRS 16, but it is only the start of an ongoing process to manage and account for their lease portfolio. An entity’s lease portfolio changes constantly and can generally be grouped into the following four categories and numerous subcategories, which all lead to different accounting outcomes:

It is vital any change in a lease arrangement, whether formally agreed with the lessor or not, is treated within the above categories no matter how complicated, as they lead to different accounting outcomes. In addition to the above, lessees also have to account for COVID-19 related rent concessions after considering the May 2020 amendments to IFRS 16. You can read more about these in our International Financial Reporting Bulletin: Accounting for lessee rent concessions: FAQs.

Our BDO IFRS experts currently assist our Australian clients with their lease accounting problems in the following ways:

- Providing monthly, quarterly or annual outsourced lease accounting

- Preparation of position papers outlining the various practical expedients utilised and accounting policy choices, including accounting for COVID-19 related rent concessions (i.e. audit ready services)

- Licensing BDO Lead, our IFRS 16 technology solution.

Please contact Aletta Boshoff or any of our BDO IFRS experts if you would like to know how we take the hassle out of your ongoing lease management and reporting obligations.