Accounting for non-refundable research and development incentives

For tax years ending up to 30 June 2021, the Research and Development (R&D) tax incentive provides targeted R&D offsets designed to encourage more Australian companies to engage in R&D. The incentive has two core components as follows:

- 43.5% refundable* tax offset for eligible entities with an aggregated turnover of less than $20 million per annum, or

- 38.5% non-refundable tax offset for all other eligible entities (entities may be able to carry forward unused offset amounts to future income years).

*These R&D incentives are only ‘refundable’ in cash to the extent that the current income tax liability is insufficient to utilise the R&D incentive. For example, if the current income tax liability is $50,000 and the ‘refundable’ incentive is $70,000, $50,000 of the incentive will reduce the current income tax liability to $Nil, and cash of $20,000 will be received for the remaining $20,000 of the refundable incentive.

Which Accounting Standard?

It is not clear which accounting standard determines the appropriate accounting for R&D incentives (investment tax credits) because they are scoped out of both:

- AASB 112 Income Taxes (refer paragraph 4), although temporary differences that arise from investment tax credits are accounted for under AASB 112, and

- AASB 120 Accounting for Government Grants and Disclosure of Government Assistance - paragraph 2(b) specifically scopes out government assistance that is provided in the form of benefits that are available in determining taxable profit or loss, or are determined or limited on the basis of the entity’s income tax liability.

Income tax approach (AASB 112)

Under this approach, AASB 112 is applied by analogy because the incentive is only available as a reduction in the income tax liability.

Government grant approach (AASB 120)

AASB 120, paragraph 2(b) specifically scopes out government assistance that are “… determined or limited on the basis of income tax liability”. Because entities receive the benefit of the R&D incentive via a reduction in current or future income tax liabilities, some consider these to be specifically scoped out of AASB 120, paragraph 2(b)). Although the total amount of the R&D incentive is not determined (based on) the income tax liability (i.e. it is based on R&D expenditure), it is limited to the amount of the entity’s income tax liability in a particular period (and unused credits can be carried forward to be set off against future tax liabilities).

However, this approach is based on the view that the purpose of the R&D incentive is to provide government assistance, and on this basis, one can analogise to the requirements of AASB 120, and therefore account for the entire R&D incentive as a government grant.

‘Split approach’

Under this approach:

- The amount of the R&D incentive that corresponds to the company tax rate (e.g. 30%) is recognised by applying AASB 112 by analogy, and

- The remainder (i.e. 8.5%) is recognised applying AASB 120 by analogy.

The rationale for using this approach is that:

- If the entity chooses not to claim the R&D incentive (38.5% of R&D spend), it will still be able to claim a normal tax deduction based on 30% of the R&D spend, and

- Any excess benefit from the R&D incentive (8.5%) is considered a government grant in accordance with AASB 120 Accounting for Government Grants and Disclosure of Government Assistance.

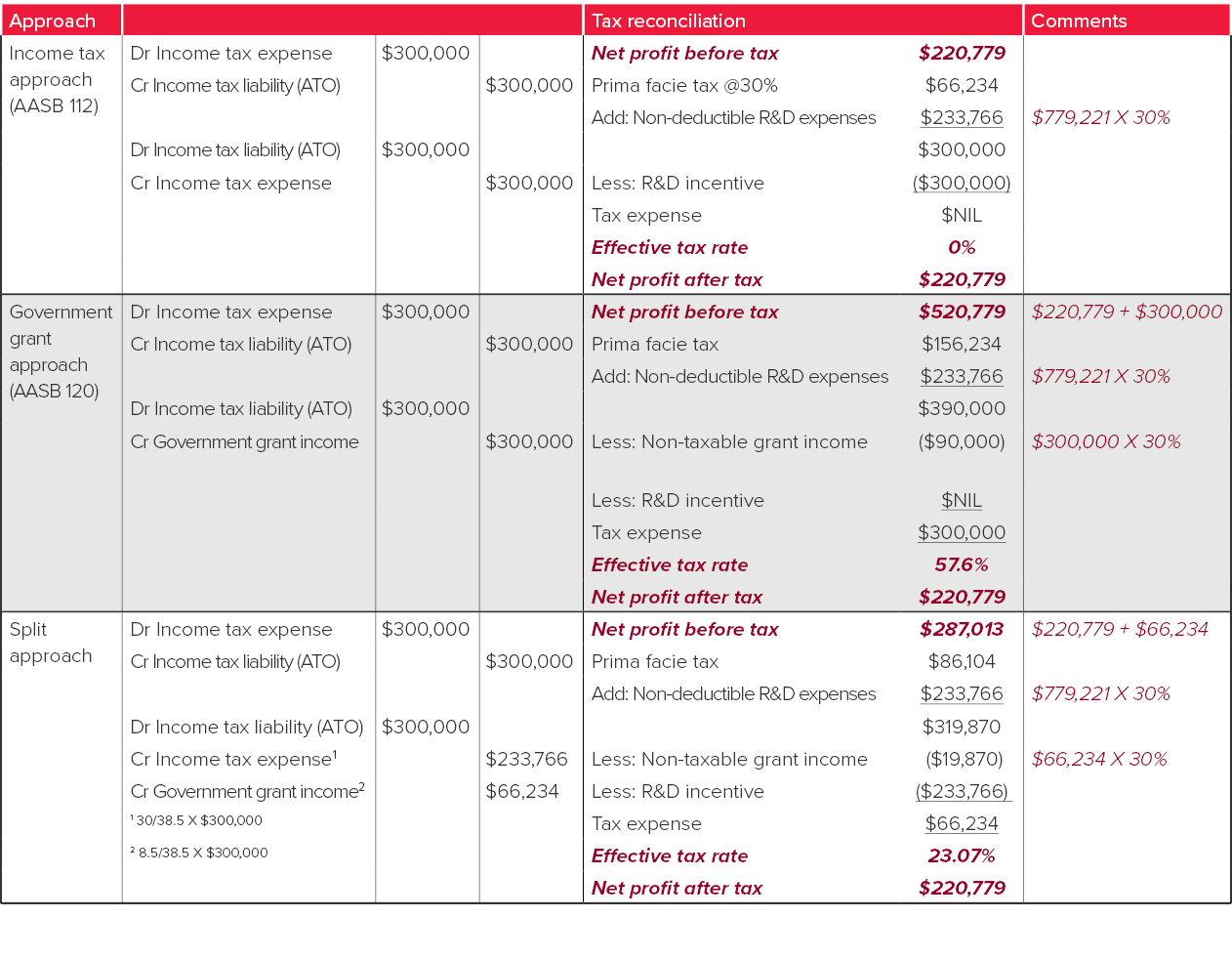

Example 1 – Current tax liability owing

Entity A has an accounting net profit of $220,779, which is arrived at after deducting $779,221 of R&D expenditure, which has been expensed in profit or loss.

Entity A is also entitled to a non-refundable R&D incentive of $300,000 (i.e. 38.5% of R&D spend of $779,221).

Entity A’s tax rate is 30%. (We have used a 30% tax rate for illustrative purposes but in practice some entities may be subject to lower tax rates).

Calculation of income tax liability

| $ | |

| Net accounting profit | 220,779 |

| Add: Non-deductible R&D expenses | 779,221 |

| Taxable profits | 1,000,000 |

| Tax rate | 30% |

| Income tax payable | 300,000 |

| Less: R&D incentive (non-taxable) | (300,000) |

| Net tax liability | NIL |

The table below shows the journal entries and tax reconciliations for each of the three different approaches:

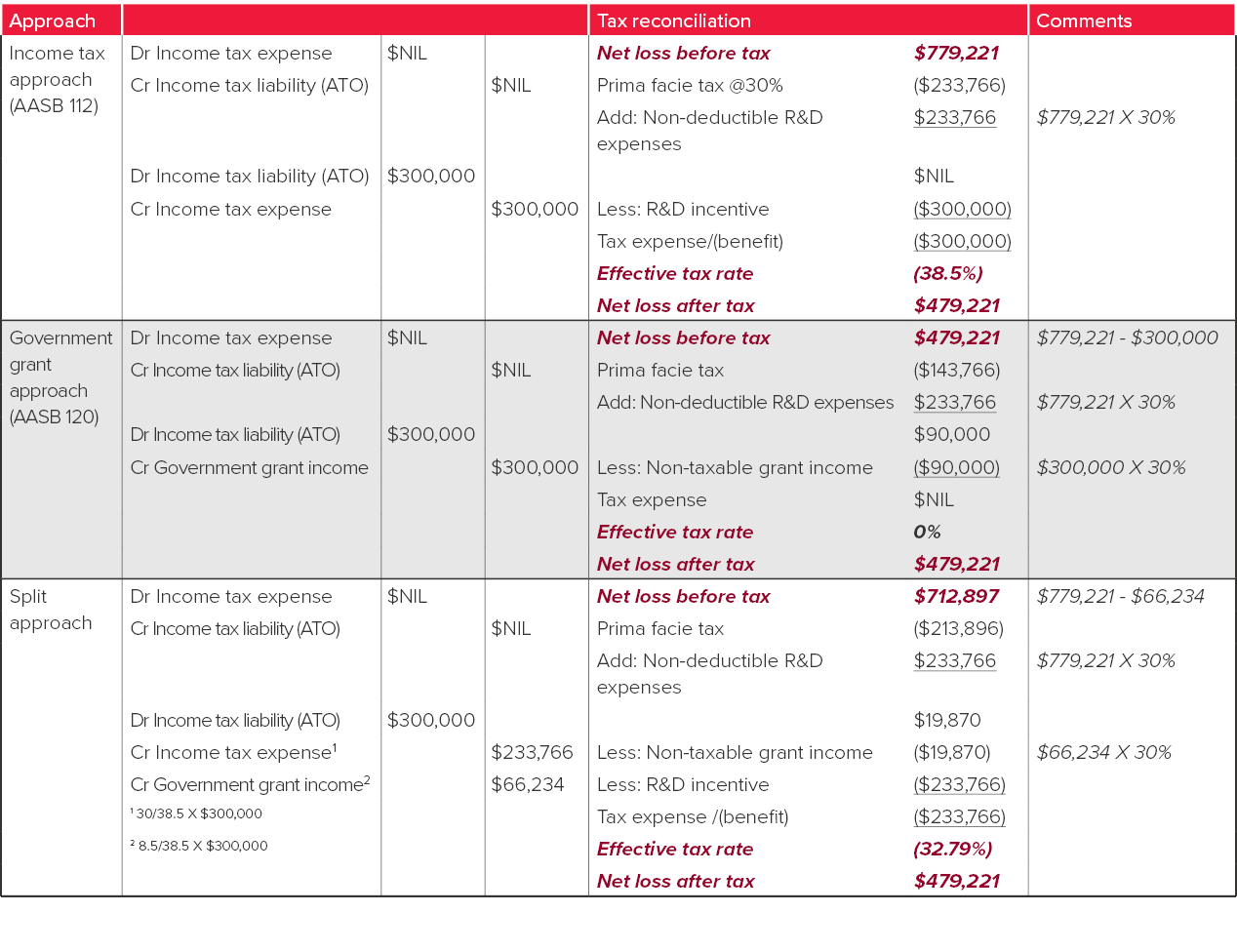

Example 2 – No current tax liability owing

Entity B has an accounting loss of $779,221, which is arrived at after deducting $779,221 of R&D expenditure, which has been expensed in profit or loss.

Entity B is also entitled to a non-refundable R&D incentive of $300,000 (i.e. 38.5% of R&D spend of $779,221).

Entity B’s tax rate is 30%. (We have used a 30% tax rate for illustrative purposes but in practice some entities may be subject to lower tax rates).

Assume it is probable that Entity B will be able to recover its unused tax credits in future periods against future taxable profits.

Calculation of income tax liability

| $ |

Net accounting loss | (779,221) |

Add: Non-deductible R&D expenses | 779,221 |

Taxable profits | NIL |

Tax rate | 30% |

Income tax payable | NIL |

R&D incentive (non-taxable) – carried forward | 300,000 |

The table below shows the journal entries and tax reconciliations for each of the three different approaches:

Changes arising from the Federal Budget

For tax years beginning on or after 1 July 2021 (i.e. ending 30 June 2022), the October 2020 Federal Budget introduced changes to the rates for non-refundable incentives, depending on the entity’s R&D intensity. We will discuss this in more detail in future editions of Accounting News.