IASB issues guidance on making materiality judgements (IFRS Practice Statement 2 Making Materiality Judgements)

After almost two years in the making, the International Accounting Standards Board (IASB) on 14 September 2017 finally issued its long-awaited non-mandatory guidance on making materiality judgements in IFRS Practice Statement 2 Making Materiality Judgements (Practice Statement)1.

While the IASB’s Disclosure Initiative has shone a spotlight on the need to ‘declutter’ financial statements, and to focus on ‘material’ disclosures rather than applying a ‘checklist mentality’, there has been a distinct lack of guidance to assist preparers and auditors in determining what is material and what is not.

The primary aim of this Practice Statement is to fill this void, and assist preparers and auditors in making materiality judgements to streamline and improve the quality of information disclosed in financial statements, i.e. to drive behavioural change. The framework outlined in the Practice Statement, which includes a ‘four step’ process, is a useful tool for preparers and auditors when making judgements about measurement and disclosures in financial statements.

1 Click on link and then you will need to ‘register’ to obtain a free copy of the Practice Statement

Definition of ‘material’

The definition of ‘materiality’ in the Practice Statement, which is in the process of being updated by ED 282 Definition of Material, focuses on three key issues, and provides guidance on each of these:

- Who are the primary users of financial statements (i.e. existing and potential investors, lenders and other creditors)

- What decisions do they primarily make, and

- What are their information needs?

Information needs

Regarding information needs of primary users, the Practice Statement requires preparers of financial statements to:

- Identify each group of primary users and then what information is common to the needs of that user group (e.g. investors, lenders, etc.).

- Include the common information for each group, not merely information that is common to all user groups.

- Repeat information that is already publicly available because the fact that information is already in the public domain does not impact an entity’s assessment of whether it is material to the financial statements.

- If required by local laws and regulations, include disclosures that are additional to IFRS requirements, regardless of their materiality (e.g. s300A remuneration report requirements for listed entities).

The four step process

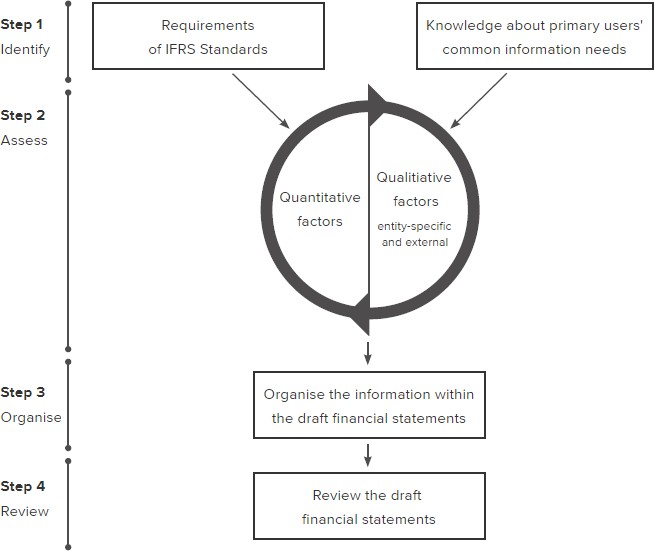

The Practice Statement outlines a four step process for assessing whether items, including disclosures, are material to the financial statements.

Figure 1: Extracted from Practice Statement

Step one – Identify information that primary users might need to make decisions

The starting point here is all IFRS disclosures required in Accounting Standards, supplemented by additional information primary users might need to understand the impact of the transaction, event or other condition on financial performance, position and cash flows.

Step two – Assess whether potentially material information in step one is, in fact, material

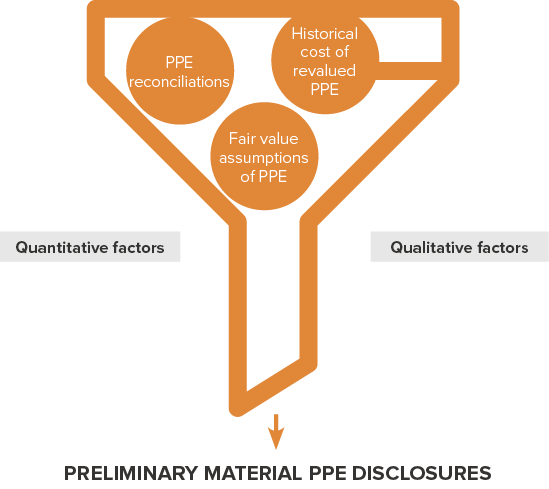

This is a filtering process, where we start with the complete potential pool of disclosures identified in step one, and then decide whether for each disclosure the primary users could reasonably be expected to be influenced by the information when making decisions about providing resources to the entity.

Step two is also an iterative process whereby we consider both quantitative and qualitative factors before concluding that disclosures are immaterial.

Image Caption

Image Caption

Figure 2: Illustration of the step two filtering process of potentially material disclosures

The Practice Statement includes discussion and examples on what is meant by ‘quantitative’ and ‘qualitative’ factors but stops short of giving benchmarks or guidelines for setting quantitative materiality thresholds.

Step three – Organise information in a clear and concise way

Once we have decided which disclosures from the total possible pool are material (refer step one and step two above), we need to ensure that disclosures are organised, characterised and presented clearly and concisely so that it is understandable. This involves a similar process to what we should already be applying as part of the IASB’s ‘decluttering’ initiative, including:

- Emphasising material matters

- Tailoring information to the entity’s own circumstances (avoid using boiler-plate disclosures)

- Without omitting material information, use simple, plain English language to describe details as concisely as possible

- Highlight relationships between different pieces of information (make use of cross-referencing)

- Provide information in a format appropriate for its type, e.g. tabular format or narrative

- Provide information in a way that maximises, to the extent possible, comparability among entities and across reporting periods

- Avoid or minimise duplication of information in different parts of the financial statements (although s300A remuneration report disclosures must be included in the body of the remuneration report itself, and cannot be cross-referenced from the financial statements), and

- Ensure material information is not obscured by too much immaterial information.

Step four – Review draft financial statements

This last step involves ‘stepping back’ when reviewing the draft financial statements to consider, based on our knowledge of all transactions, events and conditions, whether all material information has been included in the financial statements.

Specific topics

The Practice Statement also provides guidance on making materiality judgements when assessing:

- Prior period information

- Errors

- Information about covenants, and

- Interim financial reporting.

Application date

It can be applied any time from issue date, 14 September 2017.