Will the three new accounting standards (AASB 9, 15 and 16) make you large (or small)?

Most readers would by now be aware of the ‘triple threat’, or three new accounting standards that apply to financial statements in the near future, AASB 15 Revenue from Contracts with Customers and AASB 9 Financial Instruments applying for the first time to December 2018 financial years, and AASB 16 Leases applying for the first time to December 2019 financial years.

While some entities may not be impacted by these standards in a major way, most will have some nuances that will ultimately impact the amount and timing of revenue recognition, impairment of financial assets such as trade and other receivables, and most commonly, have some operating leases to be capitalised on the balance sheet.

BDO commentsAll entities need to perform a detailed assessment (and document) whether and how they will be impacted by AASB 9, 15 & 16. This assessment will then be audited when the transition impacts are disclosed in the financial statements prior to transition, and again during the first year the new standards are applied. |

Need to consider the impact of the ‘triple threat’ now

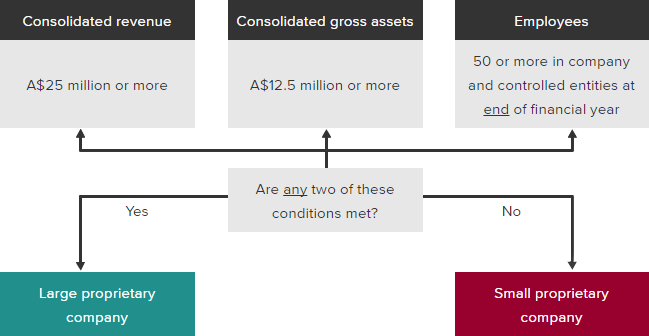

Many small companies think they will continue to be small and therefore this ‘triple threat’ will not affect them. This would be a premature assumption, because when determining whether your company is large or small for financial reporting purposes under Part 2M.3 of the Corporations Act 2001, one needs to consider the thresholds in s45A by applying Australian Accounting Standards (which would include considering the impacts of these three new standards). The diagramme below illustrates the process for deciding whether a company is small or large.

AASB 15 could make you small or large

For many entities, AASB 15 will change the timing or pattern of revenue recognition, with some entities recognising revenue earlier than currently, and others later:

- If AASB 15 requires you to change from ‘point in time’ recognition to ‘over time’ recognition, you may recognise revenue much earlier than you currently do (e.g. some property sales), or later (e.g. some licensing arrangements).

- The requirements to ‘bundle’ contracts and more clearly define performance conditions could also result in the timing of your revenue being altered.

- Contract modifications to supply additional goods and services at discounted prices may result in deferring revenue because the original contract is considered terminated, with a new contract entered into for the remaining performance obligations on the original contract, plus for the additional goods and services.

- If your contracts contain variable consideration clauses such that revenue is constrained and only recognised when it is highly probably that there will not be a significant reversal, you will recognise revenue later than under current standards.

Due to the more robust guidance on agent/principal relationships contained in AASB 15, the overall quantum of your revenue may be impacted (i.e. either reduced because AASB 15 clarifies that you are acting as an agent, or grossed up because it clarifies that you are acting as principal).

AASB 16 could make you large

Most entities have some type of operating leases, the most common being property leases for office, warehousing and manufacturing premises, or retail stores premises.

Particularly where leases contain multiple options to extend on favourable terms (lessee is reasonably certain to exercise the option because there is an economic incentive for them to do so), the discounted value of lease payments could result in significant right-of-use assets and lease liabilities being brought on balance sheet, inadvertently pushing lessees over the $12.5 million ‘asset’ threshold in s45A.

Industries most likely to be impacted by these changes include:

- Small regional airlines where the major assets (aircraft) are currently ‘off balance sheet’

- Retailers with multiple stores and extension options on store leases

- Manufacturers with purpose built or specialised premises for manufacturing facilities or warehousing

- Wholesalers with specialised or purpose built warehousing facilities

- Heavy equipment users such as manufacturers or mining entities, and

- All types of entities with large fleets of vehicles.

AASB 16 could make you small

Often forgotten is the fact that there could be instances where some contracts, previously accounted for as a lease under Interpretation 4 Determining whether an Arrangement contains a Lease that do not meet the definition of a lease under AASB 16, and will therefore be derecognised from the balance sheet.

This typically occurs with ‘take or pay’ contracts for utilities such as electricity where the customer is obliged to pay for the majority of the output generated by the asset but the supplier controls the underlying asset (e.g. a power station).

AASB 9 could make you small or large

Most businesses will be impacted in some way by the new ‘expected loss’ impairment model, which results in impairment losses on loans and receivables being booked much earlier. This could result in entities currently meeting the assets threshold being ‘small’ entities, and therefore no longer required to report.

On the other hand, some small entities may become large because AASB 9 contains stricter rules for measuring financial assets at fair value, therefore tipping them above the $12.5 million asset threshold.

Need help?

If you need help in assessing the impacts of these new standards or whether they will impact your reporting status under the Corporations Act as small or large, please contact your engagement partner or BDO’s IFRS Advisory team.