IFRS 16 is ‘business as usual for lessors’ but creates complexity for subleasing arrangements

In the April 2018 edition of Accounting News we noted that IFRS 16 Leases, which comes into effect for financial reporting periods beginning on or after 1 January 2019, will fundamentally change the manner in which lessees account for leases.

Accounting by lessors under IFRS 16

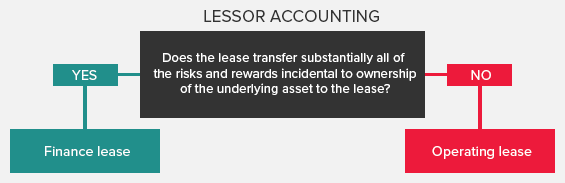

The adoption of IFRS 16 by lessors, however, will not be complex as IFRS 16 retains the IAS 17 Leases accounting treatment for lessors. This means that IFRS 16 requires a lease:

- To be classified as a finance lease if substantially all of the risks and rewards incidental to ownership of the leased asset have been transferred to the lessee

- To otherwise be classified as an operating lease.

Whether a lease is a finance lease or an operating lease depends on the substance of the transaction, rather than the form of the contract. As a result, classification can require the application of considerable professional judgement.

To assist with that judgement, IFRS 16 provides examples of situations that individually or in combination would normally lead to a lease being classified as a finance lease (IFRS 16, paragraph 63):

| Situations that would normally lead to a lease being classified as a finance lease: |

| The lease transfers ownership of the underlying asset to the lessee by the end of the lease term. |

| The lessee has the option to purchase the underlying asset at a price that is expected to be sufficiently lower than the fair value at the date the option becomes exercisable for it to be reasonably certain, at the inception date, that the option will be exercised. |

| The lease term is for the major part of the economic life of the underlying asset even if title is not transferred. |

| At the inception date, the present value of the lease payments amounts to at least substantially all of the fair value of the underlying asset. |

| The underlying asset is of such a specialised nature that only the lessee can use it without major modifications. |

IFRS 16 also provides indicators of situations that individually or in combination could lead to a lease being classified as a finance lease:

| Situations that could lead to a lease being classified as a finance lease: |

| If the lessee can cancel the lease, the lessor’s losses associated with the cancellation are borne by the lessee. |

| Gains or losses from the fluctuation in the fair value of the residual accrue to the lessee (for example, in the form of a rent rebate equalling most of the sales proceeds at the end of the lease). |

| The lessee has the ability to continue the lease for a secondary period at a rent that is substantially lower than market rent. |

Lease classification is made at the inception date of a lease and is reassessed only if there is a lease modification. Changes in estimates (for example, changes in estimates of the economic life, or of the residual value of the underlying asset), or changes in circumstances (for example, default by the lessee), do not give rise to a new classification of a lease for accounting purposes.

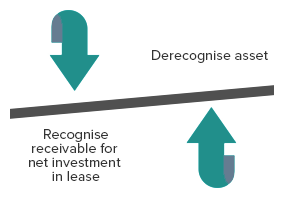

Lessor accounting for finance leases

Under IFRS 16, lessors account for finance leases by initially derecognising the asset and recognising a receivable for the net investment in the lease.

Initial direct costs (other than those incurred by a manufacturer or dealer lessor) are included in the net investment in the lease.

The lease payments included in the measurement of the net investment in the lease comprise the following payments for the right to use the underlying asset during the lease term that are not received at the commencement date:

- Fixed payments, less any lease incentives payable

- Variable lease payments that depend on an index or a rate, initially measured using the index/rate at the commencement date

- Any residual value guarantees provided to the lessor by the lessee, a related party of the lessee, or other parties unrelated to the lessor that are financially capable of discharging the obligations under the guarantee

- The exercise price of a purchase option if the lessee is reasonably certain to exercise that option, and

- Payments of penalties for terminating the lease if the lease term reflects the lessee exercising an option to terminate the lease.

The lessor must use the interest rate implicit in the lease to measure the net investment in the lease.

Subsequent to initial recognition, a lessor must recognise finance income over the lease term, based on a pattern reflecting a constant periodic rate of return on the lessor’s net investment in the lease (i.e. it must use the amortised cost method).

The new impairment requirements for financial assets included in IFRS 9 Financial Instruments must be applied to the lease receivable.

Lessor accounting for operating leases

Under IAS 17, lessors retain the leased asset on their books, and account for operating leases by recognising income received (net of lease incentives provided to the lessee) on a straight-line basis over the term of the lease (unless another systematic basis is more representative of the pattern in which benefit from the use of the underlying asset is diminished, in which case lease income received is recognised on that basis).

The lessor must also:

- Recognise costs incurred in earning the lease income as an expense

- Depreciate the asset in a manner that is consistent with the lessor’s normal depreciation policy for similar assets

- Assess the leased asset for impairment under IAS 36 Impairment of Assets, and

- Add initial direct costs incurred in obtaining the lease to the carrying amount of the leased asset and recognise those costs as an expense over the lease term on the same basis as the lease income.

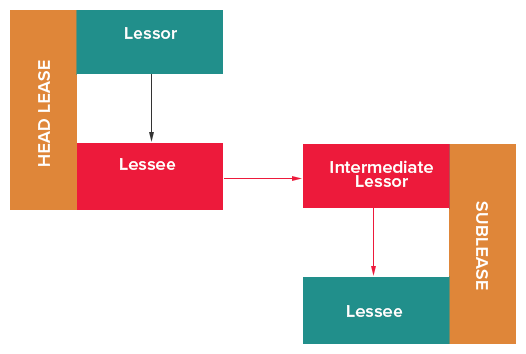

Subleasing

While the IFRS 16 requirements for accounting for leases as outlined above are ‘business as usual’ for lessors, they are more complex when applied by a lessor in a sublease arrangement.

What is a sublease?

A sublease is a transaction whereby a lessee leases an asset from a lessor (head lease), and the lessee then re-leases the same asset (as intermediate lessor) to another third party lessee (sublease).

IFRS 16 requires an intermediate lessor to classify the sublease as a finance lease or an operating lease as follows:

- If the head lease is a short-term lease that the entity, as a lessee, has accounted for by recognising the lease payments as an expense on a straight-line basis over the term of the lease, the sublease must be classified as an operating lease

- Otherwise, the sublease must be classified by reference to the right-of-use asset arising from the head lease, rather than by reference to the economic useful life of the underlying asset (such as the item of property, plant or equipment that is the subject of the lease).

Therefore, where the head lease is not a short-term lease expensed on a straight line basis over the lease term, the lessor must use the general principles (and the associated examples and indicators) for classification of a lease as an operating or a finance lease (as outlined above) by reference to the right-of-use asset.

Examples

The following examples illustrate the different accounting treatments for subleases classified as finance AND operating leases.

Background

An intermediate lessor enters into a five-year lease for 5,000 square metres of office space (the head lease) with the head lessor.

| Example 1 | Example 2 |

| Fact patterns for subleases | |

| At the commencement of the head lease, the intermediate lessor subleases the 5,000 square metres of office space for two years to a sub-lessee. | At the beginning of year 3 of the lease, the intermediate lessor subleases the 5,000 square metres of office space for the remaining three years of the head lease to a sub-lessee. |

| Classification of subleases | |

| OPERATING LEASE | FINANCE LEASE |

|

|

| Accounting for sublease | |

When the intermediate lessor enters into the sublease:

| When the intermediate lessor enters into the sublease:

|

During the term of the sublease, the intermediate lessor:

| During the term of the sublease, the intermediate lessor recognises:

|

Concluding thoughts

Many lessors have, quite understandably, concluded that the adoption of IFRS 16 will not impact them. However, where an entity is a lessor in a sublease arrangement, IFRS 16 creates complexity in accounting for the lease. As part of their process of adopting IFRS 16, finance teams should therefore identify all leases in which they are the intermediate lessor, and determine whether each lease will be classified as a finance lease or an operating lease, and what the applicable accounting treatment will be.