How will the new financial instrument standard impact business combinations when classifying financial assets under IFRS 9?

Most entities will by now be applying the new requirements in IFRS 9 Financial Instruments when classifying and measuring their financial assets. However, it is important to note that when acquiring a business and applying IFRS 3 Business Combinations, groups will need to reassess classification and measurement from the perspective of the acquirer on acquisition date.

For financial assets acquired in a business combination, initial recognition occurs at the time of the business combination (acquisition date).

Acquirers will need to reassess each financial asset of the acquiree at acquisition date, and decide whether classification by acquiree at either amortised cost, fair value through profit or loss (FVTPL), or fair value through other comprehensive income (FVTOCI) is still appropriate in the context of the acquirer.

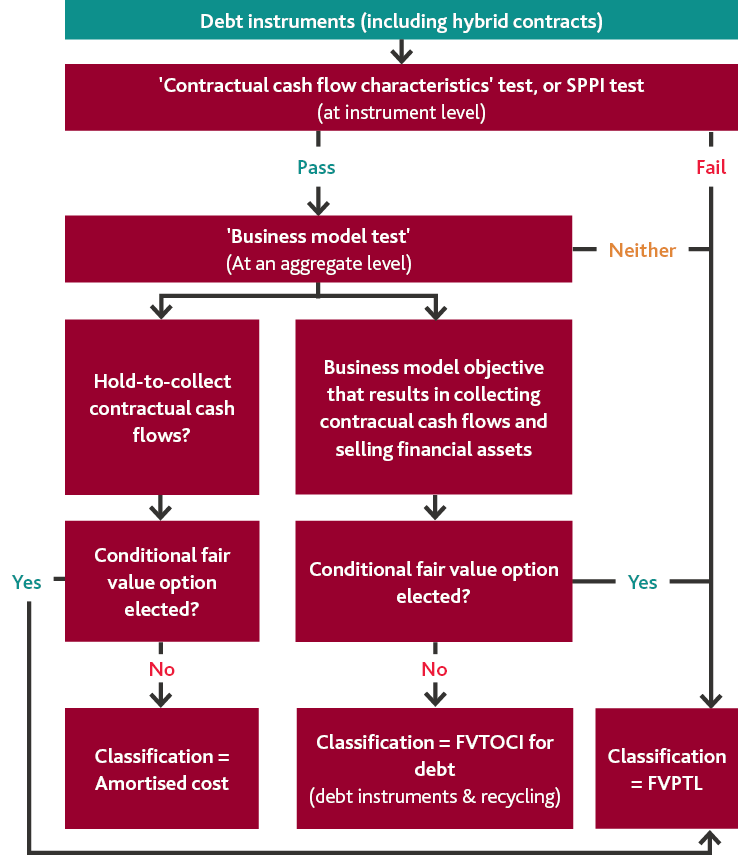

Debt instruments

The decision tree below illustrates how we determine the appropriate classification of a debt instrument.

Example 1 – Debt instruments

Big Co acquired Little Co on 1 January 2019. Little Co has the following financial assets (debt instruments) in its books at acquisition date, 1 January 2019:

| Financial asset | Amount | Classified by Little Co as… |

| Trade receivables | $3,600,000 | Amortised cost (hold to collect business model) |

| Related party loans – non-current Note: Loan is secured over property of borrower whose fair value at origination date (1 January 2014) was $1,300,000 | $1,000,000 | Amortised cost (hold to collect business model) |

| Government bonds | $500,000 | Amortised cost (hold to collect business model) |

On acquisition date (initial recognition), Big Co determines that:

- Trade receivables continue to be classified and measured at amortised cost

- The related party loan should be classified at FVTPL because the value of the property security has dropped to $800,000 at acquisition date (i.e. fails the SPPI test), and

- The business model for the government bonds has changed to ‘hold to collect and sell’, resulting in them being classified and measured at FVTOCI.

This will result in accounting differences between Little Co and Big Co Group as follows:

| Financial asset | Amount | Classified by Little Co as… | Classified by Big Co Group as… | Impact |

| Short term trade receivables | $3,600,000 | Amortised cost | Amortised cost | None |

| Related party loans – non-current Note: Loan is secured over property of borrower, fair value $1,300,000 at origination date (1 January 2014) | $1,000,000 | Amortised cost | FVTPL | At initial recognition (acquisition date), Big Co Group recognises the loan at fair value, with subsequent changes in fair value recognised in profit or loss. |

| Government bonds | $500,000 | Amortised cost OR FVTOCI. If it meets the requirements for Little Co to be able to reclassify a financial asset under IFRS 9, paragraph 4.4.1 and B4.4.1-B4.4.3 (i.e. Little Co also changed its business model to ‘hold to collect and sell’), then it would be measured at FVTOCI by Little Co. Judgement may need to be applied based on specific facts and circumstances. IFRS 9 sets quite a high hurdle for reclassifying financial assets. | FVTOCI | At initial recognition (acquisition date), Big Co Group recognises the government bonds at fair value, with subsequent changes in fair value recognised in other comprehensive income. |

Fair value is “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

For the short-term trade receivables, the amortised cost is likely to approximate its fair value due to its short term nature.

For the related party loan, the fair value would assume a discount rate that is a current market interest rate reflective of the remaining period to maturity and as well as the security pledged over the loan.

For government bonds, a direct quoted price for the bond may be available. If a direct quoted price is not available, a present value calculation could be performed using a discount rate based on a market interest rate reflecting the same credit quality.

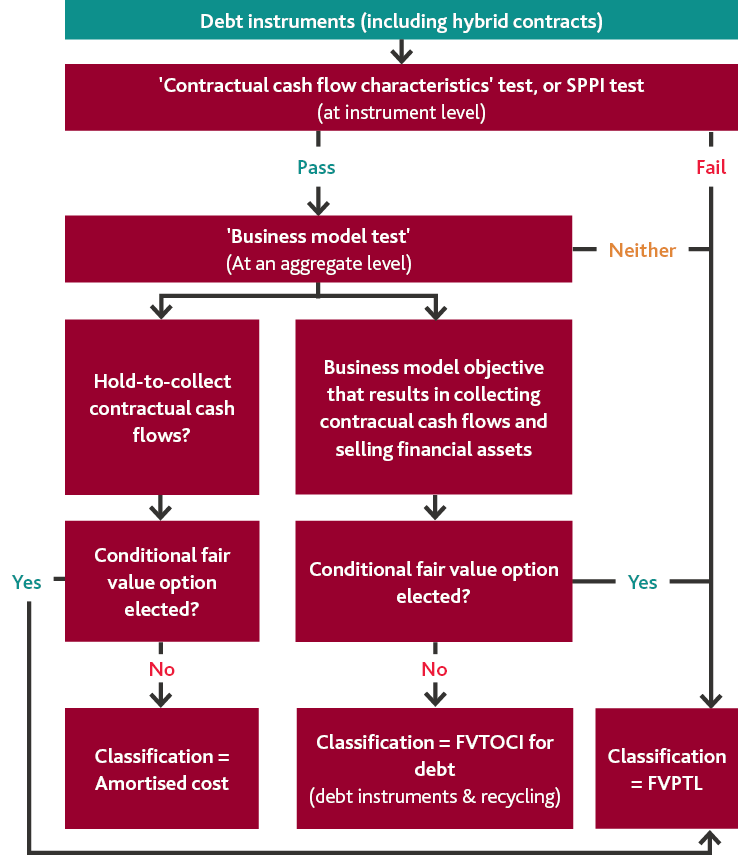

Equity instruments

The decision tree below illustrates how we determine the appropriate classification of an equity instrument.

Although the default category for measuring investments in equity instruments is FVTPL, entities can, on initial recognition, make an irrevocable election to classify these at FVTOCI if they are not held for trading, nor contingent consideration recognised by an acquirer in a business combination (IFRS 9, paragraph 4.1.4).

Example 2 – Equity instruments

Big Co acquired Little Co on 1 January 2019. Little Co has the following financial assets (equity instruments) in its books at acquisition date, 1 January 2019:

| Financial asset | Amount | Classified by Little Co as… |

| Listed shares | $500,000 | FVTPL |

| Investment in ABC Pty Limited | $750,000 | FVTOCI |

On acquisition date (initial recognition), Big Co makes an irrevocable election to present fair value changes in the listed shares in other comprehensive income because they are not held for trading by the group. These listed shares are therefore classified and measured at FVTOCI.

This will result in accounting differences between Little Co and Big Co Group as follows and consolidation adjustments being made each year for as long as these investments are held.

| Financial asset | Amount | Classified by Little Co as… | Classified by Big Co Group as… | Impact |

| Listed shares | $500,000 | FVTPL | FVTOCI | At initial recognition (acquisition date) there will be no impact as the listed shares are measured at fair value in the books of Little Co and also on consolidation. However, subsequent to initial recognition, adjustments will need to be made on consolidation by Big Co Group to recognise fair value movements in other comprehensive income rather than profit or loss. |

| Investment in ABC Pty Limited | $750,000 | FVTOCI | FVTOCI | None |