Accounting for land tax rebates received by landlords and the impact on outgoings audits

Background

The Queensland Government is providing a 25% land tax rebate that reduces the land tax liability of company or trust landowners (landlords) for the 2019-2020 assessment period if the property was owned at 30 June 2019. The rebate is only available where:

- Such landlords lease out their properties to one or more tenants that have been impacted by COVID-19, and the landlord provides rent relief to the affected tenants by an amount at least commensurate with the land tax rebate, and/or

- The property is not currently leased but is available and marketed for lease, the landlord’s ability to secure tenants has been impacted by COVID-19 and the relief is required to meet the landlord’s financial obligations.

The rebate must first be applied to provide rent relief for tenants and the balance of the rebate can then be applied by the landlord to meet their other financial obligations (e.g. in relation to debt and other expenses).

Assessments for land tax for the 2019-2020 year would typically have been levied late in 2019 calendar year.

Refer to https://www.qld.gov.au/environment/land/tax/covid-19 for more detailed information on the workings of the scheme.

Fact pattern

Landlord A (a for-profit entity) rents out its property to one tenant that is experiencing financial hardship due to COVID-19. On 30 June 2020, Landlord A agrees to provide rent relief to its tenant in an amount of $50,000 via a monthly rent reduction of $8,333 per month for April to September 2020.

Assuming the land tax expense for the 2019-2020 year is $200,000, and the rebate is $50,000, should the land tax rebate be accounted for by the landlord as:

- A reduction of land tax expense for the year ended 30 June 2020 (and therefore reduce the amount of outgoings to be reimbursed by tenants), or

- A government grant under AASB 120 Accounting for Government Grants and Disclosure of Government Assistance?

Is land tax rebate a reduction of land tax expense?

Given the facts of the Queensland scheme, the main purpose of the rebate appears not to be to reduce the landlords’ land tax expense, but rather to provide assistance to landlords during COVID-19, i.e. to enable landlords to:

- Provide rent relief to tenants, and use any excess to meet their financial obligations, or

- Meet their financial obligations where properties are not leased due to COVID-19.

The 25% land tax rebate should therefore not be accounted for as a reimbursement of land tax expense.

Is land tax rebate a ‘government grant’?

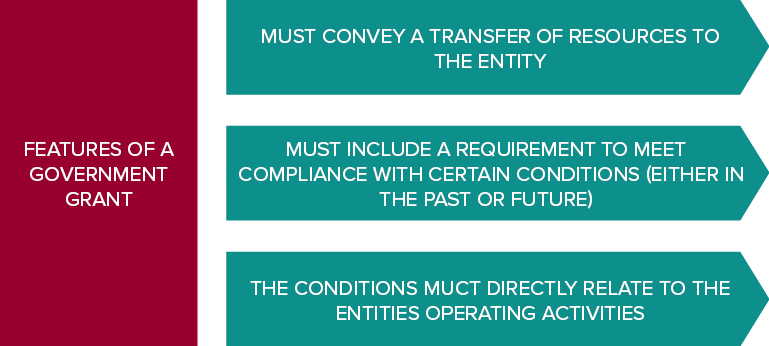

Government grants are assistance by government in the form of transfers of resources to an entity in return for past or future compliance with certain conditions relating to the operating activities of the entity.

The Queensland 25% land tax rebate is therefore a government grant because:

- It transfers economic resources to the entity in the form of the rebate

- In order to receive the rebate, the landlord must comply with certain conditions, i.e. the rebate is only received if the landlord provides rent relief to tenants, and/or the unleased property is available and marketed for lease, the landlord’s ability to secure tenants has been impacted by COVID-19, and

- The conditions relate directly to the entities operating activities (e.g. a landlord leasing properties to tenants).

When is the land tax rebate recognised?

Government grants are only recognised under AASB 120, paragraph 7 when there is reasonable assurance that:

- The entity will comply with the conditions attaching to them, and

- The grants will be received.

The entity (landlord) is only likely to have complied with the conditions attaching to the grant when:

- The landlord has, or had agreed, to provide rent relief to its COVID-19-affected tenants by an amount at least commensurate with the land tax rebate, and/or

- The property is not currently leased but is available and marketed for lease, the landlord’s ability to secure tenants has been impacted by COVID-19 and the landlord requires the relief to meet its financial obligations.

AASB 120, paragraph 12 requires government grants to be recognised in profit or loss on a systematic basis over the periods in which the entity recognises as expenses the related costs for which the grants are intended to compensate. Therefore Landlord A recognises the government grant income during the periods to compensate for lost rental income.

Presentation in the financial statements of land tax rebate income

Landlords need to consider their existing accounting policies for presentation of government grant income in the financial statements because the presentation of land tax rebate income should be consistent with that policy. If the landlord does not have an accounting policy because they receive no grant income, AASB 120, paragraph 29 usually provides a choice of presenting the receipt of the government grant income in the financial statements either on a ‘gross’ or ‘net’ basis.

Grants related to income are presented as part of profit or loss, either separately or under a general heading such as ‘Other income’; alternatively, they are deducted in reporting the related expense.

AASB 120, paragraph 29

We concluded above that the land tax rebate is not accounted for as a reduction in land tax expense, but rather as government grant income to compensate for loss of rental income. The ‘net basis’ of presentation is therefore not appropriate in these circumstances because the grant is not intended to compensate for a ‘related expense’. Therefore, Landlord A would present the government grant income from the land tax rebate, and the land tax expense on a ‘gross basis’ as follows:

| Gross basis | 2020 |

| Other income - Government grants | $50,000 |

| Land tax expense | ($200,000) |

| Net profit | ($150,000) |

What if Landlord A is a not-for-profit entity?

Regardless of whether Landlord A is a for-profit or a not-for-profit entity, the main purpose of the land tax rebate remains the same, i.e. to enable landlords to:

- Provide rent relief to tenants, and use any excess to meet their financial obligations, or

- Meet their financial obligations where properties are not leased due to COVID-19.

The 25% land tax rebate should therefore not be accounted for as a reimbursement of land tax expense, but rather as a government grant. Government grants received by not-for-profit entities are recognised as income under AASB 1058 Income of Not-for-Profit Entities and presented on a ‘gross basis’ as displayed above.