Does IFRS 15 or IFRS 9 apply to fees charged to customers by lenders?

For entities that are in the business of lending, there are a variety of charges and fees that can make up its revenue streams. Some examples of fees that a lender might charge include (note that the descriptions for these fees are likely to differ from entity to entity):

- Interest earned on the loan receivable

- Drawdown fees

- Establishment fees

- Direct debit fees

- Penalty fees

- Fees for failed payments (e.g. direct debit refused due to insufficient funds in the customer’s account), and

- Legal fees.

Questions frequently arise whether the above fees fall within the scope of IFRS 15 Revenue from Contracts with Customers or IFRS 9 Financial Instruments.

Same principles apply to the borrower

Although the concepts and examples explained below focus on the accounting for various fees charged by a lender, the same principles apply to fees paid by a borrower in terms of which fees are to be included as part of the effective interest rate and which are required to be expensed.

When does IFRS 15 apply?

A lender would normally apply the requirements in IFRS 15 to all contracts with customers, except for financial instruments and other contractual rights or obligations that are within the scope of IFRS 9, IFRS 9 applies (refer IFRS 15, paragraph 5).

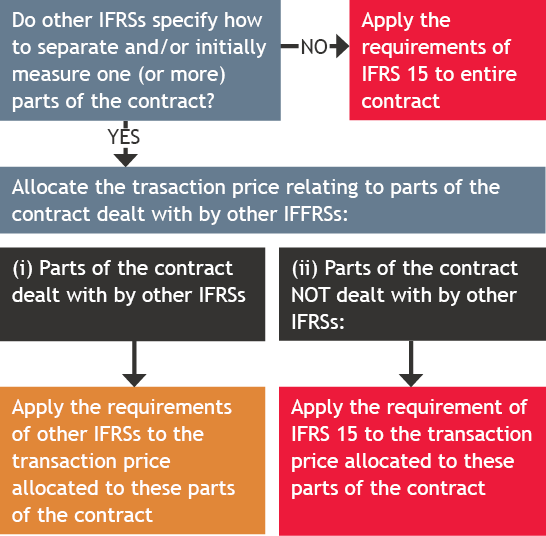

If Accounting Standards other than IFRS 15 (e.g. IFRS 9) specify how to separate and/or initially measure one or more parts of the loan contract, then the lender first applies the separation and/or measurement requirements in those other Standards. If those other Standards (e.g. IFRS 9) do not specify how to separate and/or initially measure one or more parts of the loan contract, then the lender applies IFRS 15 to the whole or remaining parts of the loan contract (refer to IFRS 15, paragraph 7).

This means that IFRS 9 is applied first to loan contracts, and IFRS 15 only applies to fee revenue not addressed by IFRS 9.

Step One: Applying IFRS 9 to fee revenue charged by a lender in a loan contract

In applying the effective interest method under IFRS 9, the lender identifies fees that are an integral part of the effective interest rate of a financial instrument, and these are treated as an adjustment to the effective interest rate (IFRS 9, paragraph B5.4.1).

Fees that are NOT considered an integral part of the effective interest rate are then accounted for under IFRS 15 (refer Step Two below).

Examples of fees that ARE an integral part of the effective interest rate of a financial instrument include the following.

Origination fees

Origination fees received by the lender relate to the creation or acquisition of a financial asset. Such fees may include compensation for activities such as:

- Evaluating the borrower’s financial condition

- Evaluating and recording guarantees, collateral and other security arrangements

- Negotiating the terms of the instrument, and

- Preparing and processing documents and closing the transaction.

These fees are an integral part of generating an involvement with the resulting financial instrument.

Commitment fees

Commitment fees are those received by the lender to originate a loan when the loan commitment is not measured at FVTPL, and it is probable that the borrower will enter into a specific lending arrangement. These fees are regarded as compensation to the lender for an ongoing involvement with the acquisition of a financial instrument.

If the commitment expires without the lender making the loan, the fee is recognised as revenue on expiry. (IFRS 9, paragraph B5.4.2).

‘When applying the effective interest method, an entity would amortise any fees, points paid or received, transaction costs and other premiums or discounts that are included in the calculation of the effective interest rate over the expected life of the financial instrument…’.

Extract of IFRS 9, paragraph B5.4.4

Transaction costs include fees and commission paid to:

- Agents (including employees acting as selling agents),

- Advisers,

- Brokers and dealers,

- Levies by regulatory agencies and security exchanges, and

- Transfer taxes and duties.

Step Two: Applying IFRS 15 to fee revenue charged by a lender in a loan contract

Fees charged by the lender other than those falling into the ‘origination fees’ and ‘commitment fees’ categories described in Step One above are NOT considered an integral part of the effective interest rate, and are therefore accounted for under IFRS 15 rather than IFRS 9.

Examples of fees charged by lenders that are NOT an integral part of the effective interest rate include:

- Fees charged for servicing a loan

- Commitment fees to originate a loan when the loan commitment is not measured at FVTPL and it is unlikely that a specific lending arrangement will be entered into, and

- Loan syndication fees received by an entity that arranges a loan and retains no part of the loan package for itself (or retains a part at the same effective interest rate for comparable risk as other participants) (refer IFRS 9, paragraph B5.4.3).

Examples

The following table includes examples of the types of fees charged by lenders and whether they are likely to be considered an integral part of the effective interest rate (i.e. accounted for under IFRS 9) or not (i.e. accounted for under IFRS 15).

Fee | Description | IFRS 9 or IFRS 15? |

Draw down fees | Fee paid to lender when the funds are advanced | IFRS 9 - integral part of generating an involvement with the resulting loan receivable IFRS 9, paragraph B5.4.2(a) |

Loan origination/establishment fees | Fee paid to lender for setting up loan contract | IFRS 9 - integral part of generating an involvement with the resulting loan receivable IFRS 9, paragraph B5.4.2(a) |

Direct debit fees | Charge for the customer using the direct debit service. The fee is charged on a per use basis (e.g. $2 per every direct debit) | IFRS 15 – Revenue for service performed |

Penalty fees | If the customer is late in paying they will incur a penalty fee of $50 for the additional administrative process/costs involved for processing the late payment | IFRS 15 |

Penalty interest | If the customer is late in paying, an additional 5% will be charged in addition to the interest rate specified in the loan contract, for each late coupon payment | IFRS 9 – The additional payment expected is a revision to the payments of the financial instrument and should be accounted for as a ‘catch up’ adjustment under IFRS 9, whereby the difference between the present value of revised cash flow payments discounted at the original effective interest rate, and the carrying amount of the loan, is recognised in profit or loss. Note that if the penalty is only expected to apply in the next period, the profit or loss effect would be similar to simply recognising the additional penalty interest directly in profit or loss. |

Legal fees | Legal expenses incurred in chasing up payments from customers are recharged to the customer | IFRS 15 – Revenue for service performed Note that legal expenses incurred by lender will be accounted for as an expense and the recharge from the customer is accounted for as revenue. |

Placement fees | Fees charged for arranging a loan between a borrower and an investor, where the entity retains no part of the loan (i.e. no loan receivable is recognised in the entity’s books) | IFRS 15 - Revenue for service performed IFRS 9, paragraph B5.4.3(c) |

Investment management fee | Management fees paid for services such as investment advice or research services | IFRS 15 – Revenue for services performed |

Fees for reduction of interest | Fees charged to the borrower that reduce the loan’s nominal interest rate | IFRS 9 - Integral part of the loan receivable |

Processing fee | Fees paid to the lender as compensation for granting a complex loan | IFRS 9 - Integral part of generating the loan receivable. Fees for closing the transaction are part of the EIR IFRS 9, paragraph B5.4.2(a) |

Expedite fee | Fee for agreeing to process the loan and lend quickly | IFRS 9 - Integral part of generating the loan receivable Fees for processing documents and closing the transaction are part of the EIR |

Monthly administration fee | Monthly fee charged to the customer for administration of the loan | IFRS 9 - Integral part of generating the loan receivable |

Broker fee | Fee paid to mortgage broker for arranging the loan that is recharged to the customer | IFRS 9 - Integral part of generating the loan receivable |

Provider fee | Referral fee in respect of a loan that is recharged to the customer | IFRS 9 - Integral part of generating the loan receivable |

Loan servicing fee | Fee for collecting interest and principal repayments from the borrower and passing it on to fund providers | IFRS 15 - Revenue for service performed IFRS 9, paragraph B5.4.3(a) |

Commitment fees – drawdown probable | Fee paid to lender in return for the lender committing to lend to borrower a certain amount, and it is probable that the borrower will draw down the amount | IFRS 9 – Amount deferred until loan is drawn down and the fee is included in the EIR IFRS 9, paragraph B5.4.2 |

Commitment fees – drawdown unlikely | Fee paid to lender in return for the lender committing to lend to borrower a certain amount, and it is unlikely that the borrower will draw down the amount | IFRS 15, recognise the commitment fee as revenue over the period of the commitment IFRS 9, paragraph B5.4.3 |

Commitment fees – only probable that half of the amount is to be drawn down | Fee paid to the lender in return for the lender committing to lend to the borrower a certain amount, and it is only probable that 50% of the facility would be used | Apportion the commitment fee so that half of the fee would be deferred and accounted for under IFRS 9 (include in the EIR), and half would be accounted for under IFRS 15 over time. |