ASIC relief for AFS licensees transitioning to general purpose financial statements

ASIC relief for AFS licensees transitioning to general purpose financial statements

In this article, we endeavour to address some questions following the Australian Securities and Investments Commission (ASIC) announcement of the new financial reporting requirements for Australian Financial Services (AFS) licensees. We also address the subsequent publication of the new Form FS70 Australian financial services licensee profit and loss statement and balance sheet (Form FS70).

In previous years, some non-reporting entities holding AFS licences prepared and lodged special purpose financial statements (SPFS) with ASIC. This occurred regardless of whether the entity was reporting under Chapter 7 or Chapter 2M of the Corporations Act 2001 (Corporations Act).

Accounting standards apply to full-year Chapter 2M financial reports under section 296 of the Corporations Act. Accounting standards also apply to Chapter 7 financial reports under the certification section of Form FS70. Under the Corporations Regulations and the Corporations Act, ASIC can prescribe reporting requirements through Form FS70.

Following changes in the accounting standards framework for full-year financial reports of entities reporting under Chapter 2M, the option to prepare SPFS has been removed. This meant that AFS licensees expected they could transition to Tier 2 (Simplified Disclosures) general purpose financial statements (GPFS). However, a new financial reporting framework - consistent with the framework for entities reporting under Chapter 2M - applies to licensees reporting under Chapter 7 for years commencing 1 July 2021. Under this new framework, most licensees will instead need to prepare full Tier 1 GPFS where:

- They have ‘public accountability’ as described in AASB 1053 Application of Tiers of Australian Accounting Standards

- They are deemed to have public accountability by ASIC for the purposes of Chapter 7 reporting.

What is the difference between Chapter 2M and Chapter 7 reporting obligations?

An AFS licensee that is not a disclosing entity, unlisted public company, registered scheme, or large proprietary company is not required to lodge financial statements under Chapter 2M. Therefore, the licensee only reports under Chapter 7 of the Corporations Act. In such cases, the entity lodges its financial statements and Form FS70 with ASIC. However, if the licensee is a type of entity identified above, it is also required by Chapter 2M to lodge a financial report with ASIC.

There is no transitional relief from restating comparatives for entities preparing GPFS for the first time under Chapter 2M. This is because Chapter 2M requires application of all Australian Accounting Standards, including comparatives. AFS licensees that previously prepared SPFS must now, as a minimum, prepare Tier 2 GPFS (Simplified Disclosures) for years ending 30 June 2022.

Where does ASIC define which AFS licensees are deemed to have public accountability?

ASIC’s announcement lists, but does not define, the various types of AFS licensees deemed to have public accountability for the purpose of Chapter 7 reporting. For most types of deemed publicly accountable entities, Form FS70 - specifically the ‘Certification’ in section 11 – identifies and cross-references to where these definitions can be found. For example, a licensee that forms part of the wholesale trustees’ sub-sector is defined in regulation 37 of the ASIC Supervisory Cost Recovery Regulations 2017.

Can AFS licensees that are deemed to have public accountability be relieved from preparing Tier 1 GPFS for Chapter 7 reporting?

No, an AFS licensee must prepare Tier 1 GPFS if the terms of its AFS licence permit the licensee to conduct any of the types of activities listed in section 11 of Form FS70. This is regardless of whether the licensee actually conducts those activities. AFS licensees cannot use their judgement to self-assess whether Tier 1 GPFS is required.

If an entity is deemed to be publicly accountable for Chapter 7 reporting, are Tier 1 GPFS also required for Chapter 2M reporting?

This is not necessarily the case. AFS licensees that are deemed to be publicly accountable for Chapter 7 reporting must prepare Tier 1 GPFS. For Chapter 2M reporting, Tier 1 GPFS are only required if the licensee has public accountability according to the definition in AASB 1053.

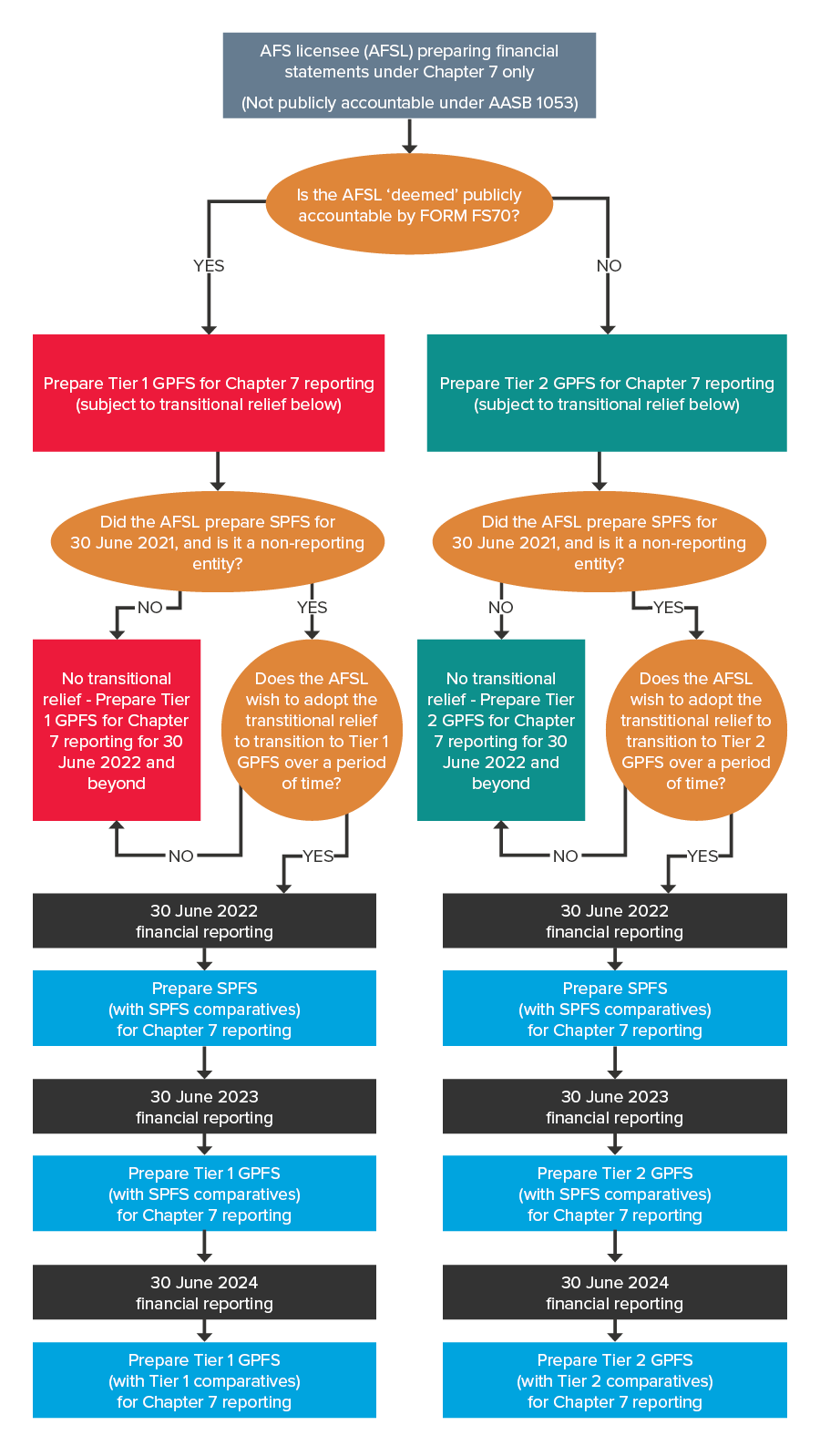

What transitional relief is available for AFS licensees only reporting under Chapter 7?

ASIC’s FAQs and Form FS70 outline the transitional relief that is available to AFS licensees reporting only under Chapter 7. The licensee can choose to defer preparing GPFS by one year if both of the following criteria are met:

- They are not reporting entities

- They prepared SPFS for the immediately preceding financial year (30 June 2021).

However, the full recognition and measurement requirements of the Australian Accounting Standards continue to apply and consolidation is not required. Comparatives for the first GPFS can be prepared using the disclosures contained in the previous SPFS. This applies even if the AFS licensee chooses not to defer preparation of its first GPFS by one year.

No transitional relief is available for AFS licensees reporting only under Chapter 7 that either:

- Are reporting entities who previously prepared Tier 1 or Tier 2 GPFS

- Previously prepared GPFS using the Reduced Disclosure Regime, or early adopted Simplified Disclosures. This is because Tier 2 GPFS were prepared for the prior period, rather than SPFS.

If applying the transitional provisions, the first GPFS are required for financial years beginning on or after 1 July 2022 (or years ending 30 June 2023). The required GPFS are:

- Tier 1 GPFS if the licensee is deemed to be publicly accountable

- As a minimum, Tier 2 GPFS if the licensee is not deemed to be publicly accountable.

If an AFS licensee chooses to defer preparation of the first GPFS by one year to 30 June 2023, the types of financial statements, including comparatives, required when applying this transitional relief are shown in the table below.

|

Year ended |

Chapter 7 - Deemed publicly accountable |

Chapter 7 - NOT deemed publicly accountable |

|

30 June 2022 |

SPFS, with SPFS comparatives |

SPFS, with SPFS comparatives |

|

30 June 2023 |

Tier 1 GPFS, with SPFS comparatives |

Tier 2 GPFS, with SPFS comparatives |

|

30 June 2024 |

Tier 1 GPFS, with Tier 1 comparatives |

Tier 2 GPFS, with Tier 2 comparatives |

If an AFS licensee chooses to prepare its first GPFS for 30 June 2022, the types of financial statements and comparatives required are shown in the table below.

| Year ended |

Chapter 7 - Deemed publicly accountable |

Chapter 7 - NOT deemed publicly accountable |

|

30 June 2022 |

Tier 1 GPFS, with SPFS comparatives |

Tier 2 GPFS, with SPFS comparatives |

|

30 June 2023 |

Tier 1 GPFS, with Tier 1 comparatives |

Tier 2 GPFS, with Tier 2 comparatives |

The following decision tree illustrates the above financial reporting requirements and transitional relief available to AFS licensees reporting only under Chapter 7:

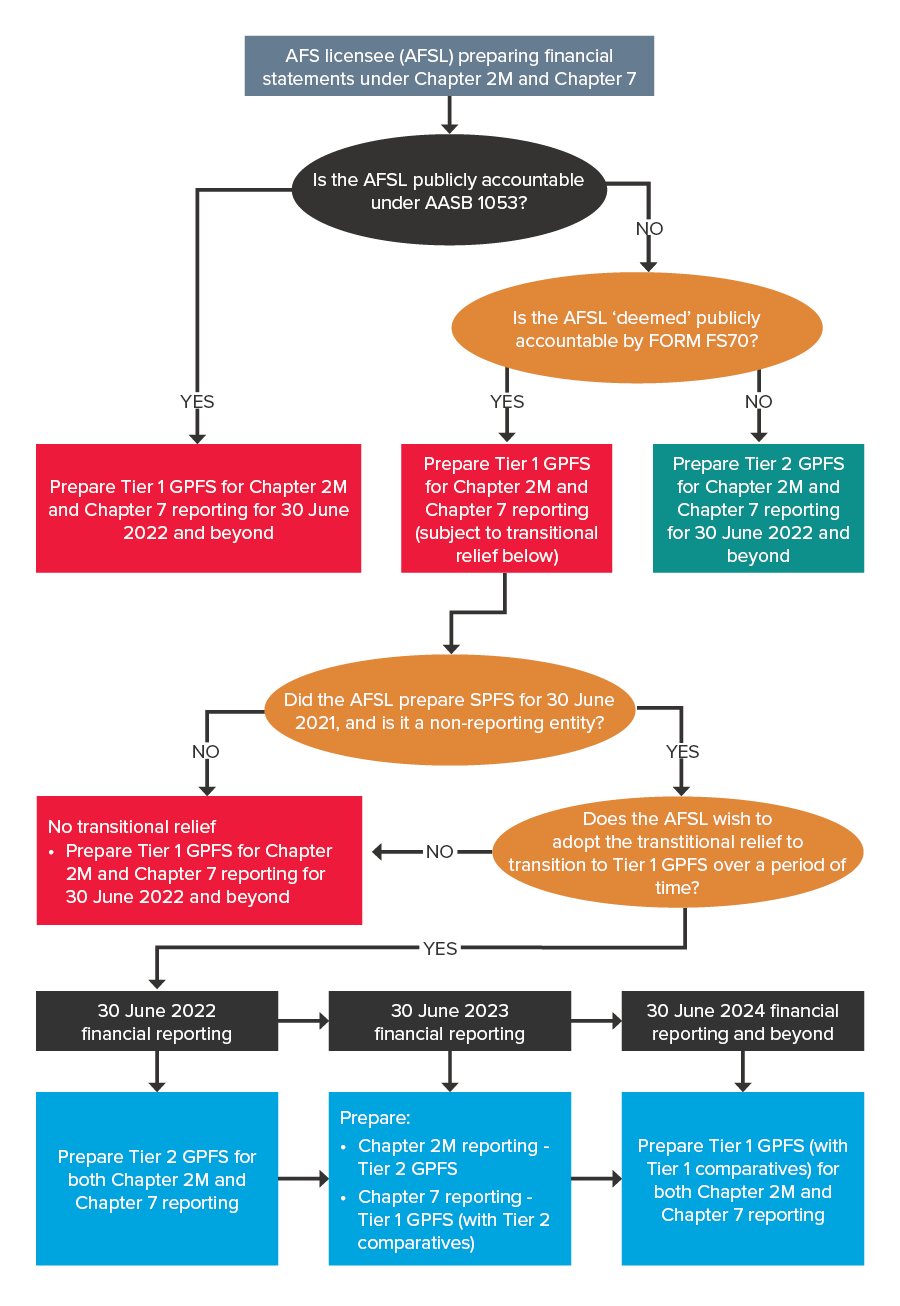

What transitional relief is available for AFS licensees reporting under both Chapter 2M and Chapter 7?

As noted above, there is no transitional relief from restating comparatives for entities preparing GPFS for the first time under Chapter 2M. This is because Chapter 2M requires application of all Australian Accounting Standards, including comparatives. AFS licensees that previously prepared SPFS must now, as a minimum, prepare Tier 2 GPFS (Simplified Disclosures) for years ending 30 June 2022.

AFS licensee NOT deemed publicly accountable by ASIC

If an AFS licensee is not deemed to be publicly accountable, the Tier 2 GPFS prepared for Chapter 2M reporting can also be used to meet the Form FS70 requirements and Chapter 7. In other words, no transitional relief is available and none is needed.

AFS licensee is deemed publicly accountable by ASIC

Some AFS licensees may not have public accountability according to the definition in AASB 1053, but are deemed to have public accountability for Chapter 7 reporting purposes according to Form FS70. This results in different reporting requirements for Chapter 2M and Chapter 7, which is demonstrated in the table below.

| Chapter 2M - Not publicly accountable |

Chapter 7 - Deemed publicly accountable |

|

Tier 2 Simplified Disclosures |

Tier 1 Full GPFS |

These AFS licensees could potentially prepare two sets of GPFS on an ongoing basis – Tier 2 for Chapter 2M, and Tier 1 for Chapter 7.

In practice, we expect most AFS licensees in this scenario to prepare one set of Tier 1 GPFS to meet both their Chapter 2M and Chapter 7 reporting obligations. This is because they need to be lodged with ASIC at the same time.

However, at 30 June 2022 this would mean having to provide comparatives for all Tier 1 disclosures in the prior period. This is because Chapter 2M provides no exemption for comparatives in the first set of GPFS at 30 June 2022.

The burden of providing all Tier 1 comparatives for 30 June 2021 may be too onerous, given that the Form FS70 requirements regarding ‘deemed’ publicly accountable entities was only finalised in June 2022.

Therefore, Form FS70 provides relief to ‘deemed’ publicly accountable AFS licensees enabling them to transition to Tier 1 GPFS over a period of time. However, this relief only applies if all of the following criteria are met:

- They are not reporting entities

- They prepared SPFS for the immediately preceding financial year (30 June 2021)

- They are not publicly accountable according to AASB 1053.

The transition relief and types of GPFS required is shown in the table below.

|

Year ended |

Chapter 2M - Not publicly accountable |

Chapter 7 - Deemed publicly accountable |

|

30 June 2022 |

Tier 2 GPFS Simplified Disclosures |

Tier 2 GPFS Simplified Disclosures |

|

30 June 2023 |

Tier 2 GPFS Simplified Disclosures1 |

Tier 1 GPFS, with Tier 2 GPFS comparatives |

|

30 June 2024 |

Tier 1 GPFS, with Tier 1 GPFS comparatives2 |

|

If the AFS licensee wishes to ‘fast track’ this transition process, there are different types of GPFS required in each financial year for Chapter 2M and Chapter 7 reporting. This is demonstrated in the table below.

| Year ended |

Chapter 2M - Not publicly accountable |

Chapter 7 - Deemed publicly accountable |

|

30 June 2022 |

Tier 2 GPFS Simplified Disclosures1 |

Tier 1 GPFS, with Tier 2 comparatives |

|

30 June 2023 |

Tier 1 GPFS, with Tier 1 comparatives2 |

|

1AFS licensees must prepare Tier 2 GPFS for Chapter 2M because the Tier 1 GPFS prepared for Chapter 7 has an exemption for comparatives, which is permitted by Form FS70 but not by Australian Accounting Standards.

2Although Tier 2 GPFS would suffice for Chapter 2M reporting, we expect AFS licensees to lodge Tier 1 GPFS for both Chapter 2M and Chapter 7 reporting purposes in practice.

The following decision tree illustrates the above financial reporting requirements and transitional relief available to AFS licensees reporting under both Chapter 2M and Chapter 7:

How does an AFS licensee describe the basis of preparation of the financial statements, if they have applied transitional provisions?

As noted above, transitional relief is only available for Chapter 7 reporting. AFS licensees applying the transitional provisions in their financial statements will need to amend the Basis of Preparation note. This is to explain how the transitional arrangements noted in Form FS70 have been applied. The Basis of Preparation note should state:

- That all recognition and measurement requirements of Australian Accounting Standards have been applied

- Whether the disclosures for the current year have been prepared on a Tier 1, Tier 2, or SPFS basis

- The basis upon which the comparative disclosures have been prepared. For example, the comparative disclosures were on a SPFS basis, or on the basis of Tier 2 GPFS

- The disclosure requirements that the AFS licensee has complied with, or those they have not complied with, if special purpose accounts are being prepared.

AFS licensees reporting under Chapter 2M must prepare GPFS, either Tier 1 or Tier 2, as appropriate. These must include comparatives. Therefore, no adjustment is required to the Basis of Preparation note for Chapter 2M GPFS.

Is an AFS licensee able to apply the relief from preparing consolidated financial statements, if it is an intermediate parent entity?

Yes. AASB 10 Consolidated Financial Statements, paragraph 4(a), provides an exemption to certain intermediate parent entities from needing to prepare consolidated financial statements. ASIC has clarified that paragraph 11(a)(iii) of the certification in Form FS70 is not intended to override the exemption that applies under paragraph 4(a). If an AFS licensee meets all the criteria in paragraph 4(a), it need not present consolidated financial statements alongside its separate financial statements.

Is the ‘four column’ approach required for GPFS, where the parent entity holds the AFS licence?

Yes. Consider the following group structure:

For Chapter 2M reporting purposes:

- The parent prepares consolidated financial statements under s295(2)(b) and includes disclosures about the parent entity in a note, as required by Regulation 2M.3.01

- The subsidiary is not required to prepare financial statements because it is a small proprietary company.

For Chapter 7 reporting, GPFS are required for the AFS licensee itself, as the parent holds the AFS licence. This means the parent must present four columns in its GPFS, being the consolidated group, including the subsidiary, as well as for the parent itself.

Need assistance?

Please contact our IFRS & Corporate Reporting team if you would like further information, or if you require assistance with any AFS licensee financial reporting matters.