Exemptions from preparing consolidated financial statements

Exemptions from preparing consolidated financial statements

For many years, Australian ‘non-reporting entities’ have been preparing special purpose financial statements for the Australian Securities and Investments Commission (ASIC) and other regulators. These usually took the form of standalone financial statements for a parent entity, without consolidation.

Exemptions for intermediate parent entities

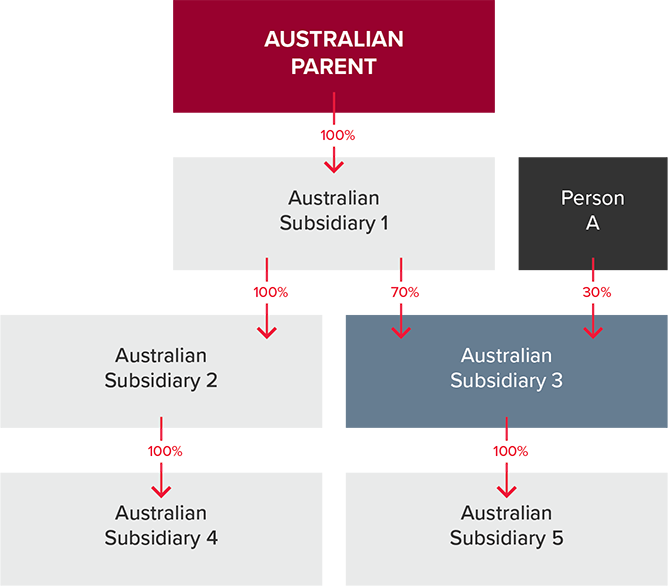

There are exemptions to preparing consolidated financial statements that apply for intermediate parent entities. For vertical groups, preparing numerous sets of consolidated financial statements is a time-consuming, costly, and onerous task. This can often have little benefit, particularly where all entities in the group are wholly-owned. Refer to Figure 1 below for an example of a vertical group structure.

Figure 1:

As a result, IFRS 10, paragraph 4(a) contains an exemption whereby the intermediate parent entities in a vertical group need not present consolidated financial statements. This will apply if all the following criteria are met:

- parent need not present consolidated financial statements if it meets all the following conditions:

- it is a wholly-owned subsidiary or is a partially-owned subsidiary of another entity and all its other owners, including those not otherwise entitled to vote, have been informed about, and do not object to, the parent not presenting consolidated financial statements;

- its debt or equity instruments are not traded in a public market (a domestic or foreign stock exchange or an over-the-counter market, including local and regional markets);

- it did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organisation for the purpose of issuing any class of instruments in a public market; and

- its ultimate or any intermediate parent produces financial statements that are available for public use and comply with IFRSs, in which subsidiaries are consolidated or are measured at fair value through profit or loss in accordance with this Standard.

Source: IFRS 10, paragraph 4(a)

Our example in Figure 1 above illustrates that Australian Subsidiary 1, Australian Subsidiary 2, and Australian Subsidiary 3 are all exempt from preparing consolidated financial statements. This exemption will apply if:

- They are all unlisted entities

- None of the entities are in the process of filing financial statements with a regulator to issue shares to the public

- Any partially-owned entities (Australian Subsidiary 3) have approval from their owners not to prepare consolidated financial statements

- The Australian Parent prepares consolidated IFRS financial statements.

However, all of the entities are required to prepare standalone (separate) general purpose financial statements. These may be either Tier 1 (Full GPFS) or Tier 2 (Simplified Disclosures), as appropriate.

Deeds of cross guarantee

ASIC Corporations (Wholly-Owned Companies) Instrument 2016/785 (Legislative Instrument 2016/785) relieves wholly-owned, large proprietary companies in a group from preparing financial statements. This will apply if the group has entered into a ‘deed of cross guarantee’.

If the above group applies Legislative Instrument 2016/785, and all subsidiaries are large, then the subsidiaries will not need to prepare standalone (separate) financial statements.

Ultimate Australian parent is not exempt

It is important to note that the above exemption for intermediate parent entities does not apply to the ultimate Australian parent. The ultimate Australian parent entity can never be exempt from consolidation. This is because there is an Australian-specific requirement - AASB 10, paragraph Aus 4.2 - that requires it to prepare consolidated financial statements.

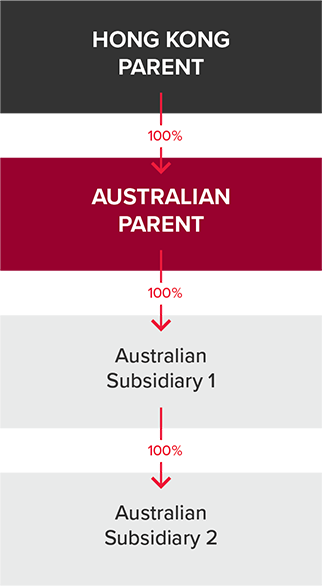

Figure 2:

In Figure 2 above, only Australian Subsidiary 1 is exempt from preparing consolidated financial statements. The Australian Parent must prepare consolidated financial statements.

Need assistance?

Determining which entities in a group are required to prepare general purpose financial statements, including consolidation, can be a complicated. Please contact BDO’s IFRS & Corporate Reporting team if you require assistance.