Next steps for Tier 3 not-for-profit private sector financial reporting

Next steps for Tier 3 not-for-profit private sector financial reporting

Following on from its recent Discussion Paper Development of Simplified Accounting Requirements (Tier 3 Not-for-Profit Private Sector Entities), at its May 2023 meeting, the Australian Accounting Standards Board (AASB) decided to proceed with developing an Exposure Draft for a Tier 3 framework for not-for-profit (NFP) private sector financial reporting.

To simplify the accounting requirements, wording for some recognition and measurement requirements in Tier 3 will need to be simplified from what we are used to seeing in IFRS for Tier 1 (full general purpose) and Tier 2 (Simplified Disclosures). The AASB cannot simply pick up equivalent wording from IFRS because it is too complicated.

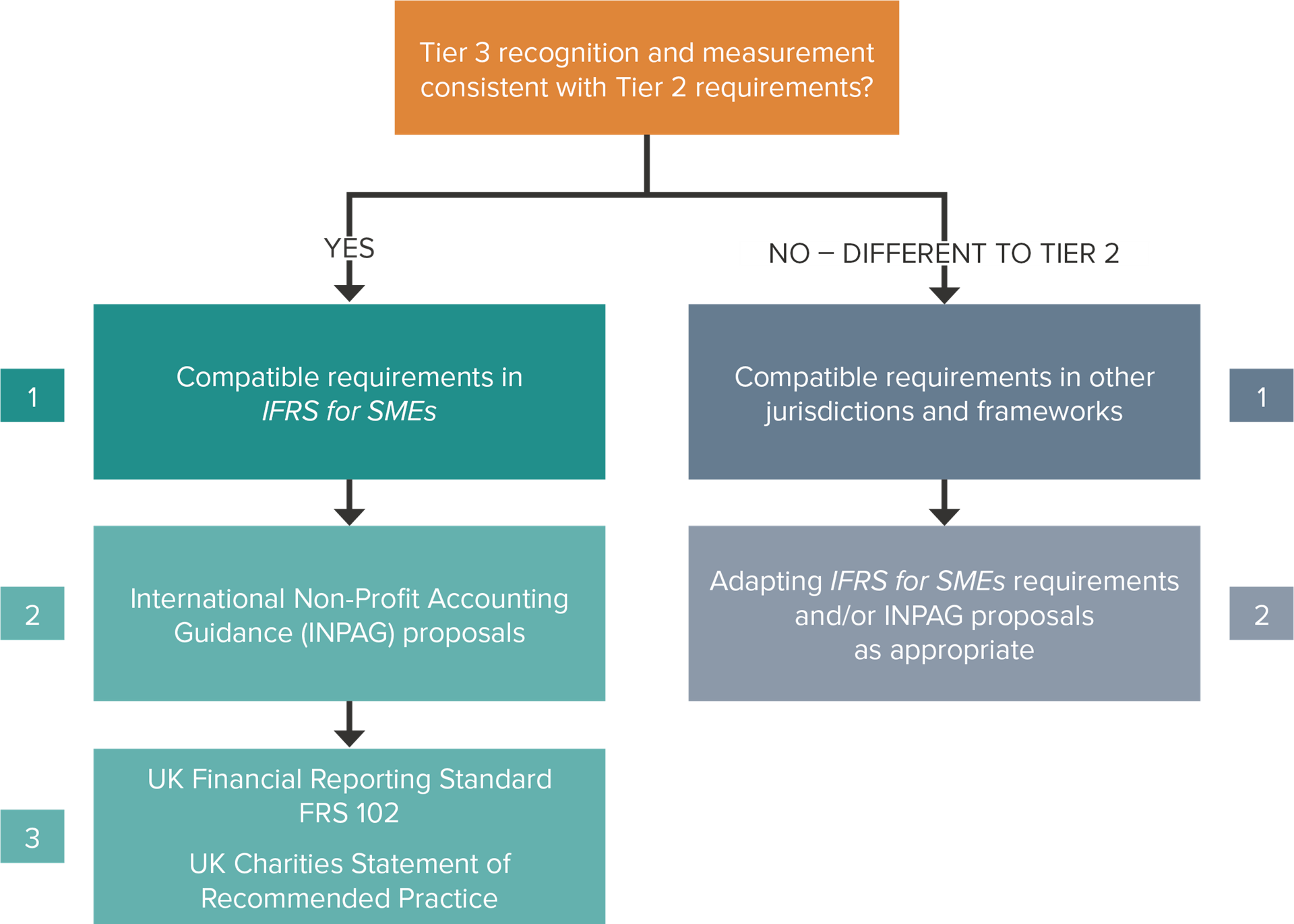

This means that if a proposed Tier 3 simplified recognition or measurement requirement is consistent with the corresponding Tier 2 IFRS recognition or measurement principles, the AASB will in the first instance source wording for its Exposure Draft from compatible requirements in IFRS for SMEs, complemented by the International Non-Profit Accounting Guidance (INPAG) proposals or, in their absence, the UK Financial Reporting Standard FRS 102 and the UK Charities Statement of Recommended Practice.

If a proposed Tier 3 simplified recognition or measurement requirement is different to the corresponding Tier 2 IFRS recognition or measurement principles, the AASB will in the first instance consider compatible requirements in other jurisdictions and frameworks. If these don’t exist, it will then adapt the IFRS for SMEs wording and/or the INPAG proposals as appropriate.

The AASB may also need to make additional simplifications, including language, which would be derived primarily from considering the New Zealand Tier 3 Standard.

Next steps

The AASB will consider at a future meeting how this approach will apply for selected Tier 3 topics.

Some interesting reading

The AASB recently released its Research Report that identifies the common financial items in the financial statements of Australian charities. It looked at 260 financial statements of charities with revenues ranging from $500,000 to $3 million. The findings are intended to provide input for the AASB when developing their Exposure Draft for Tier 3 general purpose financial statements. Please read the Research Report for more information.

Need help?

Any Tier 3 reporting framework is still a few years away. Meanwhile, smaller NFP private sector entities may still be grappling with the complexities of applying Tier 2 requirements. Please contact our IFRS & Corporate Reporting team if you require assistance with any aspects of your not-for-profit accounting issues.