Transition disclosures for Simplified Disclosures are not so simple

Transition disclosures for Simplified Disclosures are not so simple

Many entities that previously prepared special purpose financial statements (SPFS) will be transitioning to general purpose financial statements (GPFS) for the first time in their 30 June 2022 financial statements. In most cases, these entities can prepare Tier 2 GPFS (Simplified Disclosures) because they do not have public accountability under AASB 1053 Application of Tiers of Australian Accounting Standards.

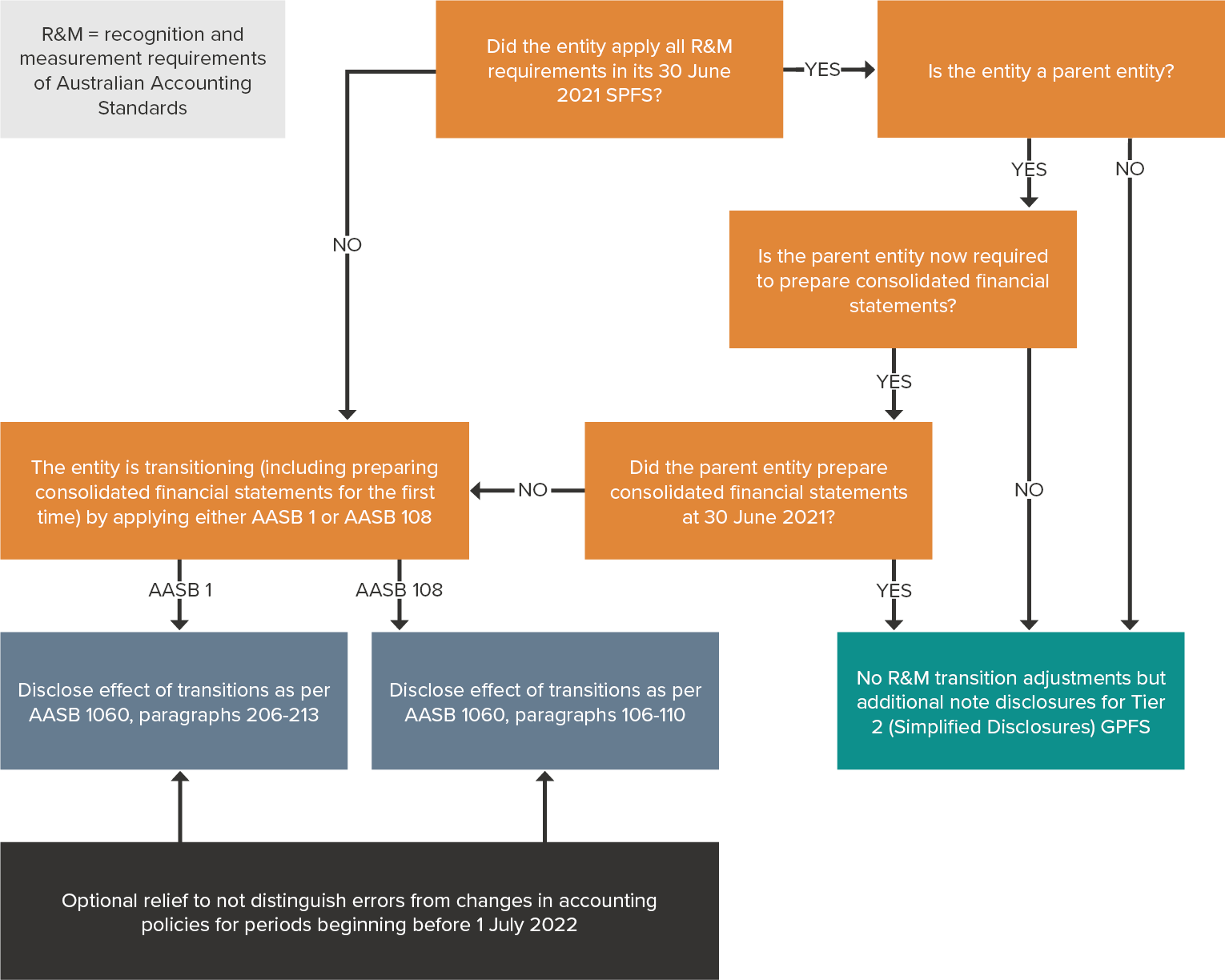

The decision tree below illustrates the transition process outlined in paragraph 18A of AASB 1053 for entities transitioning to Simplified Disclosures at 30 June 2022:

Entity previously applied all recognition and measurement requirements

If a standalone entity previously applied all the recognition and measurement requirements contained in Australian Accounting Standards, no transition adjustments are required to reconcile last year’s SPFS to the first set of Simplified Disclosures GPFS at 30 June 2022.

ASIC’s long-standing view, contained in Regulatory Guide RG 85 Reporting Requirements for non-reporting entities, is that all the recognition and measurement requirements of Australian Accounting Standards had to be applied in order to present a true and fair view of the financial position and profit or loss of entities preparing financial statements in accordance with Chapter 2M of the Corporations Act 2001.

We therefore do not expect to see transition adjustments for these entities. However, if errors in a prior year’s financial statements are identified and need to be rectified, these must be adjusted and disclosed, in accordance with AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors. Errors should not be labelled as ‘transition adjustments’.

We also do not expect to see transition adjustments for entities transitioning from the Reduced Disclosure Requirements (RDR) to Simplified Disclosures because they were already required to comply with all the recognition and measurement requirements in their RDR financial statements.

Entity previously applied all recognition and measurement requirements but did not prepare consolidated financial statements

In the past, some parent entities in a group may not have prepared consolidated financial statements because they were not a ‘reporting entity’ under Statement of Accounting Concepts 1 Definition of the Reporting Entity (SAC 1). However, their separate, or individual entity, financial statements complied with all the recognition and measurement requirements of Australian Accounting Standards.

For 30 June 2022 onwards, separate financial statements are no longer required for the parent entity if reporting under Chapter 2M of the Corporations Act 2001. Parent entity information is instead included in the note disclosures as required by Regulation 2M.3.01. Only consolidated financial statements are required, and these must include comparatives. Transition disclosures must be provided to explain the differences between 2021 financial statements, which were prepared for the parent entity only, and the 2022 financial statements, which have been prepared on a consolidated basis.

It should be noted that there are exemptions available under IFRS 10 Consolidated Financial Statements whereby consolidated financial statements may not be required for investment entities and certain intermediate parent entities.

Transitioning to Simplified Disclosures

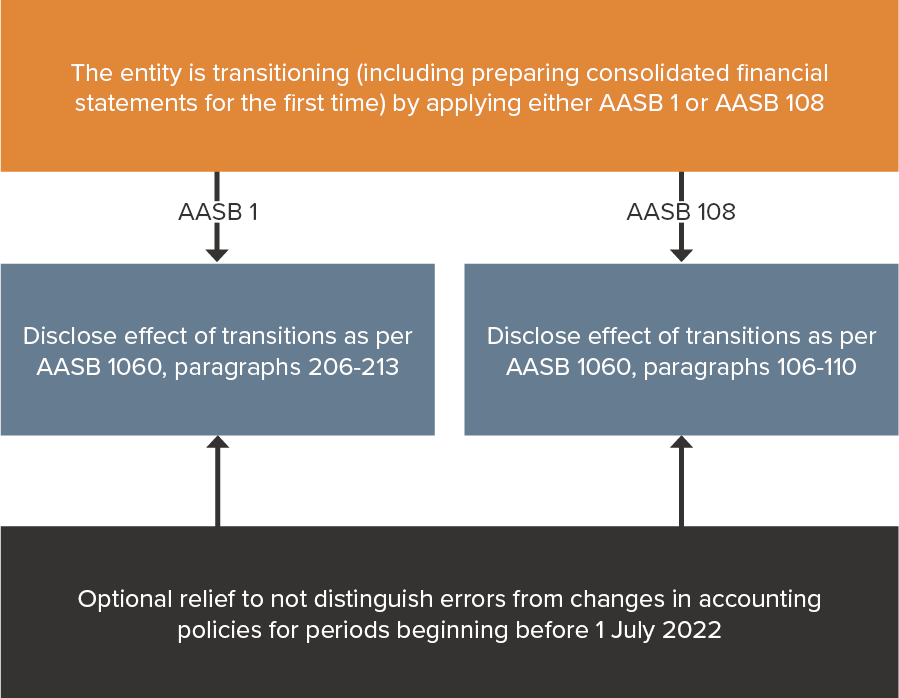

As noted in the decision tree above, and extracted below, there are two ways entities can transition from preparing parent entity financial statements to preparing consolidated financial statements. They can either apply AASB 1 First-time Adoption of Australian Accounting Standards and get relief from restating prior business combinations on a fully retrospective basis, or they can choose the ‘harder’ AASB 108 option, which requires full retrospective restatement of prior business combinations. The AASB 108 option may be difficult to apply in practice if business combinations occurred a number of years ago. This is because identification and valuation of fair value adjustments, including intangibles, and the subsequent accounting may be difficult to determine without the use of hindsight.

We therefore expect that most groups will apply AASB 1 when transitioning to consolidated Simplified Disclosures GPFS because it provides ‘short cuts’ for determining the amount of goodwill and consolidation adjustments to recognise from past business combinations.

What should transition disclosures look like in the 30 June 2022 financial statements if the parent entity is transitioning using AASB 1?

If the parent entity is transitioning to consolidated financial statements using AASB 1, transition disclosures must be provided in the 30 June 2022 financial statements in accordance with paragraphs 206 to 213 of AASB 1060.

Firstly, the Basis of Preparation or Transition note should explain that:

- This is the first set of general purpose financial statements prepared in accordance with Australian Accounting Standards – Simplified Disclosures

- The prior year financial statements were SPFS for the individual parent entity, and that the current period financial statements are for the consolidated group, applying Simplified Disclosures (AASB 1060), with comparatives restated

- AASB 1060 requires more note disclosure than SPFS, particularly relating to key management personnel compensation and related party transactions and balances.

Secondly, an accounting policy note should be added to explain the ‘Principles of consolidation’.

Thirdly, reconciliations must also be provided to quantify differences between equity and profit or loss shown in the 2021 SPFS for the parent entity, as compared to restated consolidated equity and profit or loss in the 2022 consolidated Simplified Disclosures GPFS. In other words, the reconciliations compare amounts determined in accordance with the previous financial reporting framework (SPFS) with the new Simplified Disclosures reporting framework, which requires consolidated financial statements.

For 30 June 2022 year-ends, the reconciliation of equity amounts is required at both the:

- Date of transition to Simplified Disclosures (1 July 2020)

- End of the latest period presented in the entity’s most recent financial statements (30 June 2021).

The reconciliation of profit or loss amounts is required for the year ended 30 June 2021, which is the latest period in the entity’s most recent annual financial statements.

Example wording for the Basis of Preparation or Transition note could be as shown in the table below:

These are the first general purpose financial statements prepared in accordance with Australian Accounting Standards – Simplified Disclosures, which requires compliance with all the recognition and measurement requirements of Australian Accounting Standards (including presenting consolidated financial statements).

The financial statements for the previous period were special purpose financial statements for the parent entity. The financial statements for the current period are for the consolidated group, comprising the parent entity and all of its subsidiaries. Comparatives for the year ended 30 June 2021 have been restated accordingly. Refer to accounting policy 1(x) for ‘Principles of Consolidation’ and to Note 1(y) for reconciliations of the impact of consolidation on equity at 1 July 2020 and 30 June 2021, and profit or loss for the year ended 30 June 2021.

Australian Accounting Standards – Simplified Disclosures requires more note disclosures than special purpose financial statements, particularly relating to key management personnel compensation and related party transactions and balances. Comparatives have been restated to reflect these additional disclosure requirements.

AASB 1060 is not prescriptive as to how and where the reconciliations should be provided in the 2022 financial statements.

Entity previously did not apply all recognition and measurement requirements

We expect that entities falling into this category are mainly ones required to prepare financial statements applying Australian Accounting Standards by either:

- Legislation other than the Corporations Act 2001

- Constitutions created or amended from 1 July 2021.

ASIC’s long-standing view outlined in RG85 means that non-reporting entities preparing financial statements under Chapter 2M should have applied the recognition and measurement requirements in previous financial statements. In addition, ASIC’s Form FS70 required financial statements for AFS licensees to be prepared applying the recognition and measurement requirements as well.

What should transition disclosures look like in the 30 June 2022 financial statements if an individual entity is transitioning using AASB 1?

Similar transitional disclosures are required as noted for first-time consolidated financial statements above, except that the transition adjustments would arise only from applying the recognition and measurement requirements in Australian Accounting Standards for the first time, and not from consolidation adjustments.

The Basis of Preparation or Transition note should explain that:

- This is the first set of general purpose financial statements prepared in accordance with Australian Accounting Standards – Simplified Disclosures, and comparatives have been restated

- The prior year financial statements were SPFS for the entity

- The current period financial statements have been prepared applying different accounting policies to the prior year. This statement should cross-reference where details of the new policies can be found.

- AASB 1060 requires more note disclosure than SPFS, particularly relating to key management personnel compensation and related party transactions and balances.

All new accounting policies should be described as part of ‘Accounting policies’ or together with note disclosures for each relevant financial statement item.

Reconciliations must be provided to quantify differences between equity and profit or loss shown in the 2021 SPFS and the 2022 Simplified Disclosures GPFS.

For 30 June 2022 year-ends, the reconciliation of equity amounts is required at both the:

- Date of transition to Simplified Disclosures (1 July 2020)

- End of the latest period presented in the entity’s most recent financial statements (30 June 2021).

The reconciliation of profit or loss amounts is required for the year ended 30 June 2021, which is the latest period in the entity’s most recent annual financial statements.

Example wording for the Basis of Preparation or Transition note could be as shown in the table below:

These are the first general purpose financial statements prepared in accordance with Australian Accounting Standards – Simplified Disclosures, which requires compliance with all the recognition and measurement requirements of Australian Accounting Standards (including presenting consolidated financial statements).

The financial statements for the previous period were special purpose financial statements for the entity. Comparatives for the year ended 30 June 2021 have been restated accordingly. Refer to accounting policy 1(x), 1(y) and 1(z) for details of changes in accounting policies, and to Note 1(aa) for reconciliations of the impact of changes in accounting policies on equity at 1 July 2020 and 30 June 2021, and profit or loss for the year ended 30 June 2021.

Australian Accounting Standards – Simplified Disclosures requires more note disclosures than special purpose financial statements, particularly relating to key management personnel compensation and related party transactions and balances. Comparatives have been restated to reflect these additional disclosure requirements.

As noted above, AASB 1060 is not prescriptive as to how and where the reconciliations should be provided in the 2022 financial statements.

What transition disclosures are required in the 30 June 2022 financial statements if the entity is transitions using AASB108?

If the entity chooses to transition using AASB 108 instead of AASB 1, the disclosures contained in paragraphs 106 to 110 of AASB 1060 must be provided. These are essentially the same as those when initially applying a new accounting standard, and include:

- The nature of the change in accounting policy

- The amount of the adjustment for each financial statement line item affected, for the current period and each prior period presented

- The amount of adjustments relating to periods before those presented, to the extent practicable

- An explanation if it is impracticable to determine any of these above-mentioned amounts.

If the entity selects a transition option under another accounting standard, it must include the full disclosure requirements in that standard instead of the disclosures noted above.

If errors from a previous year’s financial statements need to be rectified, these must be retrospectively adjusted, and disclosed, in accordance with AASB 108. Errors should not be labelled as ‘transition adjustments’. However, for years commencing before 1 July 2022, there is optional transitional relief such that the entity need not distinguish errors from changes in accounting policies.

Need assistance?

Our discussion above highlights that preparing transition disclosures for Simplified Disclosures is not a simple exercise. Please contact our IFRS & Corporate Reporting team if you require assistance preparing your first Simplified Disclosures GPFS.