AASB proposes guidance for determining fair values in the public sector (AASB 13)

AASB proposes guidance for determining fair values in the public sector (AASB 13)

It is very common for not-for-profit (NFP) public sector entities in Australia to recognise their non-financial, non-current assets at fair value to facilitate reporting in compliance with AASB 1049 Whole of Government and General Government Sector Financial Reporting. However, in practice there is divergence in the manner that the fair value principles contained in AASB 13 Fair Value Measurement (Australian equivalent of IFRS 13) are applied in valuations. This is particularly the case for non-current, non-financial assets that are not held primarily to generate net cash inflows (for instance, assets that are held to provide a public service).

In order to address the lack of consistency in applying fair value principles, the Australian Accounting Standards Board (AASB) recently issued Exposure Draft 320 Fair Value Measurement of Non-Financial Assets of Not-for-Profit Public Sector Entities (ED 320). ED 320 proposes that authoritative implementation guidance as illustrative examples be added to AASB 13, and applicable to Australian NFP public sector entities only.

Authoritative implementation guidance relates to the following three areas that have previously given rise to divergence in practice:

- Market participant assumptions

- Highest and best use

- Application of the cost approach.

Who will be affected?

The ED 320 proposals only apply to NFP public sector entities that measure their non-current, non-financial assets at fair value.

Type of assets

The ED 320 fair value guidance proposals only apply to non-financial assets not held primarily to generate net cash inflows.

Market participant assumptions

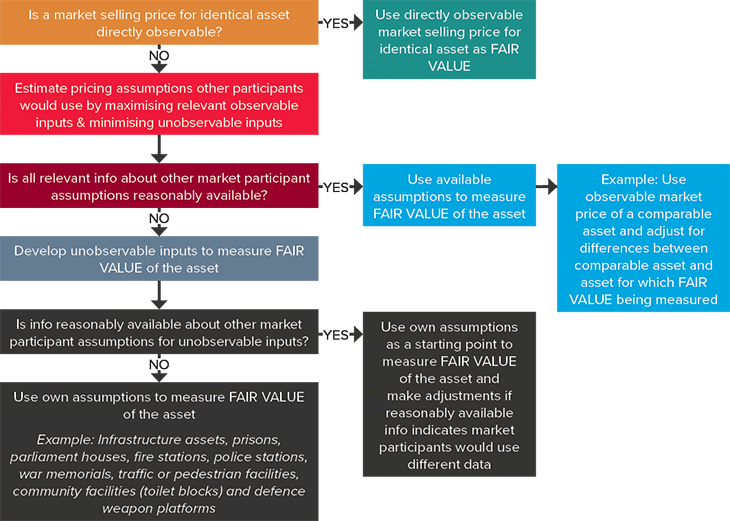

AASB 13 requires an entity to determine the fair value of assets using the assumptions that market participants would use when considering the value of the asset. However, there is no requirement to identify specific market participants, which leads to difficulty in identifying which assumptions may need to be used. To address this issue, ED 320 focusses on the entity identifying either a market price for the sale of an identical asset, or maximising the use of observable inputs.

Where valuation techniques need to revert to level 3 unobservable inputs because level 1 or 2 inputs are not available, the entity does not need to undertake exhaustive efforts to obtain information about market participant assumptions, and would be able to use its own assumptions.

The ED 320 implementation guidance proposes the following process when determining fair value:

Highest and best use

An entity’s current use of a non-financial asset is presumed to be its highest and best use. This is unless market or other factors suggest that a different use by market participants would maximise the value of the asset.

If the presumption is rebutted because the appropriate level of management is committed to an alternative use for the asset, the alternative use must be: physically possible, legally permissible, and financially feasible. In other words, the other market participants would be willing to invest in the asset’s service capacity, considering the asset’s ability to provide needed goods and services to beneficiaries, and the cost of providing those goods and services.

Application of cost approach

Another area of the valuation principles that has not been applied consistently is the type and nature of costs included in the valuation when the cost approach is applied. If a NFP public sector entity uses the cost approach to determine fair value of a non-financial asset, that is not primarily held for its ability to generate net cash inflows, ED 320 proposes that the entity:

- Assumes the asset will be replaced in its existing location, even if it would be feasible to replace it in a cheaper location

- Estimates the replacement cost assuming the asset currently does not exist, meaning that it has to be built from scratch or acquired. The replacement cost of a ‘reference asset’ (hypothetical asset) is therefore used as input to the valuation. All costs necessary to acquire or construct the asset being valued (subject asset) must also be included in the asset’s current replacement cost (fair value)

- Adjusts the estimated replacement cost of the reference asset for differences between the current service capacity of the reference asset and the subject asset.

Determining the replacement cost

The ED 320 proposals effectively require a NFP public sector entity to assume a hypothetical acquisition or construction of the asset for which fair value is being determined. Therefore, the following costs for the hypothetical acquisition or construction of the asset being valued (subject asset) would be included as part of the replacement cost:

- Once-only costs, such as design costs, for a hypothetical construction of the subject asset

- Costs of removal or disposal of any unwanted existing structures on land that would be incurred when acquiring or constructing the subject asset

- Disruption costs that would hypothetically be incurred when acquiring or constructing the subject asset.

In addition, the replacement cost includes costs that reflect the manner of replacement in the ordinary course of operations, rather than using the cheapest legally permitted costs. For example, if replacement of a road would usually occur at night to ensure minimal traffic disruption, more expensive night-time costs are included in the asset’s replacement cost, rather than lower daytime costs.

Economic obsolescence

AASB 13, paragraph B9 requires adjustments to current replacement cost where there has been physical deterioration of the asset, functional (technological) obsolescence, or economic (external) obsolescence.

ED 320 proposes the following additional guidance as to when adjustments for economic obsolescence are required:

- An adjustment is required when the asset has suffered a decline in demand for its services. A formal decision to reduce the physical capacity of the asset is not required before an adjustment is made for economic obsolescence

- An adjustment is not required for economic obsolescence where there is surplus capacity that is necessary for standby or safety purposes.

An example where economic obsolescence adjustments are required is a public school with a capacity for 500 students, which due to demographic changes only has current and reasonably foreseeable enrolments of 100 students. In determining the fair value of the school buildings, the gross replacement cost would be based on the required capacity of a building for 100 students only, rather than the existing capacity of 500 students.

Proposed application date

The proposed application date for the amendments contained in ED 320 is for annual periods beginning on or after 1 January 2024, with early adoption permitted.