What recent interest rate increases mean for discount rates used for lease accounting

What recent interest rate increases mean for discount rates used for lease accounting

As noted in our October 2022 Corporate Reporting Insights article, the measurement of many assets and liabilities involves the use of fair values or other techniques that include determining the present value of future cash flows. Recent increases in interest rates in Australia are likely to have a direct impact on the measurement of many of these items because when interest rates increase, so do the discount rates used in present value calculations.

At its meeting on 7 February 2023, the Reserve Bank of Australia (RBA) increased the cash rate for the ninth time to 3.35%, the highest level since September 2012. The yields on Australian Government bonds have also increased accordingly, which is applying upward pressure on incremental borrowing rates (IBRs).

How is the IBR determined?

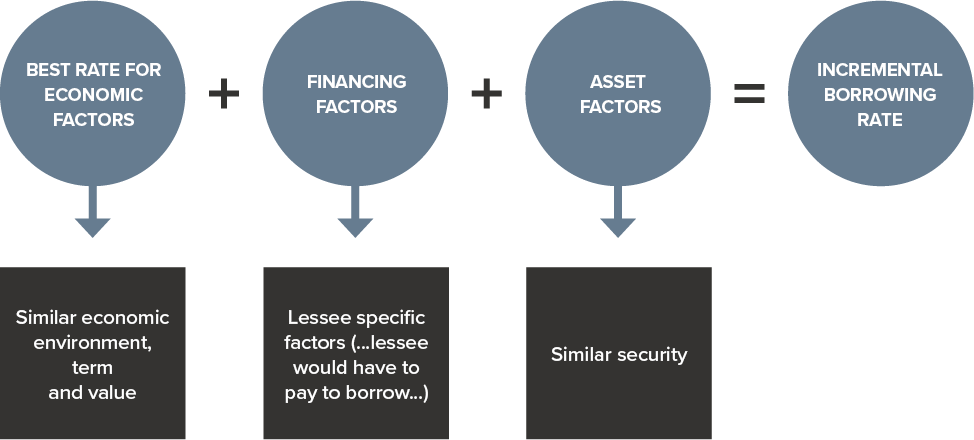

The IBR is the rate of interest that a lessee would have to pay to borrow over a similar term and with similar security, the funds necessary to obtain an asset of similar value to the right-of-use asset in a similar economic environment.

The IBR is made up of three components:

As yields on government bonds have increased as the RBA cash rate has increased, so the risk-free rate, or base rate must increase. In addition, due to current economic conditions, many entities may find that their credit spread has also increased. Both these factors will affect the IBR used for new leases, or where there has been a modification to an existing lease, or a reassessment of the lease term on an existing lease.

More information

Please refer to our previous article or our IFRS in Practice for more guidance on determining IBRs.

Need help?

Please contact our IFRS & Corporate Reporting team if you require assistance with your lease accounting.