In this issue of our series exploring the connectivity between climate-related and financial reporting, we dive into the four pillars that structure the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and their intersection with the International Sustainability Standards Board's (ISSB) imminent sustainability reporting standards.

Many organisations approach the path to climate reporting with the assumption that they're not 'doing anything' in the space.

However, when working with clients starting on this path, we often find that they have relevant enterprise structures and processes but are yet to apply them to a climate-related lens. By utilising existing structures, organisations can ensure they apply the same rigour and quality to climate disclosure as to other critical operations.

Why commit to climate-related reporting

Stakeholders are demanding greater transparency about the climate-related risks and opportunities facing the businesses that they have financial exposure to. Disclosure of an organisation's climate-related approach to governance, strategy, risks and metrics allows stakeholders—for example, investors, insurance underwriters, or financiers—to fully assess the organisation's awareness, capacity and maturity in this area to make informed investment decisions.

For 30 June 2023 reporting, Australian regulators, including the Australian Securities and Investment Commission (ASIC), the Australian Prudential Regulation Authority (APRA), and the Australian Securities Exchange (ASX) strongly encourage entities to comply with the TCFD recommendations in order to include disclosures on business risks and opportunities, including climate-related risks and opportunities, in their annual report (e.g. operating and financial review (OFR)). The imminent publication of IFRS 2 ‘Climate-related Disclosures’ will incorporate the principles of the TCFD recommendations. IFRS 2 is expected to be mandatory for certain entities (i.e. listed entities) from 30 June 2025 onwards. Compliance with the TCFD recommendations in FY23 and FY24 would put entities on a path to mandatory compliance with the new IFRS S2 by FY25.

The TCFD recommendations also provide a framework that is a useful management tool. By actively considering climate-related risks and opportunities, a business may build resilience by identifying, measuring and managing the potential impact of climate change on their business as well as identifying opportunities.

Four pillars of TCFD recommendations

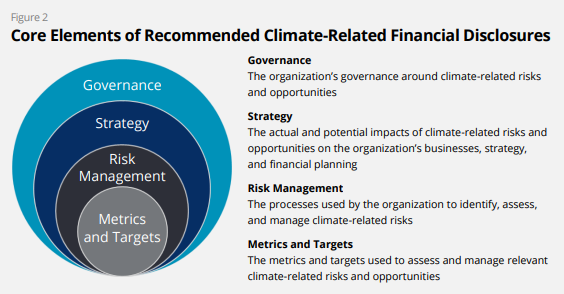

One challenge businesses face is acquiring sufficient knowledge and understanding of climate impacts to complement their detailed context and experience of their business. However, the TCFD recommendations provide a neat package of eleven recommendations structured into four core pillars to guide users in their analysis and disclosures, being:

- Governance

- Strategy

- Risk management, and

- Metrics and targets.

The TCFD recommendations provide the structure required to guide your organisation to climate-related disclosure. Notably, the four pillars do not operate in isolation - interdependence between the pillars is evident throughout the guidance provided, as are the common themes and challenges that can occur. Here we look at the overarching value the four pillars can bring.

Source: Figure 2, Recommendations of the Task Force on Climate-related Financial Disclosures

1. Governance

Assigning responsibilities to the Board and management team concerning climate-related risks will be of importance to stakeholders. This recognises the significance of the potential risks and opportunities, and the necessary stewardship of the highest-level governance bodies for overseeing these matters, as well as managing those issues.

Integrating the management of climate-related risk across the enterprise is critical. It cannot be viewed in isolation from other critical financial and operational processes, including capital allocation frameworks, enterprise risk frameworks and procurement policies.

2. Strategy

The strategy pillar seeks to test the resilience of the enterprise strategy to identify climate-related risks and opportunities. This goes as far as forecasting expected developments over time against identified future scenarios. Will cashflows withstand the anticipated impacts? Do asset values hold up?

Considering the short-, medium- and long-term implications will be necessary for stakeholders in forming their expectations of the business's future performance. A mechanism should be established to amend, review and revise the enterprise strategy periodically, with climate change considerations embedded within the process to ensure the resilience of the strategy.

3. Risk management

Similarly the approach to risk management is not about re-inventing risk management processes. Rather, it's an opportunity to augment the organisation's existing risk management appetite, profile and management activities with the additional view of the climate change lens.

The key elements include embedding the processes for identifying, assessing, and managing climate-related risks into the existing enterprise risk management frameworks.

Risk management disclosure allows stakeholders to understand better the organisation's overall climate-related risk profile and approach to the management of those risks.

4. Metrics and targets

Disclosure of metrics and targets used to assess and manage relevant climate-related risks allows stakeholders to assess the organisation's climate-related exposure and progress over time. Harnessing the organisation's existing data management systems, where mapped to identified metrics, may help to efficiently support the collation of climate-related metrics and ensure the required level of quality.

A critical step is calculating the organisation's greenhouse gas (GHG) emissions footprint. This creates a baseline footprint to develop future targets and the strategy to get there. Start by gaining an understanding of scope 1, 2 and 3 emissions:

- Scope 1 emissions are direct GHG emissions that occur from sources owned or controlled by the company

- Scope 2 emissions are indirect GHG emissions resulting from the generation of purchased energy (typically electricity) consumed by the company

- Scope 3 emissions are indirect GHG emissions that exist both upstream and downstream within your supply and value chains. They are a consequence of the company's activities but occur from sources not owned or controlled by the company.

Find out more about calculating scope 1, 2 and 3 emissions.

What changes in IFRS S2?

The International Sustainability Standards Board (ISSB) has been established by the International Financial Reporting Standards (IFRS) Foundation to develop disclosure standards for climate-related financial risks. The TCFD recommendations underpin the structure and principles of the draft International Financial Reporting Standards (IFRS) Foundation standard for mandatory climate-related disclosures (IFRS S2), and the four pillars of the TCFD recommendations will essentially become the four pillars of IFRS S2.

In its comparison paper, the ISSB points out that the TCFD recommendations and IFRS S2exposure draft recommendations are consistent. The difference between the two frameworks lies in the supporting guidance, including the granularity of information, not the core recommendations or recommended disclosures.

What does this mean for Australian organisations?

TCFD reporting has long been recommended as a methodology for organisations to assess and manage their climate-related risks. ASIC, APRA and ASX have strongly and consistently advocated for the adoption of TCFD recommendations within disclosure frameworks for quite some time.

As climate-related reporting becomes more ingrained in corporate Australia, preparers will need to draw on the sustainability team's knowledge and expertise from finance and risk colleagues to guide the structure and location of any sustainability and climate-related disclosures. A collaborative approach will help to produce a holistic picture of the organisation and ensure it meets the required standards, checks, and balances.

Here to help

Our national sustainability team can support your organisation to:

- Determine the scope and applicability of the TCFD recommendations

- Conduct gap analyses between your current climate-related processes, controls and disclosures against the TCFD expectations and requirements

- Calculate scope 1, 2 and 3 emissions; and

- Draft and prepare TCFD reports.

Contact us today.