Private equity deal-making in the Technology, Media & Telecommunications (TMT) sector remains strong despite uncertainty due to macroeconomic conditions as well as the increased volatility in public capital markets.

FY22 began with strong momentum following historic deal-making activity in FY21. Corporates, institutional and retail investors increased their focus on technological enablement and transformation in a post-COVID world. For private equity firms, where the TMT sector has traditionally been a popular source of returns, this drove competition and increased valuations.

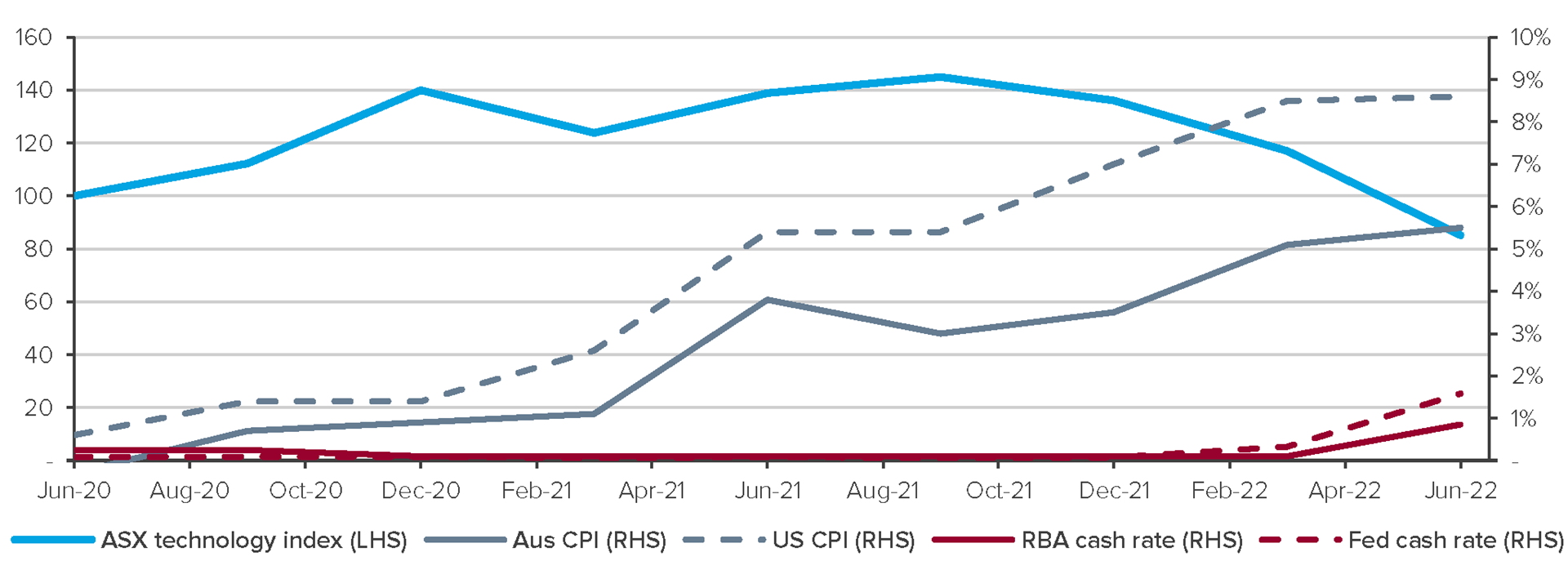

That said, the macroeconomic backdrop of upward inflationary pressures and interest rate hikes heightened volatility for public capital markets. Over the course of FY22, governments in developed markets such as the US and Australia exercised contractionary monetary policy to curb inflation.

ASX technology index performance and macroeconomic factors

(Click to enlarge) - Source: S&P Capital IQ, Reserve Bank of Australia, US Federal Reserve Bank, BDO analysis

(Click to enlarge) - Source: S&P Capital IQ, Reserve Bank of Australia, US Federal Reserve Bank, BDO analysis

The negative correlation between share price performance and rising inflation and interest rates is particularly evident in the ASX 200 Information Technology Index (XIJ). The index indicates tech stocks fell c.60% between Sep-21 and Jun-22, as investors shied away from pre-profit stocks trading at higher-than-average revenue multiples; characteristics more apparent within the TMT sector in comparison to other sectors.

Some commentators expected the downturn in public capital markets to spill over to private capital markets. While these factors undoubtedly increased attentiveness from PE firms in the short-term, they did not negatively impact Australian PE investment and deal flow in the TMT sector. This is attributable to the fact that sophisticated investors within PE firms look beyond short-term volatility, focusing on investment opportunities within a c.3-5 year horizon.

Deal volume by TMT sub-sector

Sub-sector |

FY22 Total |

% of total deals |

|

Software |

31 |

66% |

|

IT Infrastructure |

5 |

11% |

|

Electronics |

4 |

9% |

|

Internet |

3 |

6% |

|

IT Security/Cybersecurity |

2 |

4% |

|

Telecoms |

1 |

2% |

|

Information Services |

1 |

2% |

|

Total |

47 |

100% |

Source: Preqin, BDO analysis

Specifically, there were 47 PE TMT deals in FY22 (up from 37 deals in FY21), culminating in USD 1.2bn of deal value. As expected, software was the hottest sub-sector, representing c.66% of FY22 deal volume. Software businesses are highly attractive to PE due to their recurring-revenue model, relatively fixed cost base, and highly scalable and non-capital intensive nature. Further, B2B software businesses are less influenced by short-term macroeconomic disruptions given they are embedded into core IT infrastructure and operations.

Top PE TMT deals in FY22

Portfolio company |

Value (USD m) |

Sub-sector |

Acquirer(s) |

Type |

Date |

|

Rhipe Ltd |

306 |

Internet |

Crayon Group Holding ASA, Softline Group, Da Vinci Capital Management |

Add-on |

Jul-21 |

|

CH Digital Pty Ltd |

267 |

Software |

Highpost Capital |

Buyout |

Mar-22 |

|

Gnie Solutions Pty Ltd |

250 |

Software |

Pacific Equity Partners, The Citadel Group Limited |

Add-on |

Oct-21 |

|

GBST Holdings Limited |

181 |

Software |

Anchorage Capital Partners |

Buyout |

Dec-21 |

|

Hell Let Loose |

42 |

Software |

LDC, Team17 Digital Ltd. |

Add-on |

Jan-22 |

Most active PE firms in Australasian TMT sector (FY22)

PE firm |

Deal volume |

|

BGH Capital |

4 |

|

Accel-KKR |

4 |

|

Vista Equity Partners |

3 |

|

Hg |

3 |

|

Australian Business Growth Fund |

2 |

|

Other |

99 |

|

Total |

115 |

Spotlight deal 1

|

Target: |

Console Australia Pty Ltd |

|

Acquirer: |

Accel-KKR |

|

Acquirer country: |

US |

|

Announced date: |

Mar-22 |

|

Type: |

Add-on |

|

Synopsis: |

Console is a software-as-a-service business, and provider of property management and trust accounting software. The company has over 2,800 real estate agencies using its software. Accel-KKR is US-based technology-focused private equity firm with over USD 16bn in assets under management. This transaction serves as a bolt-on acquisition for its portfolio company Reapit Ltd, an industry leading property software provider. Accel-KKR engaged BDO, led by Corporate Finance Partner Sebastian Stevens, to provide financial due diligence on this transaction. |

Spotlight deal 2

|

Target: |

HUBBED Pty Ltd |

|

Acquirer: |

Australian Business Growth Fund (ABGF) |

|

Acquirer country: |

Australia |

|

Announced date: |

Jun-22 |

|

Type: |

Growth capital |

|

Synopsis: |

HUBBED is an Australian tech-enabled solution for last mile delivery and return logistics. In Jun-22, HUBBED received an USD 8.6m investment from the Australian Business Growth Fund, which incorporates a 30% voting interest for the fund. ABGF provides growth capital to Australian SMEs. It was founded with initial capital of AUD 540m as a public-private partnership between the Australian Government and six Australian banks. ABGF has a unique profit-for-purpose investment model intended to fuel the growth of the SME sector. ABGF engaged BDO, led by Corporate Finance Partner Daniel Coote, to provide financial due diligence on this transaction. |

Contact us

If you are interested in how BDO can help you with your Private Equity needs, please get in touch with our Private Equity team.