This article was originally published 24 March 2023, and updated 23 June 2023.

Today’s policymakers are determined not to repeat the mistakes of the 70s when inflation continued to spike due to wavering central bank policy and are hiking rates at the fastest pace we have seen in decades. These hikes translated to a repricing of assets across the board. Out of the repricing of assets, a disparity appeared between the value of many listed and unlisted assets, prompting questions as to whether these unlisted assets are being fairly valued.

With a growing trend towards unlisted asset investment, particularly among superannuation funds, it is important to understand asset valuations and how price disparities can impact your investment decision-making.

What is an ‘unlisted asset’?

Most individuals would be familiar with large, publicly listed assets such as BHP and NAB, which are available to buy on an exchange such as the Australian Stock Exchange (ASX). These shares are traded daily and priced depending on supply and demand. In comparison, an unlisted or ‘private’ asset is not listed on an exchange. Just like your house, an unlisted asset is not traded daily, and its true value is usually only realised once the asset is sold.

Unlisted assets can provide several advantages for investors. For instance, these assets provide diversification benefits, given you have access to a large sector of companies and assets that are not available on the listed exchange. A longer-term focus allows private assets to see through short term economic volatility and remain unaffected by listed boards who might be pressured into making shorter-term decisions.

Unlisted assets are also less volatile than their listed counterparts. Unlike listed markets where prices fluctuate daily, unlisted assets are typically valued at set intervals (for example, quarterly or annually).

Superannuation funds generally have a panel of valuers, chosen based on their expertise, tasked with valuing assets, rotated to ensure these assets are consistently valued in accordance with Australian Prudential Regulation Authority’s (APRA’s) guidelines.

While the valuer is selected based on their expertise, the valuation report obtained is generally not publicly available making it difficult for superannuation fund members to understand the assumptions underlying the unlisted asset valuation and how they may have changed in response to broader market volatility.

How has the current environment affected listed vs unlisted asset values?

In 2022, valuations of the publicly listed commercial property funds index posted returns of negative 20.5 per cent (S&P/ASX 200 A-REIT TR Index). This is in stark contrast to the unlisted property funds index of positive 6.6 per cent – a 27.1 percentage point difference in returns – reported by the Property Council of Australia (PCA) (PCA/MSCI Annual Property Index).

In the current environment of aggressive changes in interest rates, chatter inevitably emerges questioning whether unlisted assets are being valued fairly. Over the last year, some superannuation funds have posted impressive returns in their flagship funds, most of which contain some form of unlisted investment. This has caught the attention of APRA, which is currently undertaking a review of unlisted assets including the level of transparency and risk to investors, after their 2021 review revealed that few superannuation funds had robust valuation methods in place for unlisted assets.

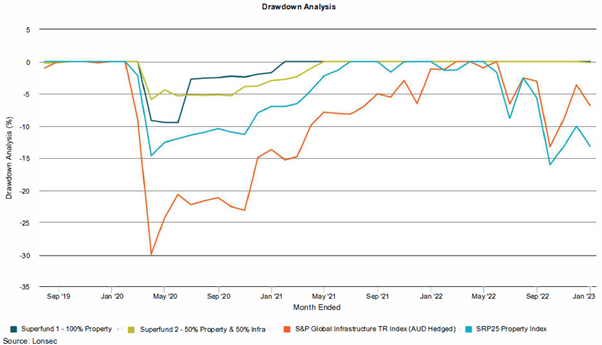

Figure 1: Drawdown analysis, data supplied by Lonsec. (click to open full size)

The chart above illustrates the movement of an investment from peak to trough. This cumulative peak-to-trough loss is also known as the ‘drawdown’. Here, the ‘drawdown’ compares one of Australia’s larger superannuation funds’ actively managed infrastructure and property options with their equivalent benchmark.

From the start of the COVID-19 pandemic through to today, there has been multiple instances where the price of unlisted superannuation fund investments has not fallen as far as their listed equivalents. The ‘drawdown’ graph shows the resilience seen in unlisted investments and the significant time it has taken for listed investments to recover to similar levels. Today we still see significant price discrepancies between listed and unlisted assets.

As more large-scale transactions occur and updated valuations flow through to markets, we should begin to see some normalisation in valuations across listed and unlisted assets and a decrease in the disparity. This could mean a drop or stagnation of unlisted assets or a rallying of listed assets.

Premium commercial property sales have been highly publicised recently for selling substantially below valuation, while strategic decisions are being made by large superannuation funds to steer further away from property exposure. Could this be a sign of what’s to come for unlisted assets throughout 2023 and 2024?

What should investors do?

Investors should be aware of the difference between listed and unlisted investments and ensure they are not inadvertently buying into large valuation gaps. Most superannuation fund members are invested in a superannuation fund’s default option, which generally invests your contributions in a diversified mix of holdings, with only a smaller allocation to unlisted assets.

Last year, over $140b was passed through to superannuation funds in the form of employer and voluntary contributions, with total assets under management surpassing $3.3T. Along with contributions flowing into super, funds are also increasingly paying out pensions. With a sizeable and stable pool, superannuation funds now have the luxury to lock up capital in long-duration investments that are typically less accessible to mum and dad investors. One of Australia’s largest superannuation funds now allocates almost one fifth of their balanced investment option in private markets including private equity, credit, property and infrastructure.

It is important to note that superannuation is a long-term investment, which means investors can look through short-term valuation lags and volatility.

When faced with concerns or anxiety over sudden fluctuations in your investments or superannuation, seek professional financial advice for your personal circumstances. For support making the right decisions for your circumstances and keeping on track through market highs and lows, reach out to your local BDO Private Wealth adviser.

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in Australia to discuss these matters in the context of your particular circumstances. BDO Australia Ltd and each BDO member firm in Australia, their partners and/or directors, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it.

BDO Private Wealth Advisers Pty Ltd ABN 62 805 149 677 AFS Licence No. 238280 is a member of a national association of separate member firms which are all members of BDO Australia Ltd ABN 77 050 110 275, an Australian company limited by guarantee. BDO Private Wealth Advisers Pty Ltd and BDO Australia Ltd are members of BDO International Ltd, a UK company limited by guarantee, and form part of the international BDO network of separate member firms. Liability limited by a scheme approved under Professional Standards Legislation.

BDO is the brand name for the BDO network and for each of the BDO member firms.

© 2023 BDO Private Wealth Advisers Pty Ltd. All rights reserved.