As with most developed countries, Australia’s population is aging. In June 2021, 4.3 million Australians (or 17 per cent of the population) were aged 65 and over. As the Baby Boomer generation continues to age, the proportion of older Australians is expected to increase. By 2061, the number of people aged 65 and over is expected to reach 8.8 million (or 23 per cent of the population). This creates a demographic composition not previously experienced in Australia (and many other countries), resulting in challenges but also opportunity.

An additional 4.5 million older Australians means an increased consumer base for a multitude of industries including health and retirement living. Importantly, there is a range of retirement living options including retirement villages, manufactured home estates, co-located developments, and serviced apartments with various levels of aged care and medical facilities. There are numerous opportunities in the retirement village sector including the building of new developments, increasing the amenities available in existing developments and providing services not currently in the market.

It is likely future retirement living will look different than it does now. Typically, retirement developments have focused on easing into old age with lower physical impact activities being the focus. With the general population becoming healthier than their predecessors, it is likely that older Australians will demand more active retirement options, seeking to maintain a sense of community, social networks, and an active lifestyle from their younger years.

In addition to the change in the type of retirement living that may be required, the location of retirement living may change as the population ages. People aged over 65 years old are more likely to live in a coastal or regional area than in a city, with 17.7 per cent favouring a tree or sea change in retirement. In comparison, only 13.7 per cent of over 65s live in metro areas. Popular areas for those aged 65 and over are the Gold Coast, Newcastle, Central Coast, and the Mornington Peninsula.

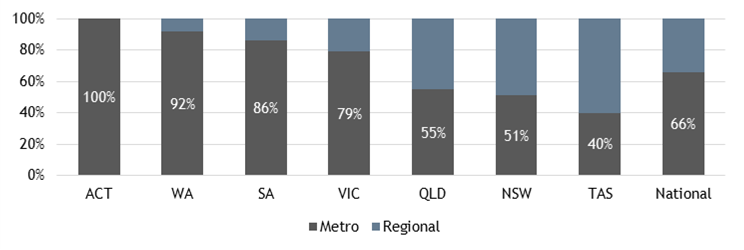

In 2020, retirement listings on realestate.com.au show 58 per cent of retirement listings were in Queensland and New South Wales, with 66 per cent of these listings located in metro areas (see Figure 1). However, the split between metro and regional listings is not as high for all states with Queensland, New South Wales and Tasmania exhibiting a more even split between regional and metro. In Queensland and New South Wales, the top areas are regional, with the Sunshine Coast and Central Coast top for retirement listings.

Figure 1: Retirement living listings by state and regional split

Source: Real Estate Australia March 2021 Retirement Living Report. (click to enlarge)

While listings provide an indication of where the supply of retirement living is concentrated, it does not indicate where demand is greatest. The areas that are of greatest interest from retirees, are New South Wales, Victoria, and Tasmania. The Eastern Suburbs of Sydney, Hobart and Launceston are in high demand, not only because they are desirable locations, but also because of the relatively smaller supply in the market. In general, beachside areas are the most in-demand, with a few outer metro areas that are near to green spaces, but still close enough to all city amenities.

An increase in the number of older Australians looking to relocate to regional and beachside areas, provides an opportunity to grow the retirement living pipeline as well as rethink how and where retirement living is provided.

Maximising the development

As developments for retirement living continue to grow and attract more developers, there is an opportunity to structure the development and the arrangements with residents, for a successful commercial and tax effective outcome.

Whilst each development has its own unique circumstances and value proposition, there are some key factors to consider. To achieve an optimal structure, we recommend the following:

- Prior to engaging investors in retirement developments, understand their tax profile as they may have an exit strategy in mind. In particular, some investors may want to access the 50% CGT discount and would likely require a trust to be the holder of the land asset.

- Maximise the development and operating structure, and ensure there is sufficient asset protection (e.g. the separation of the asset owner and developer). Tax planning opportunities exist where the landholder and the operating structure are separate, which can affect the timing of when income is recognised.

- Carefully consider the development structure and cash flow modelling to ensure debt repayments can be made where the landholder is a trust. We recommend the depreciation incentives are maximised to manage this risk.

- Explore the depreciating incentives available. Opportunities exist to provide tax deferred distributions to investors in the initial holding period. This can assist with loan repayment obligations where the depreciation deductions are made by the land holder trust. An external quantity surveyor should be engaged to prepare the tax depreciation schedule.

- Re-evaluate the type of arrangement agreed upon with the residents. By offering a bond-type arrangement with the retirement village resident, rather than a typical sale of a leasehold, there are several commercial and tax benefits that can be achieved.

There are several ways to improve the structure of a development and the provided list is non-exhaustive. Prior to the acquisition or development of any retirement living asset, seek advice from an adviser.

Questions? Contact us for more information

BDO’s Real Estate and Construction team supports all real estate and construction clients - through assurance, consulting, tax, and advisory services. For more information, please get in touch with our team.