Student Careers

At BDO we are passionate about creating opportunities for individuals to grow and develop their career, with an array of pathways available.

Join our early careers talent community and register your interest for future graduate, vacation and undergraduate opportunities!

We are looking for driven graduates who want to develop their careers in a nurturing and welcoming professional services environment. Being a graduate at BDO allows you to gain experience in an open-door culture, build relationships with clients and expand your network. You will get involved in real client work from the beginning of your career, supported by your Partners and team every step of the way.

Our undergraduate program is open to students in their first to final year of study. This program allows you to work in a full-time or part-time capacity while completing your university degree.

As a Vacationer at BDO, you will gain real-world, paid work experience in your chosen service line – think of it like a ‘try before you buy’ career opportunity. You will be allocated a buddy for the duration of your placement and get the chance to engage in career development and networking activities throughout the program. There will be opportunities to work with professionals on current client work, while experiencing our culture first-hand.

Student opportunities are available across all our service lines, dependent on location. Learn more about our service lines below.

BDO’s Advisory team provides transaction, risk, consulting, and strategic services to a broad range of clients. With more than 15 distinct speciality service areas, our national practice supports clients in navigating challenges throughout the entire business lifecycle. This includes assisting with corporate and personal insolvency matters, corporate finance transactions, due diligence and reporting, risk mitigation, financial crime investigations, litigation, cyber security, business transformation, data and technology, people advisory and more.

Arush Senanayake, Analyst, Corporate Finance

“Corporate Finance is a technically demanding service line. The team consistently prioritise knowledge development, with regular training as well as providing substantial exposure to different types of work. I particularly enjoy the non-repetitive nature of the work as well as the frequent technical discussions within the team.”

Applications for our 2025/2026 Student Programs have now closed. Express your interest for future opportunities below.

Vacation Programs

Graduate Program

Start dates may vary so always check the job advertisements or contact our team for more information.

You may be wondering which service line or team to apply for with the degree you have studied. Click on your degree below to understand your career options:

Please note: the team and degree pathway may vary by location.

Invitation to online video interview

Attend an assessment centre or interview

Receive an offer

Start your role!

Starting your career is a big step, but we are here to support you at every stage. If you need any additional support, you can contact our friendly student recruitment team at student.careers@bdo.com.au

While BDO is a global professional services firm, we pride ourselves on still having a ‘small-firm feel’ which means an awesome workplace culture, supportive environment, and great employee benefits*. BDO supports your professional development and mental and physical wellbeing by providing opportunities to get involved in our community.

* benefits may vary based on location.

Want to know what a career at BDO looks like? Check out our people's stories here.

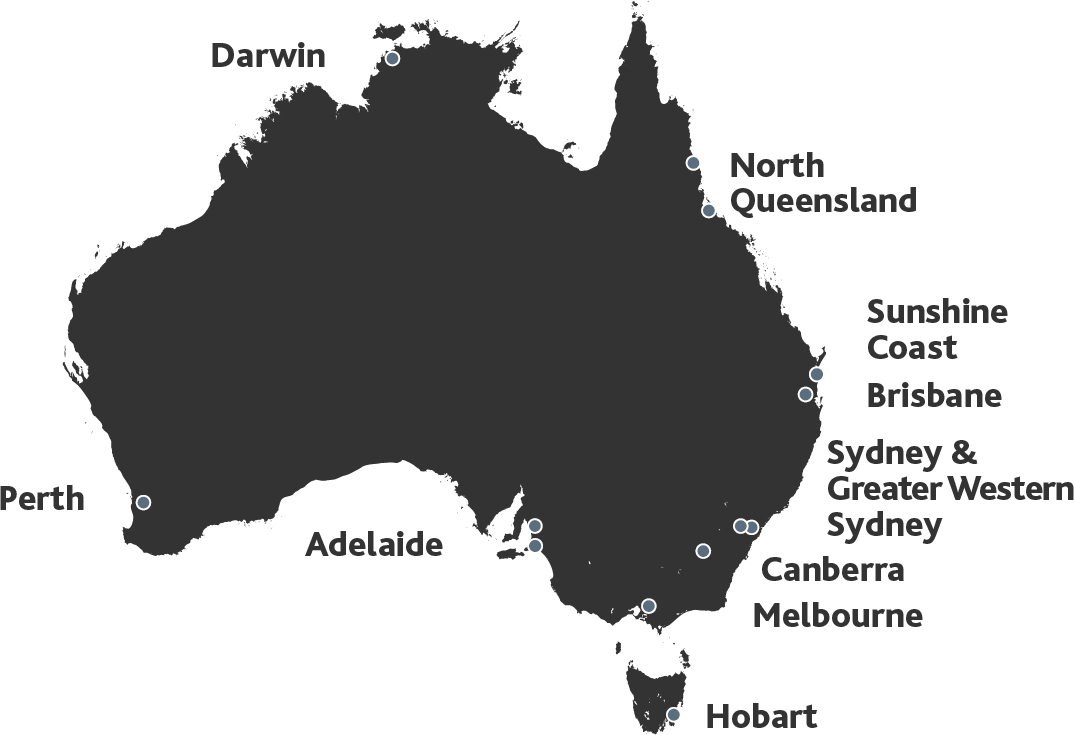

We have student career opportunities in each of our major offices and our friendly student talent team are here to assist you every step of the way. To contact the team, email student.careers@bdo.com.au.

Darwin

Hobart