NFPs – Grants to NFPs to transfer research findings to a customer – Timing of revenue recognition revisited

AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Nor-for-Profit Entities apply to not-for-profit entities (NFPs) with annual periods beginning on or after 1 January 2019 (i.e. 31 December 2019 year-ends).

In December 2019, the Australian Accounting Standards Board (AASB) announced that it was deferring the application of AASB 15 and AASB 1058, but only for research grants, to annual periods beginning on or after 1 July 2019 (i.e. 30 June 2020 year-ends). It made this concession to give recipients more time to navigate the complexities of the AASB 15/AASB 1058 requirements and their impact on the accounting for research grants.

At the same time, the AASB amended Examples 4A, 4B and 4C relating to research grants (included in Appendix F to AASB 15), as well as the guidance provided in revamped AASB FAQ No.5. While the answers to each fact pattern stay the same, the AASB clarified its thought process for concluding whether, in each example, revenue is recognised ‘over time’ or at a ‘point in time’. This article demonstrates this revised thought process, and also summarises the fact pattern and conclusions resulting from a new Example 4D that has been added to Appendix F.Please refer to our June 2019 edition of Accounting News for a detailed summary of the analysis of Examples 4A, 4B and 4C, as well as the accounting on initial recognition, and journal entries applying AASB 15.

FAQ No. 5 (Chart 3)

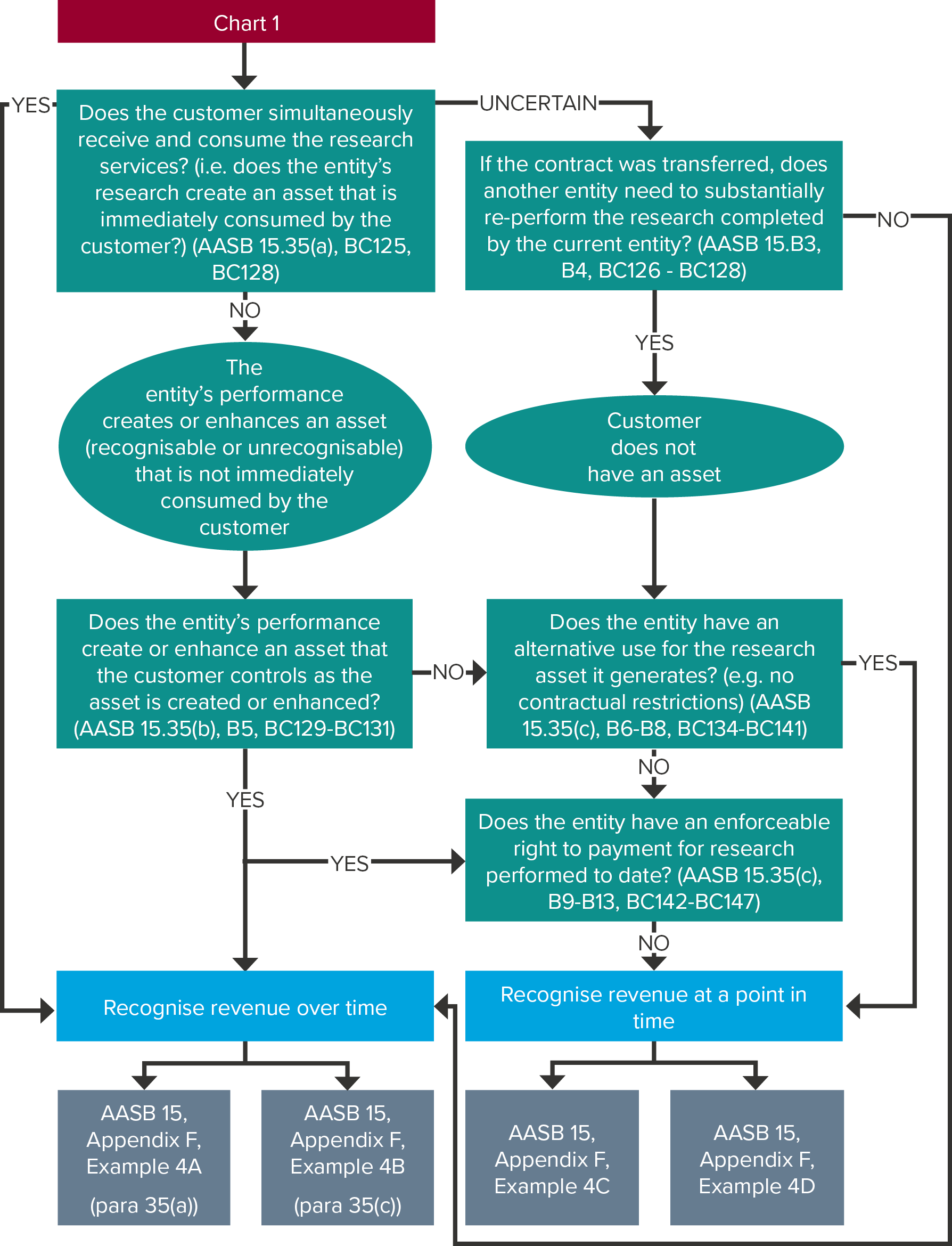

Chart 3 has been amended in the AASB’s updated FAQ No. 5 to clarify, using Examples 4A, 4B, 4C and 4D from AASB 15, Appendix F, that all aspects of AASB 15, paragraph 35, need to be considered in determining whether revenue from sufficiently specific performance obligations with respect to the transfer of research findings is recognised ‘over time’ or at a ‘point in time’.

Chart 3 extracted from AASB FAQ No. 5

AASB 15, Appendix F - Examples 4A, 4B, 4C

Below is an extract of the relevant Fact Patterns.

Facts common to all examples | ||

Research Institute C receives a cash grant from a donor, Marine Sanctuaries Trust M of $5.3 million to undertake research that aims to track whale migration along the eastern coast of Australia. Terms of the grant that are common to all three examples are as follows:

| ||

Example 4A additional facts | Example 4B additional facts | Example 4C additional facts |

Publication of research data on a public website as it is obtained, so that any researchers can use the data. | Publication of the research data is required at the conclusion of the research, rather than contemporaneously. | Publication of the research data is required at the conclusion of the research, rather than contemporaneously. |

Annual progress reports and a final report are required. | Interim and final reports analysing the tracking data obtained. | Interim and final reports analysing the tracking data obtained. |

| Institute is restricted from readily directing the tracking information and analysis for another use of the Institute. | Institute is able to utilise the research it performs for any other use of the Institute. |

In all facts patterns it has determined that there is an enforceable contract with a customer that includes sufficiently specific obligations (refer to June 2019 Accounting News for analysis as that part of these examples has not changed).

Accounting treatment – Timing of revenue recognition

While the accounting treatment on initial recognition for Examples 4A, 4B and 4C are the same (i.e. receipt is recognised as a contract liability on initial recognition), the pattern or timing of revenue recognition may vary, depending on when the ‘sufficiently specific’ promises are satisfied, i.e. when the research data is published on a public web site.

The table below demonstrates the Chart 3 analysis for the timing of revenue recognition under AASB 15, paragraph 35. In order to be able to recognise revenue over time, an entity must be able to demonstrate that it complies with at least one of the criteria in AASB 15, paragraph 35 (although it should be noted that paragraph 35(c) requirement has been broken down into two parts in the table below because BOTH parts must be met in order to recognise revenue over time).

AASB 15, paragraph 35 criteria | Example 4A | Example 4B | Example 4C |

Does the customer simultaneously receive and consume the research services? AASB 15, para 35(a) | ✔ Research data is made public as it is collected. | X Research data is not published until the conclusion of the research. Also, performance of the research activities results in the accumulation of knowledge which is an asset (whether recognisable or unrecognisable) developed by the researcher but is not immediately consumed. | X Research data is not published until the conclusion of the research. Also, performance of the research activities results in the accumulation of knowledge which is an asset (whether recognisable or unrecognisable) developed by the researcher but is not immediately consumed. |

Does the entity’s performance create or enhance an asset that the customer controls as the asset is created or enhanced? AASB 15, para 35(b) | N/A | X Donor does not obtain the IP under the agreement, therefore the research does not create or enhance an asset that the donor controls as it is being created. | X Donor does not obtain the IP under the agreement, therefore the research does not create or enhance an asset that the donor controls as it is being created. |

The entity does not have an alternative use for the research asset it generates? AASB 15, para 35(c) | N/A | ✔ | X |

Does the entity have an enforceable right to payment for research performed to date? AASB 15, para 35(c) | N/A | ✔ Research Institute C has an enforceable right to payment for work performed to date. | ✔ Research Institute C has an enforceable right to payment for work performed to date. |

Revenue recognised… | Over time | Over time | Point in time (only one of the criteria in paragraph 35(c) is met) |

Measure of progress | As research data is published | Value of performance to customer (based on amount entitled to receive for performance to date) | On conclusion of the agreement |

BDO comment:

It is interesting to note that revenue recognition does not always co-incide with the apparent satisfaction of the promise in the contract. Examples 4B and 4C both require delivery of research findings at the conclusion of the contract, so intuitively it would seem reasonable to assume that revenue would be recognised at a POINT IN TIME (on conclusion of the agreement).

However, AASB 15, paragraph 35(c) serves to allow ‘over time’ revenue recognition if the asset created has no alternative use to the NFP (Example 4B).Example 4D – De-identified research findings (and data) made available to donor and authorised third parties periodically

As part of its process to clarify the thought process for recognising revenue over time, the AASB added Example 4D to AASB 15, Appendix F.

Example 4D has the same fact pattern as Example 4C, with one key difference.

The Chart 3 analysis for Example 4D is as follows:

AASB 15, paragraph 35 criteria | Example 4C | Example 4D |

Does the customer simultaneously receive and consume the research services? AASB 15, para 35(a) | X Research data is not published until the conclusion of the research. Also, performance of the research activities results in the accumulation of knowledge which is an asset (whether recognisable or unrecognisable) developed by the researcher but is not immediately consumed. | X Research data published periodically as required by Research Institute C’s policy (i.e. at a minimum at the end of each year). |

Does the entity’s performance create or enhance an asset that the customer controls as the asset is created or enhanced? AASB 15, para 35(b) | X Donor does not obtain the IP under the agreement, therefore the research does not create or enhance an asset that the donor controls as it is being created. | X Donor does not obtain the IP under the agreement, therefore the research does not create or enhance an asset that the donor controls as it is being created. |

The entity does not have an alternative use for the research asset it generates? AASB 15, para 35(c) | X Research Institute C is able to utilise the research it performs for any other use (i.e. there is alternate use). | X Research Institute C is able to utilise the research it performs for any other use (i.e. there is alternate use). |

Does the entity have an enforceable right to payment for research performed to date? AASB 15, para 35(c) | ✔ Research Institute C has an enforceable right to payment for work performed to date. | ✔ Research Institute C has an enforceable right to payment for work performed to date. |

Revenue recognised… | Point in time (only one of the criteria in paragraph 35(c) is met) | Point in time (only one of the criteria in paragraph 35(c) is met) |

Measure of progress | On conclusion of the agreement | As each set of de-identified research findings is made available (in our example, at the end of each year). |

If Research Institute C made the de-identified research findings available more frequently than at the end of each of the three years (for example, every six months), the point in time that Research Institute C recognises revenue would be the date on which each part of the de-identified research findings are made available.

Note: The same pattern of revenue recognition as per Example 4D would result in the following cases:

- Even if the grant agreement does not explicitly refer to Research Institute C’s policy, provided the donor is aware of the policy, Research Institute C’s past practice of making de-identified research findings available at least annually to donors and authorised third parties in accordance with the policy, may create a valid expectation that the research findings will be made available (i.e. the implicit promises to make the de-identified research findings available periodically would be treated as part of the grant terms), or

- The grant agreement refers explicitly to the requirement to make the research findings available, i.e. reference to a policy of Research Institute C would not be necessary).

Concluding thoughts

Accounting for research grants under AASB 15 and AASB 1058 is complicated. Significant judgement is involved in determining whether there is an enforceable contract with a customer, as well as whether there are ‘sufficiently specific’ performance obligations. We urge NFPs, if you have not already done so, to start reviewing all grant contracts, and in particular, contracts for research grants. If you require assistance, please contact BDO’s IFRS Advisory Team.