Grants to NFPs to transfer research findings to a customer – Does AASB 15 or AASB 1058 apply?

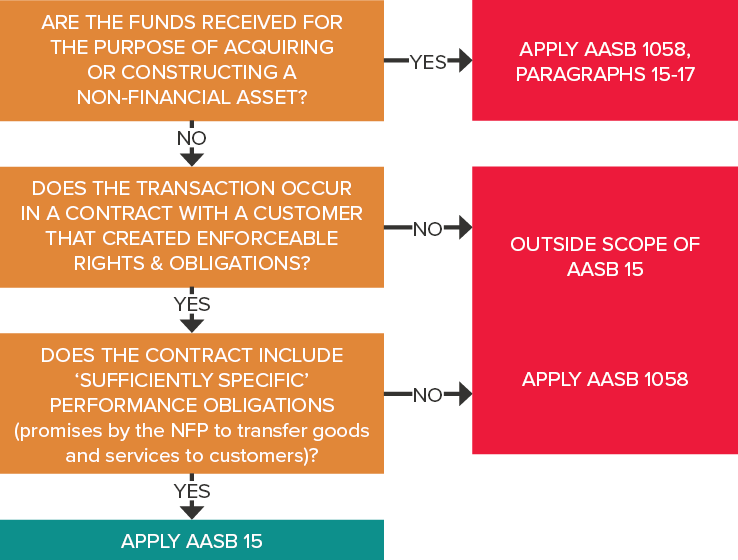

Grants and other donations received by not-for-profit entities (NFPs) can only be recognised as revenue under AASB 15 Revenue from Contracts with Customers if there is an enforceable contract with a customer, and that contract contains ‘sufficiently specific’ performance obligations. Otherwise, income is recognised under paragraph 9 of AASB 1058 Income of Not-for-Profit Entities.

Please refer to previous Accounting News articles for more background information on how to assess whether:

- The transaction occurs in a contract with a customer that creates enforceable rights and obligations (November 2018), and

- The contract includes ‘sufficiently specific’ performance obligations (February 2019).

Grants to perform research activities

One of the areas where we encounter practical difficulties in applying the above requirements is where grants are received by NFPs to conduct research activities. The assessment of whether the contract includes ‘sufficiently specific’ performance obligations very much depends on what is being transferred to the customer (grantor).

AASB FAQ no. 5

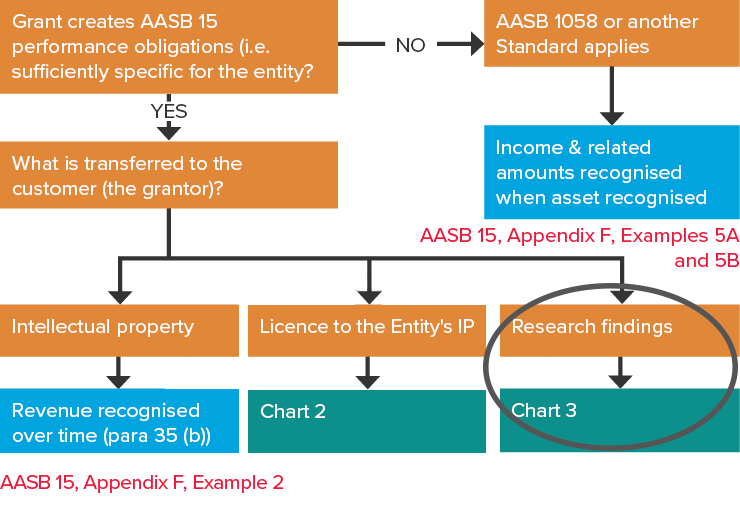

The flow chart below is extracted from FAQs issued by the Australian Accounting Standards Board (AASB) in August 2018. Chart 1 of FAQ No. 5 summarises the required thought process for determining the appropriate recognition of income from grant contracts for different types of research activities, based upon what is being transferred to the customer, i.e.:

- Intellectual property (IP)

- Licence to use the NFPs’ IP, or

- Research findings.

In April and May 2019 Accounting News, we considered the first and second aspects, i.e. where either the IP itself, or a licence to use the NFP’s IP, is transferred to the customer. This month, we look at a further example where the NFP transfers research findings.

Chart 1 extracted from AASB FAQ No. 5

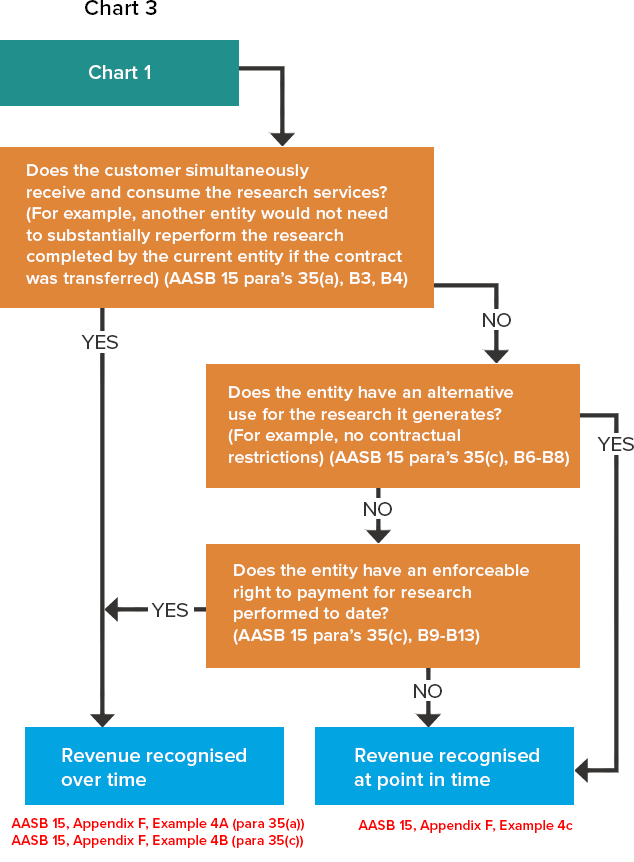

Chart 3 provides a further roadmap to assess whether the grant revenue to transfer research findings is recognised at a ‘point in time’ or ‘over time’.

Chart 3 extracted from AASB FAQ No. 5

The timing of revenue recognition depends on whether at least one of the three criteria in AASB 15, paragraph 35, have been met for recognising revenue over time, i.e. the NFP satisfies its performance obligation to transfer control of its research activities over time.

Customer simultaneously receives and consumes the research services (para 35(a)) | OR | NFP’s performance creates or enhances an asset (e.g. WIP) that customer controls as asset is created (para 35(b)) | OR | The NFP’s performance:

|

Example 4A | Examples 4B and 4C |

In this article we will analyse the three examples noted in Chart 3 above (extracted from AASB 15, Appendix F) to determine whether AASB 1058 or AASB 15 applies, and if AASB 15 applies, whether revenue is recognised over time, or at a point in time.

AASB 15 – Examples 4A, 4B and 4C

Below is an extract of the relevant Fact Patterns.

| Facts common to all examples | ||

Research Institute C receives a cash grant from a donor, Marine Sanctuaries Trust M of $5.3 million to undertake research that aims to track whale migration along the eastern coast of Australia. Terms of the grant that are common to all three examples are as follows:

| ||

| Example 4A additional facts | Example 4B additional facts | Example 4C additional facts |

| Publication of research data on a public website as it is obtained, so that any researchers can use the data. | Publication of the research data is required at the conclusion of the research, rather than contemporaneously. | Publication of the research data is required at the conclusion of the research, rather than contemporaneously. |

| Annual progress reports and a final report are required. | Interim and final reports analysing the tracking data obtained. | Interim and final reports analysing the tracking data obtained. |

| Institute is restricted from readily directing the tracking information and analysis for another use of the Institute. | Institute is able to utilise the research it performs for any other use of the institute. | |

Is there a contract with a customer?

In all of the above fact patterns, Research Institute C concludes that it has a contract with a customer that creates enforceable rights and obligations on the basis that:

- Its promise of specified research is enforceable as the grant is refundable if the research if not undertaken

- Its promise to undertake the research is ‘sufficiently specific’ and represents a single performance obligation, and

- Undertaking the research will represent services provided to the donor, as it is a beneficiary of the research even though the research data is publicly available.

Does the contract contain ‘sufficiently specific’ performance obligations?

Judgement is required here, including whether the contract specifies, either explicitly or implicitly, the nature/type of goods or services, their cost or value, quantity, and the period over which they will be transferred to the customer (AASB 15, paragraph F20).

To be ‘sufficiently specific’, we also need to be able to determine when promises in this research contract have been satisfied.

In Examples 4A, 4B and 4C, the contracts identify:

| AASB 15, paragraph F20 considerations | Examples 4A, 4B and 4C fact patterns |

| Nature or type of good or service promised | Publication of research data tracking whale migration along the eastern Coast of Australia (at various times, depending on the exact fact patterns) |

| Cost or value of good or service | $5.3 million value |

| Quantity of good or service | N/A |

| Period over which good or service is to be transferred | Three years |

Not all of the above factors need to be specified in an agreement for the promise(s) to be ‘sufficiently specific’ (AASB 15, paragraph F22). However, in these fact patterns, at least three out of four are present, which is persuasive in assessing that promise in this contract is ‘sufficiently specific’.

It is also possible to determine when the promise to transfer the research findings has been met because it can be verified when the research findings have been published on a public web site.

Note that the ability of Research Institute C to publish research results in conference presentations and/or scholarly journals, without the requirement to publish the research data on a public web site, would not be a ‘sufficiently specific’ performance obligation because no goods or services are being promised to Marine Sanctuaries Trust M (the customer).

Accounting treatment – initial recognition

As AASB 15 applies to these ‘sufficiently specific’ performance obligations, Research Institute C A allocates the cash grant received of $5.3 million in Examples 4A, 4B and 4C to its identified performance obligation and recognises the financial asset (cash) and a contract liability of $5.3 million on initial recognition as follows:

| Dr ($) | Cr ($) |

| Cash | 5,300,000 | |

| Contract liability | 5,300,000 |

Accounting treatment – timing of revenue recognition

While the accounting treatment on initial recognition for Examples 4A, 4B and 4C are the same, the pattern or timing of revenue recognition may vary, depending on when the ‘sufficiently specific’ promises are satisfied, i.e. when the research data is published on a public web site:

| Example 4A | Example 4B | Example 4C |

| As it is obtained | On conclusion of the research | On conclusion of the research |

Example 4A – Publication of research data as it is obtained (IFRS 15, paragraph 35(a))

Research Institute C concludes that the performance obligation is satisfied over time because the donor /customer (Marine Sanctuaries Trust M) receives and consumes the benefits of the research services as they are performed (IFRS 15, paragraph 35(a)). The justification for arriving at this conclusion is that another entity would not need to substantially re-perform the research completed to date by Research Institute C if that other entity were to fulfil the remaining performance obligations to the donor (IFRS 15, paragraph B4). This is because the research data is made public as it is collected and therefore available to replacement researchers.

Research Institute C therefore concludes that:

| Example 4A | |

| Revenue to be recognised … | Over time |

| Measure progress | Research data published |

Example 4B – Publication when research concluded

Because Research Institute C is restricted from readily directing the tracking information and analysis for another use, its research performance creates an asset with ‘no alternate use’ to Research Institute C.

The contract also stipulates that Research Institute C also has an enforceable right to payment for work performed to date.

IFRS 15, paragraph 35(c) therefore requires revenue recognition over time.

Research Institute C therefore concludes that:

| Example 4B | |

| Revenue to be recognised … | Over time |

| Measure progress | Value of performance to customer (based on amount entitled to receive for performance to date). |

Example 4C – Publication when research concluded

Research Institute C concludes that the performance obligation is NOT satisfied over time because none of the criteria in IFRS 15, paragraph 35 apply, i.e.:

- The donor /customer (Marine Sanctuaries Trust M) does not receive and consume the benefits of the research services as they are performed (IFRS 15, paragraph 35(a)) because another entity would need to substantially perform the research completed to date by Research Institute C as it is not made public as research progresses

- The research work does create or enhance an asset that the donor controls as the asset is created or enhanced because the IP is not transferred to the donor under this agreement (IFRS 15, paragraph 35(b)), and

- Research performance creates an asset with an alternate use to Research Institute C because there are no contractual or practical limitations on the use of the research data created (IFRS 15, paragraph 35(c) for over time revenue recognition requires the creation of an asset with ‘no alternate use’).

Research Institute C therefore concludes that:

| Example 4C | |

| Revenue to be recognised … | Point in time |

| On conclusion of the agreement | |

BDO comment:

It is interesting to note that revenue recognition does not always co-incide with the apparent satisfaction of the promise in the contract. Examples 4B and 4C both require delivery of research findings at the conclusion of the contract, so intuitively it would seem reasonable to assume that revenue would be recognised at a POINT IN TIME (on conclusion of the agreement).

However, AASB 15, paragraph 35(c) serves to allow ‘over time’ revenue recognition if the asset created has no alternative use to the NFP (Example 4B).Accounting treatment – journal entries

Examples 4A and 4B – Over time recognition

The contract liability recognised by Research Institute C is released to revenue as the research data is published (Example 4A) or based on the value provided to the customer (Example 4B), which occurs during the three-year contract period. The cumulative journal entry over the three-year period is:

| Dr ($) | Cr ($) | |

| Contract liability | 5,300,000 | |

| Revenue | 5,300,000 |

Example 4C – Point in time recognition

The journal entry to recognise the above $5.3 million contract liability is made at the end of the three-year contract period:

| Dr ($) | Cr ($) | |

| Contract liability | 5,300,000 | |

| Revenue | 5,300,000 |

Concluding Thoughts

Many NFPs defer recognition of a variety of income streams because there is a lack of clarity in the current accounting requirements for income of NFPs. However, from 1 January 2019, this situation is about to change. NFPs will need to undergo a formal assessment of all income streams to assess whether recognition under AASB 1058 or AASB 15 is appropriate. Importantly, revenue can only be recognised if there is an enforceable contract with a customer, and ‘sufficiently specific’ performance obligations. Disclosure will be required in the financial statements about key judgements made in arriving at the conclusion that performance obligations are/are not ‘sufficiently specific’. Management should therefore already be undertaking a detailed review of all contracts and agreements to determine the appropriate accounting standard for accounting for grant income.