Grants to NFPs to transfer a licence to a customer – Does AASB 15 or AASB 1058 apply?

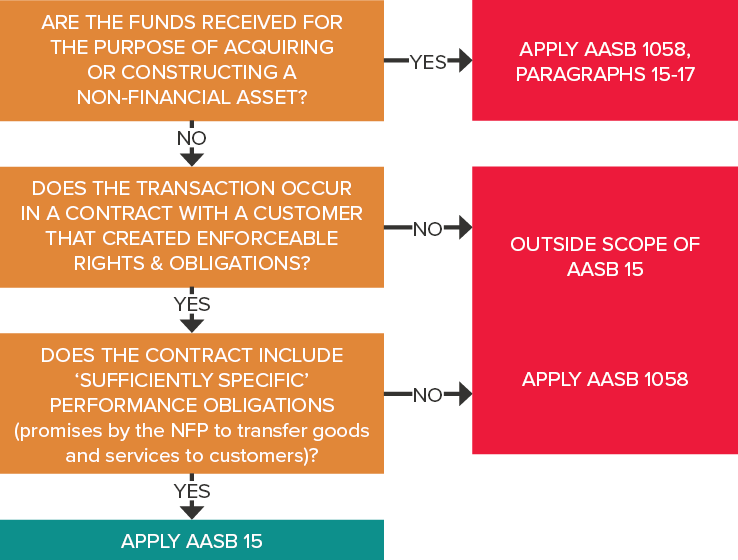

Grants and other donations received by not-for-profit entities (NFPs) can only be recognised as revenue under AASB 15 Revenue from Contracts with Customers if there is an enforceable contract with a customer, and that contract contains ‘sufficiently specific’ performance obligations. Otherwise, income is recognised under paragraph 9 of AASB 1058 Income of Not-for-Profit Entities.

Please refer to previous Accounting News articles for more background information on how to assess whether:

- The transaction occurs in a contract with a customer that creates enforceable rights and obligations (November 2018), and

- The contract includes ‘sufficiently specific’ performance obligations (February 2019).

Grants to perform research activities

One of the areas where we encounter practical difficulties in applying the above requirements is where grants are received by NFPs to conduct research activities. The assessment of whether the contract includes ‘sufficiently specific’ performance obligations very much depends on what is being transferred to the customer (grantor).

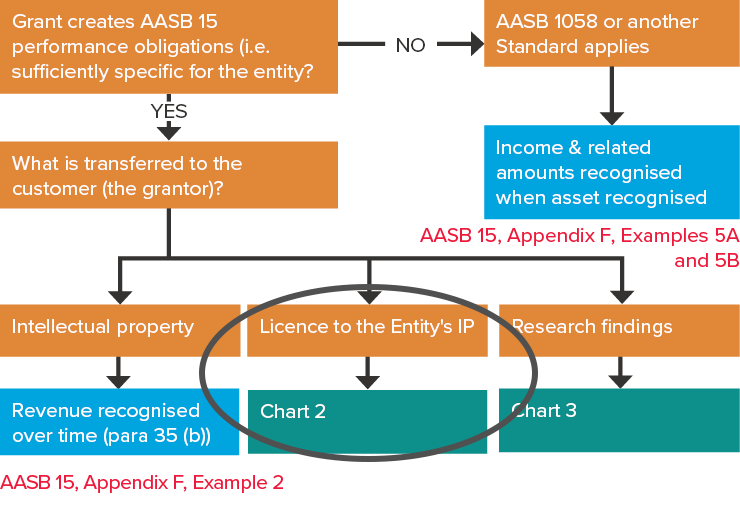

AASB FAQ No. 5

The flow chart below is extracted from FAQs issued by the Australian Accounting Standards Board (AASB) in August 2018. Chart 1 of FAQ No. 5 summarises the required thought process for determining the appropriate recognition of income from grant contracts for different types of research activities, based upon what is being transferred to the customer, i.e.:

- Intellectual property (IP)

- Licence to use the NFPs’ IP, or

- Research findings.

In April 2019 Accounting News, we considered the first aspect, i.e. where IP is transferred to a customer. This month, we look at a further example where the NFP transfers a licence to the customer to use the NFP’s intellectual property (IP).

Chart 1 extracted from AASB FAQ No. 5

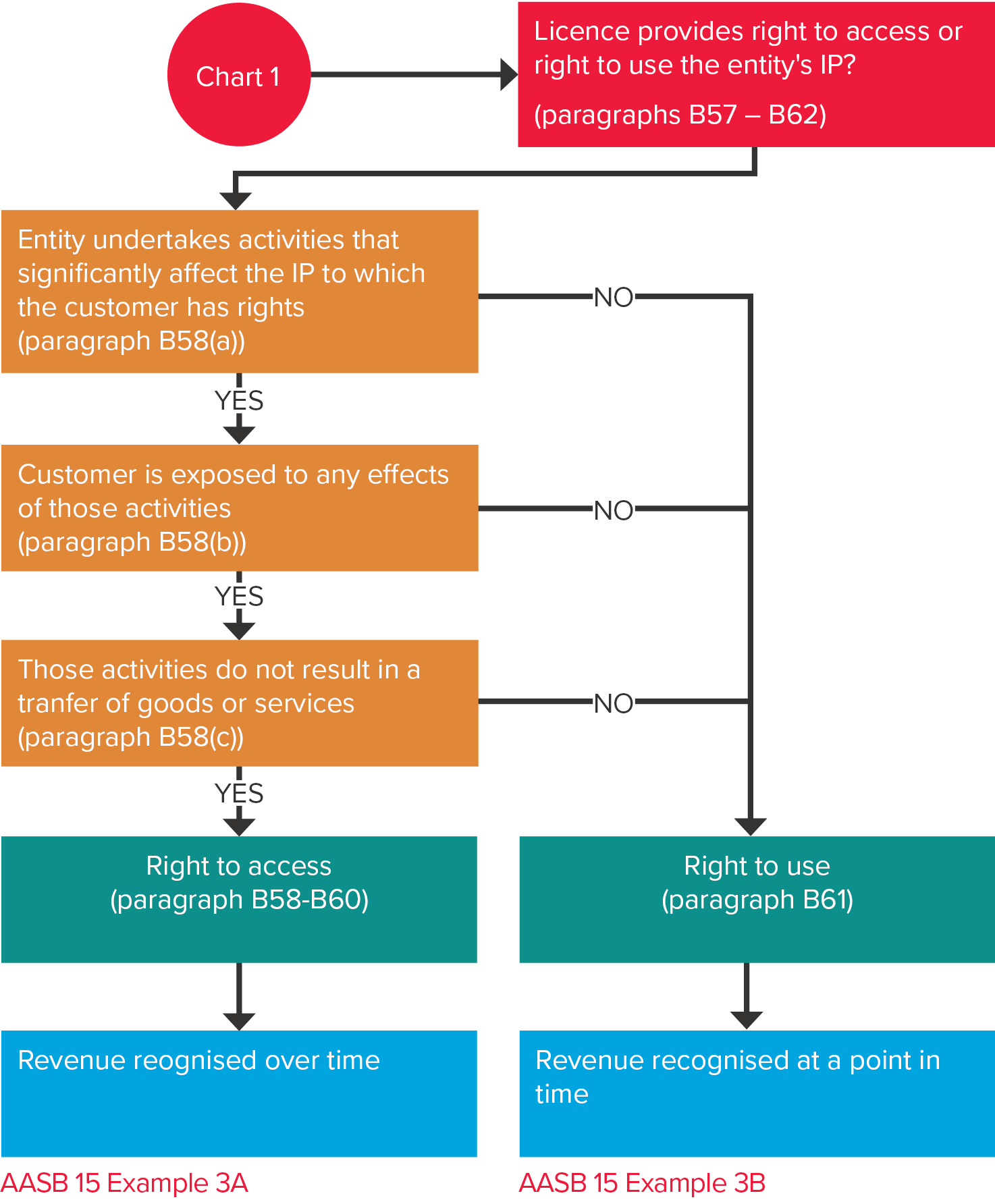

Chart 2 provides a further roadmap to assess whether the grant revenue to transfer a licence to a NFP’s IP is recognised at a ‘point in time’ or ‘over time’.

This depends on whether the licence to use the NFP’s IP provides:

| Licence conditions | Factors | Revenue recognised | Example |

| Right to access IP |

| Over time | AASB 15 - Example 3A |

| Right to use IP | One or all of factors for ‘right to access IP’ are not present | Point in time | AASB 15 - Example 3B |

In this article we will analyse the two examples noted in Chart 2 above to determine whether AASB 1058 or AASB 15 applies, and if AASB 15 applies, whether revenue is recognised over time, or at a point in time.

AASB 15 - Examples 3A and 3B

Below is an extract of the relevant Fact Patterns.

| AASB 15, Appendix F - Example 3A | AASB 15, Appendix F - Example 3B |

University A receives a cash grant from a donor, Road Safety Authority B, of $1.2 million to undertake research that aims to observe and model traffic flows and patterns through black-spot intersections and to develop proposals for improvements to the road system. The terms of the grant are:

| University A receives a cash grant from a donor, Road Safety Authority B, of $1.2 million to undertake research that aims to observe and model traffic flows and patterns along roads potentially affected by a future freeway development and to develop proposals for freeway interchanges. The terms of the grant are:

|

Analysis – Is there an enforceable contract with a customer?

In both Examples 3A and 3B, Road Safety Authority B is the customer as it will receive the licence, and University A’s promise of specified research and granting the licence is enforceable because the grant is refundable if the research is not undertaken (AASB 15, paragraph F12(a)).

Analysis – Are there ‘sufficiently specific’ performance obligations?

Judgement is required here, including whether the contract specifies, either explicitly or implicitly, the nature/type of goods or services, their cost or value, quantity, and the period over which they will be transferred to the customer (AASB 15, paragraph F20).

To be ‘sufficiently specific’, we also need to be able to determine when promises in this research contract have been satisfied.

Lastly, it is also important to remember that research activities undertaken to develop IP which will be licensed to customers are merely activities undertaken to fulfil a contract and are not ‘sufficiently specific’ performance obligations because they do not, by themselves, transfer any goods or services to customers.

In both Examples 3A and 3B, the contracts identify:

| AASB 15, paragraph F20 considerations | Examples 3A and 3B fact patterns |

| Nature or type of good or service promised | Specified research and transfer of licence |

| Cost or value of good or service | $1.2 million value |

| Quantity of good or service | One |

| Period over which good or service is to be transferred | Three years |

Not all of the above factors need to be specified in an agreement for the promise(s) to be ‘sufficiently specific’ (AASB 15, paragraph F22). However, in these fact patterns, arguably all are present, which is persuasive in assessing that the promise in this contract is ‘sufficiently specific’, i.e. for specified research and transfer of licence.

It is also possible to determine when the promise to transfer the licence has been satisfied because the annual progress reports and final report are an acquittal process that will assist in measuring progress towards satisfying the performance obligation.

University A also determines that the research services are required to develop the IP in order to fulfil the contract and therefore do not, of themselves, give rise to a transfer of goods or services to Road Safety Authority B (i.e. the research and transfer of licence are one performance obligation).

Note that the publication of research results in conference presentations and/or scholarly journals, without the requirement to deliver the licence to Road Safety Authority B, would not be a ‘sufficiently specific’ performance obligation because no goods or services are being promised to Road Safety Authority B (the customer).

Accounting treatment – Initial recognition

As AASB 15 applies to these ‘sufficiently specific’ performance obligations, University A allocates the cash grant received of $1.2 million in both Examples 3A and 3B to its identified performance obligation and recognises the financial asset (cash) and a contract liability of $1.2 million on initial recognition as follows:

| Dr ($) | Cr ($) | |

| Cash | 1,200,000 | |

| Contract liability | 1,200,000 |

Accounting treatment – Timing of revenue recognition

While the accounting treatment on initial recognition for both Examples 3A and 3B are the same, the pattern or timing of revenue recognition is different.

Example 3A – Right to access University A’s IP

University A concludes that the performance obligation is satisfied over time because University A provides the donor with the right to access its IP as it exists throughout the licence period. As the licence over University A’s IP commences at the beginning of the agreement, the above contract liability of $1.2 million is recognised as revenue over the three-year contract period. The cumulative journal entry over the three-year period is:

| Dr ($) | Cr ($) | |

| Contract liability | 1,200,000 | |

| Revenue | 1,200,000 |

Example 3B – Right to use University A’s IP

University A concludes that the performance obligation is satisfied at a point in time (at the end of the grant agreement) because the licence provides the donor with the right to use University A’s IP as it exists when the licence is granted (end of the contract period). The journal entry to recognise the above $1.2 million contract liability is therefore made at the end of the three-year contract period:

| Dr ($) | Cr ($) | |

| Contract liability | 1,200,000 | |

| Revenue | 1,200,000 |

Concluding thoughts

Many NFPs defer recognition of a variety of income streams because there is a lack of clarity in the current accounting requirements for income of NFPs. However, from 1 January 2019, this situation is about to change. NFPs will need to undergo a formal assessment of all income streams to assess whether recognition under AASB 1058 or AASB 15 is appropriate. Importantly, revenue can only be recognised if there is an enforceable contract with a customer, and ‘sufficiently specific’ performance obligations. Disclosure will be required in the financial statements about key judgements made in arriving at the conclusion that performance obligations are/are not ‘sufficiently specific’. Management should therefore already be undertaking a detailed review of all contracts and agreements to determine the appropriate accounting standard for accounting for grant income.