How to identify ‘sufficiently specific’ performance obligations when assessing whether AASB 15 or AASB 1058 applies

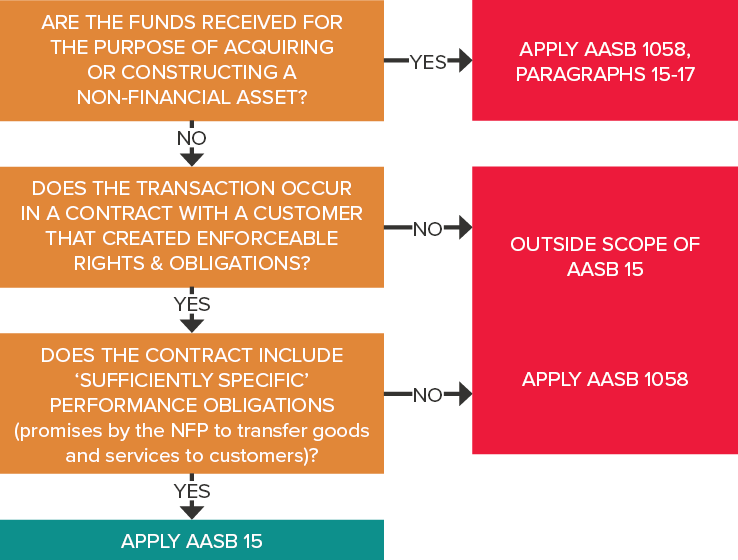

In our November 2018 Accounting News article, we illustrated how not-for-profit entities (NFPs) determine whether ‘income’ is recognised under the new income recognition standard, AASB 1058 Income of Not-for-Profit Entities, or the new revenue standard, AASB 15 Revenue from Contracts with Customers.

Key to this assessment is whether:

- Firstly, there is a contract with a customer that creates enforceable rights and obligations, and

- Secondly, the contract includes ‘sufficiently specific’ performance obligations.

Our November 2018 Accounting News article summarised the first aspect of this assessment, namely, whether there is a contract, a customer and enforceable rights and obligations. This month, we focus on the second aspect of the assessment, i.e. what are ‘sufficiently specific’ performance obligations.

Why is identifying ‘sufficiently specific’ performance obligations important?

The default position in AASB 1058 is that income is recognised immediately if it does not fall within the scope of other Australian Accounting Standards. NFPs receiving multi-year grants to provide services over a number of years, or that span year-ends may prefer, for budgeting and financial reporting purposes, not to recognise this income immediately given that goods or services will be provided in future. By being able to identify ‘sufficiently specific’ performance obligations, NFPs can defer income recognition until a later date when the obligation has been satisfied.

Where to find guidance?

AASB 15 is essentially designed for the recognition of revenue by for-profit entities. Appendix F has therefore been added to AASB 15 (refer AASB 2016-8 Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Entities) to assist NFPs in applying the five-step revenue recognition process in a not-for-profit context. Paragraphs F20-F27 of Appendix F provide additional guidance to help preparers determine whether there are ‘sufficiently specific’ performance obligations in the contract.

What are performance obligations?

A contract with a customer includes promises to transfer goods or services to the customer. If those goods or services are distinct, the promises are performance obligations and under AASB 15, must be accounted for separately. Goods or services may not be individually distinct, but may be distinct when bundled with other goods or services.

A simple example of distinct performance obligations in a for-profit arrangement would be a motor dealer selling a new car and a three-year service contract to a customer. We can see that the nature of these promises is very specific and fairly easy to identify in this case. In more complex arrangements, identifying separate performance obligations may be highly judgmental. Nevertheless, the commercial nature of a transaction by for-profit entities means that it is usually a reasonably straightforward process to identify at least the totality of goods or services to be provided in the contract.

Performance obligations in a not-for-profit context

In a not-for-profit context, identifying even the totality of goods or services to be provided (as opposed to distinct promises) can often be problematical. This is because goods or services to be provided by not-for-profit contracts are often vaguely described, if at all.

In practice, some NFP contracts might include detailed descriptions of specific promises/deliverables (e.g. need to provide 1,000 counselling hours to teenagers with anorexia) and be considered ‘sufficiently specific’ and therefore fall within the scope of AASB 15.

However, many more contracts would include motherhood statements such as a NFP being required to spend money ‘for the greater good’ (e.g. provide mental health support to teenagers with anorexia). And then in between, we would see a whole range of expectations for good or service delivery, documented in a variety of levels of detail (the grey area).

How to determine if a NFP promise is ‘sufficiently specific’?

The additional guidance contained in Appendix F, paragraph F20, notes that judgement is to be applied when determining whether a promise is ‘sufficiently specific’ or not. All conditions specified in the arrangements regarding the promised goods and services need to be considered (both explicit and implicit) including those regarding:

- The nature or type of goods or services

- The cost or value of goods or services

- The quantity of goods or services, and

- The period of time over which the goods or services must be transferred.

Each promise is assessed separately to determine if it is ‘sufficiently specific’ enough to qualify as a performance obligation.

It is important to note that for a promise to be considered ‘sufficiently specific’:

- Not all of the above-mentioned factors need to be specified

- There is no minimum number of factors that need to be specified

- There is no particular combination of factors that need to be specified, and

- Other conditions, in addition the above four, may also need to be taken into account when applying this judgement.

When has the obligation been satisfied?

The overarching principle in the above analysis is that a promise cannot be ‘sufficiently specific’ unless we are able to determine when the promise in the contract has been satisfied.

A necessary condition for identifying a performance obligation of a not-for-profit entity is that the promise is sufficiently specific to be able to determine when the obligation is satisfied.

Extract of Appendix F, paragraph F20

Therefore, if we cannot objectively ‘tick off’ when a promise has been delivered/satisfied, we don’t have a ‘sufficiently specific’ performance obligation.

Example 1 – ‘Sufficiently specific’

NFP receives a grant to ‘provide 1,000 counselling hours to support teenagers with anorexia’.

This condition would be considered ‘sufficiently specific’ because it can be objectively determined when the obligation has been satisfied (in this case, as and when each hour of counselling is provided).

Example 2 – Not ‘sufficiently specific’

NFP receives a grant to ‘provide counselling support to teenagers with anorexia’.

As no period is specified over which the services need to be provided, NFP would not be able to determine when the obligation has been satisfied. This contract would not contain ‘sufficiently specific’ performance obligations, and the grant income is therefore recognised under AASB 1058.

Example 3 – Combination of ‘sufficiently specific’ and not ‘sufficiently specific’

It is possible that some grants may include multiple promises, some of which may be considered ‘sufficiently specific’ (and therefore accounted for under AASB 15), and others may not (and therefore accounted for under AASB 1058).

Assume NFP receives a $1.2 million grant, of which $1 million is to provide ‘1,000 counselling hours to teenagers with anorexia’ and $200,000 to ‘provide counselling support to parents of teenagers with anorexia’.

Following the analysis in Examples 1 and 2 above, we can determine when the promise to provide the 1,000 teenage counselling hours has been satisfied and this condition would be considered ‘sufficiently specific’. However, we would not be able to determine when the ‘counselling support to parents of teenagers with anorexia’ has been satisfied, and income would be recognised under AASB 1058.

Implicit promises vs general statements of intent (paragraph F23)

Some promises in arrangements may be implicit and also need to be considered. For example, promises may be implied by the entity’s customary business practices, published policies or specific statements. These need to be considered (and assessed for specificity using the same process as for explicit promises) if the customer has a valid expectation that goods or services will be transferred to the customer.

However, general statements of intent to spend monies in a certain way (e.g. to improve clean water supplies in developing countries) by themselves do not mean we automatically have a performance obligation.

Activities to fulfil a contract are not ‘sufficiently specific’ performance obligations

In a for-profit context, activation fees (e.g. administration fee to join a gym) are not considered a separate performance obligation because no goods or services are transferred to the customer until the customer has access to the gym over the contract period. These activation fees are typically recognised as revenue over the period of the gym membership contract.

Similarly, in a NFP context, Appendix F, paragraph F21 states that performance obligations do not include activities necessary to fulfil a contract. For example, research activities undertaken to develop intellectual property (IP) which will be licensed to a customer do not transfer any goods or services to the customer (i.e. the customer cannot benefit from the research activities until they obtain the licence to use the IP).

Period of time by itself would not be ‘sufficiently specific’

The period of time over which goods or services must be transferred is one of the factors to consider when assessing whether a promise is ‘sufficiently specific’ (paragraph F20(d)). However, period of time by itself, with no other factors from paragraph F20 present, would not meet the ‘sufficiently specific’ criterion.

Example

NFP provides a variety of services under its charter such as counselling and housing for disadvantaged youth.

NFP receives a government grant to provide unspecified services during 2019. The lack of specificity of the actual services to be provided (i.e. counselling or housing) and the quantum (xx hours) means that there are no ‘sufficiently specific’ performance obligations.

Mission/charter/objectives not ‘sufficiently specific’ (paragraph F25)

Some NFPs are single-purpose entities, i.e. they are established with a charter/mission statement/objective to do one thing (i.e. deliver one type of service). It is unlikely that such charter, mission statement or stated objectives would describe the promises or obligations in enough detail for them to be considered to be ‘sufficiently specific’.

If Homeless NFP’s charter says its mission is to ‘provide housing to the poor’, a grant received to provide services during 2019 is not specific enough to be able to ‘tick off’ when the obligation has been satisfied.

Acquittal processes

Some agreements require an acquittal process whereby the NFP is required to show how monies received have been spent. If the acquittal process also requires the NFP to demonstrate which performance obligations have been satisfied and when, this may provide evidence that the promises are ‘sufficiently specific’.

Transfers of financial assets to construct a non-financial asset (e.g. a building)

In a contract where a donor (say a government) transfers a financial asset to a NFP to construct a non-financial asset (say a school hall), the contract does not typically require or create an obligation for the NFP to transfer the hall to the government donor or other parties. That is, the school will control the constructed non-financial asset. This contract is therefore not considered to be a contract with a customer, and this transaction is therefore accounted for under the specific requirements contained in AASB 1058, paragraphs 15-17. As such, the ‘sufficiently specific’ assessment is not required for such grants.

Concluding thoughts

Many NFPs defer recognition of a variety of income streams because there is a lack of clarity in the current accounting requirements for income of NFPs. However, from 1 January 2019, this situation is about to change. NFPs will need to undergo a formal assessment of all income streams to assess whether recognition under AASB 1058 or AASB 15 is appropriate. Importantly, revenue can only be recognised if there is an enforceable contract with a customer, and ‘sufficiently specific’ performance obligations, and disclosure will be required in the financial statements about key judgements made in arriving at the conclusion that performance obligations are/are not ‘sufficiently specific’. Management should therefore already be undertaking a detailed review of all contracts and agreements to assess whether these Step 1 and Step 2, AASB 15 criteria have been met.