Convertible notes – Are you accounting for these correctly (Part 5)?

In the current economic climate, we continue to see different types of convertible note arrangements, typically entered into by companies needing to offer attractive returns in order to obtain funds from lenders and investors.

Over the past few months we have been looking at some practical aspects regarding accounting for convertible notes, including:

- An overview of the requirements in Accounting news (March 2018)

- A detailed example of a convertible note classified as a compound financial instrument in Accounting News (April 2018)

- A detailed example of a convertible note with an embedded derivative liability in Accounting News (May 2018)

- Common scenarios encountered in practice where conversion features either meet or fail equity classification (July 2018).

As noted in these previous articles, in order for a conversion feature to be classified as ‘equity’, the ‘fixed for fixed’ test in IAS 32 Financial Instruments: Presentation must be met, i.e. at initial recognition, the conversion feature gives the holder of the convertible note the right to convert into a fixed number of equity securities of the issuer.

| Over the next few months we continue our convertible note series with examples of additional common practice issues. This month we look at a detailed example where the conversion price on a convertible note is based on the issuer’s share price at conversion date, resulting in the issue of a variable number of shares. |

Summary

Conversion terms that allow the holder to convert a convertible note into the number of shares equal, on maturity date, to the face value of the note at their market price fails the ‘fixed-for-fixed’ criterion. This is because a variable number of shares will be issued to extinguish a fixed liability amount.

Such a conversion feature is a derivative liability but, as the conversion price is set at the conversion date market share price, the derivative liability has no value; the holder simply receives shares equal in value to the cash payment that would otherwise be made. These types of notes typically only contain a liability component, being the fair value of the cash coupon and the face value of the note.

Example: Convertible into a variable number of shares

ABC Limited issues a note with a face value of $1,000.

The note has a maturity of three years from its date of issue.

The note pays a 10% annual coupon and, at any point up to its maturity, the holder can convert the note into the number of shares equal, at their quoted market price on conversion date, to $1,000.

Assume there are no transaction costs.

Step one

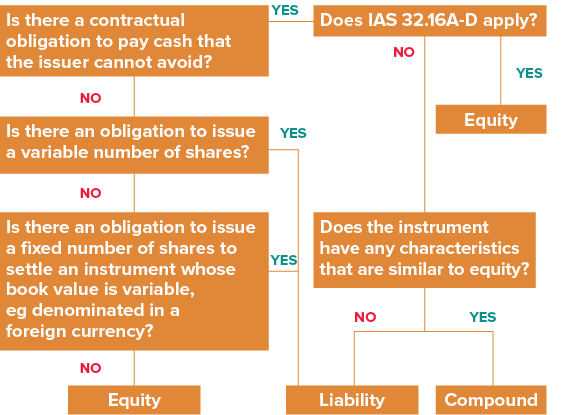

Starting with the box on the top left hand side of the flowchart above, we consider whether there is a contractual obligation to pay cash that ABC Limited (the issuer) cannot avoid. The answer is yes, because it pays an annual cash coupon, and could be required to repay the face value at the end of three years if the holder chooses not to exercise the conversion option.

Step two

Step 2 is to consider whether IAS 32.16A-D apply. When an issuer has an obligation to repurchase financial instruments in certain circumstances, IAS 32 Financial Instruments: Presentation, paragraphs 16A to 16D include exceptions to the usual principles for classifying instruments as financial liabilities. In some cases, such instruments could be classified as ‘equity’, despite an entity having an unavoidable obligation to pay out cash. However, this exception does not typically apply to convertible instruments and is not applicable in this example.

Step three

Continuing down the right hand side of the above flow chart, we then consider whether the instrument has any characteristics that are similar to equity. The answer is yes because the instrument contains an option to be converted into equity instruments, but the question of whether the conversion feature meets the criteria to be classified as equity is dealt with separately in Step four below.

The host debt component will be classified as a financial liability because of ABC Limited’s unavoidable obligation to pay cash, and on a standalone basis there is no feature in the host debt instrument that is similar to equity.

Step four

The conversion feature is then assessed on a standalone basis using the above flowchart. Starting with the box at the top left hand side of the diagram:

- There is no contractual obligation to pay cash that the issuer cannot avoid. The equity conversion feature can only be settled through the issue of equity shares, otherwise it will simply expire unexercised

- However, there is an obligation to issue a variable number of shares – the number of shares to be issued is based on quoted market price on conversion.

Therefore, the conversion feature is classified as a derivative liability.

This means that the note as a whole contains the following components:

|

For convertible notes with embedded derivative liabilities, the embedded derivative liability is determined first and the residual value is assigned to the debt host liability.

| Fair value of convertible note | - | Fair value embedded derivative | = | FV of debt host liability component |

However, in this case, the embedded derivative liability has a zero fair value because the holder simply receives shares equal in value to the cash payment that would otherwise be made. Therefore, the debt host liability’s initial carrying value equals its transaction price.

Journal entry on initial recognition:

| Dr | Cr | |

| Cash | $1,000 | |

| Debt liability | $1,000 | |

| Being cash proceeds received in exchange for the issue of the convertible note | ||