When is a lease not a lease – Does the lessee obtain substantially all the economic benefits from using the asset?

For years ending 31 December 2019, IFRS 16 Leases requires all leases, except for some short-term and low value leases, to be capitalised on the balance sheet of lessees as a right-of-use asset and lease liability.

What is a ‘lease’?

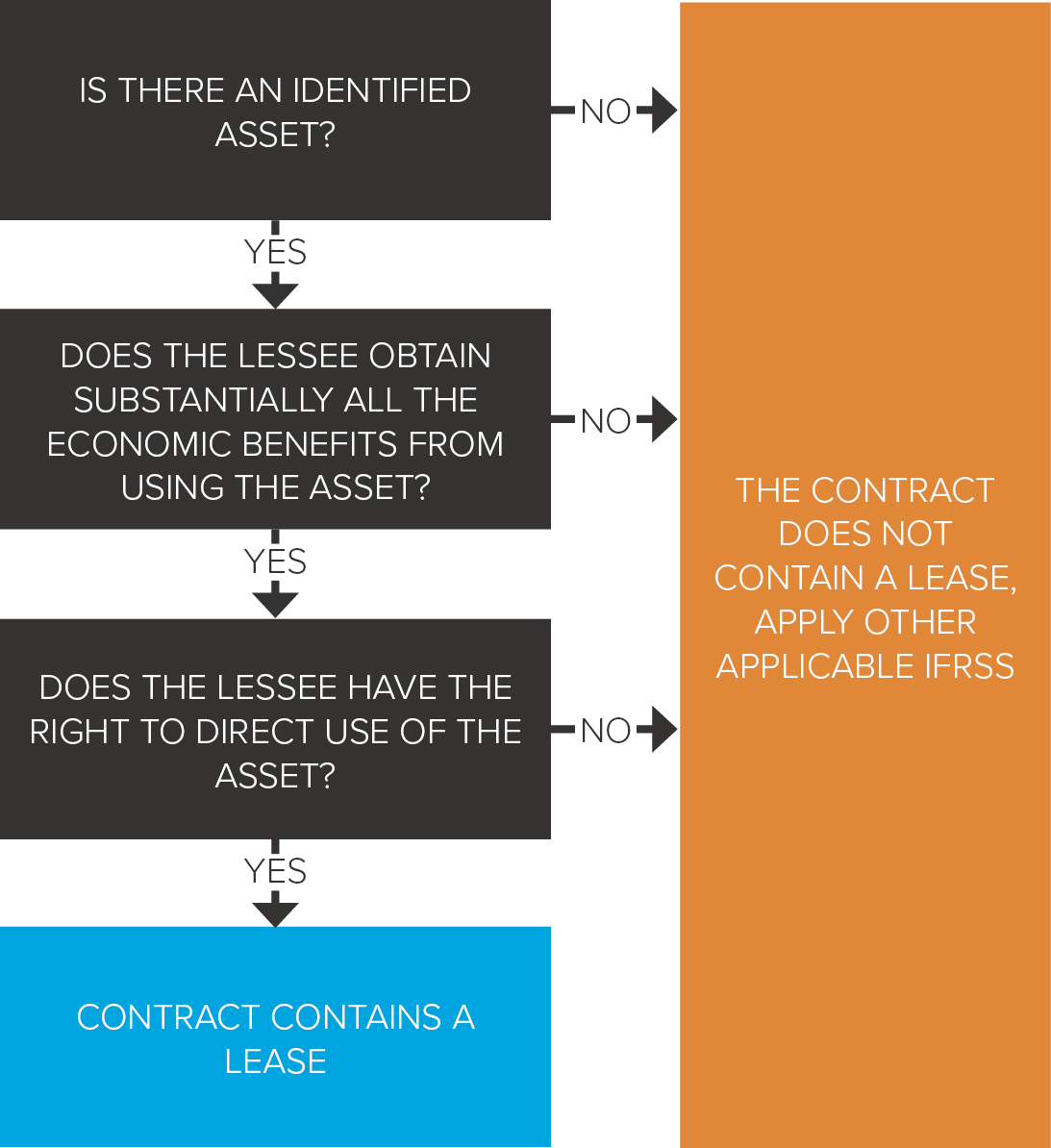

Three key issues need to be considered when determining if an agreement contains a ‘lease’. These are illustrated in the diagram below.

In November 2019 Accounting News, we looked at the first question, i.e. is there an identified asset.

In this article, we focus on the second question, i.e. whether the lessee obtains substantially all the economic benefits from using the asset.

Substantialy all the economic benefits from using the asset

In the diagram above, we can see that the lessee must obtain substantially all the economic benefits from using the leased asset. This could occur, for example, if the lessee:

- Has exclusive use of the asset throughout the period of the contract, or

- Has a right to sub-lease the asset.

Lease payments include a portion of cash flows derived from the asset

Simply because lease payments include a portion of the cash flows derived from an asset (e.g. a percentage of sales from the operations of a property) does not mean that the customer does not obtain substantially all of the economic benefits associated with the asset. Such requirements are common in retail lease contracts.

Example 1 – Obtaining economic benefits with outputs flowing to supplier

A retailer enters into a contract for the lease of a store in a shopping centre for five years.

The rental terms include payments equal to 10% of the gross sales revenue generated from the store.

The retailer has the right to determine which products are to be sold, the interior design of the store, etc.

Assessment

It is the customer’s control and use of the property which generates all of the sales revenue.

The fact that a portion of the cash flows generated from use of the property are passed to the lessor is not relevant.

The lessee has a right to 100% of the sales revenue generated from the store (i.e. all of the economic benefits generated by the store), albeit that it has negotiated a contract which results in rent being determined by reference to that gross sales revenue.

Constraints on use of the asset

In assessing whether a customer has a right to substantially all the economic benefits from using an identified asset, the assessment should be made based on the asset’s use within the defined scope of the contract. For example:

- If a contract limits the use of a vehicle to only a particular geographic area, an entity assesses only the economic benefits from using the motor vehicle within that territory. It does not consider what economic benefits could be obtained had there not been any geographical restriction in the contract.

- If a contract specifies a machine can only be utilised during specific times of the day, an entity assesses only the economic benefits from using the machinery during that time of the day. It does not consider what economic benefits could be obtained from using the machine 24 hours a day.

Economic benefits from using the asset include its primary outputs (e.g. finished goods for a manufacturer to sell) and by-products, including potential cash flows that are derived from these items. When considering economic benefits, emphasis should be placed on the benefits derived from using the asset rather than on other incidental benefits.

Example 2 – Obtaining economic benefits from use versus ownership of an asset

A customer enters into a contract with a supplier where the customer will purchase 100% of the energy produced by a bio-mass facility.

The contract specifies that the energy must be produced from this particular facility (and so the supplier does not have substantive substitution rights).

The supplier receives tax incentives from various levels of government for building the bio-mass facility, as it produces clean, renewable energy.

Assessment

The contract transfers to the customer the right to obtain substantially all of the economic benefits from using the underlying asset (the power plant) because the customer has exclusive use of the primary product of the facility (i.e. the electricity).

Although the supplier obtains economic benefits in the form of tax incentives, these derive from legal ownership of the asset, and not from its use. Therefore, the value of these tax incentives should be disregarded in assessing who obtains substantially all the economic benefits of the bio-mass facility.

Concluding thoughts

Determining whether a contract is, or contains, a lease, is usually a straightforward matter. However, in practice, complex situations may arise that require the application of considerable professional judgement, including determining whether the entity obtains substantially all the economic benefits from using the asset noted in each agreement. To enable such judgements to be made, finance teams will need to ensure that they are able to access all underlying contracts. If such contracts are not currently centrally stored, finance teams should commence the process of ensuring that all contracts are available for analysis well prior to the adoption of IFRS 16.