Key questions to ask when getting ready for general purpose financial statements

In previous editions of Accounting News, we alerted you that special purpose financial statements will be scrapped for years ending 30 June 2022 onwards. For financial years beginning on or after 1 July 2021, certain for-profit private sector entities that currently prepare special purpose financial statements (SPFS) will have to move to general purpose financial statements (GPFS).

As there are various incentives for affected entities to move to GPFS one year early, i.e. for years ending 30 June 2021, preparers should be asking the following four key questions:

- Will I need to prepare GPFS for some, or all, of my entities?

- If yes, should I consider moving to GPFS early, i.e. 30 June 2021?

- When transitioning from SPFS to GPFS, do I apply AASB 1 or AASB 108?

- Can I apply the Reduced Disclosures for Tier 2 entities?

Will I need to prepare GPFS for some, or all, of my entities?

GPFS will be required for all for-profit private sector entities that are required by:

- Legislation to prepare financial statements in accordance with Australian Accounting Standards or ‘accounting standards’, or

- Their constitutions or other documents (e.g. lending agreements) to prepare financial statements in accordance with Australian Accounting Standards, provided that the relevant document was created or amended on or after 1 July 2021.

| LEGISLATION (e.g. Part 2M of Corporations Act 2001) | OR | CONSTITUTIONS/OTHER DOCUMENTS (e.g. trust deeds) CREATED OR AMENDED ON OR AFTER 1 JULY 2021 |

| Australian Accounting Standards or ‘accounting standards’ | Australian Accounting Standards |

While the Corporations Act 2001 refers specifically to Australian Accounting Standards, other legislation may use the more generic term ‘accounting standards’ to describe the type of financial statements required. It is important to note that in both these cases (i.e. where financial statements are required by legislation), GPFS will be required.

However, for financial statements required by a constitution or other document, the new GPFS requirements only apply if the constitution or other document specifies Australian Accounting Standards. If these documents specify ‘accounting standards’, GPFS are not required.

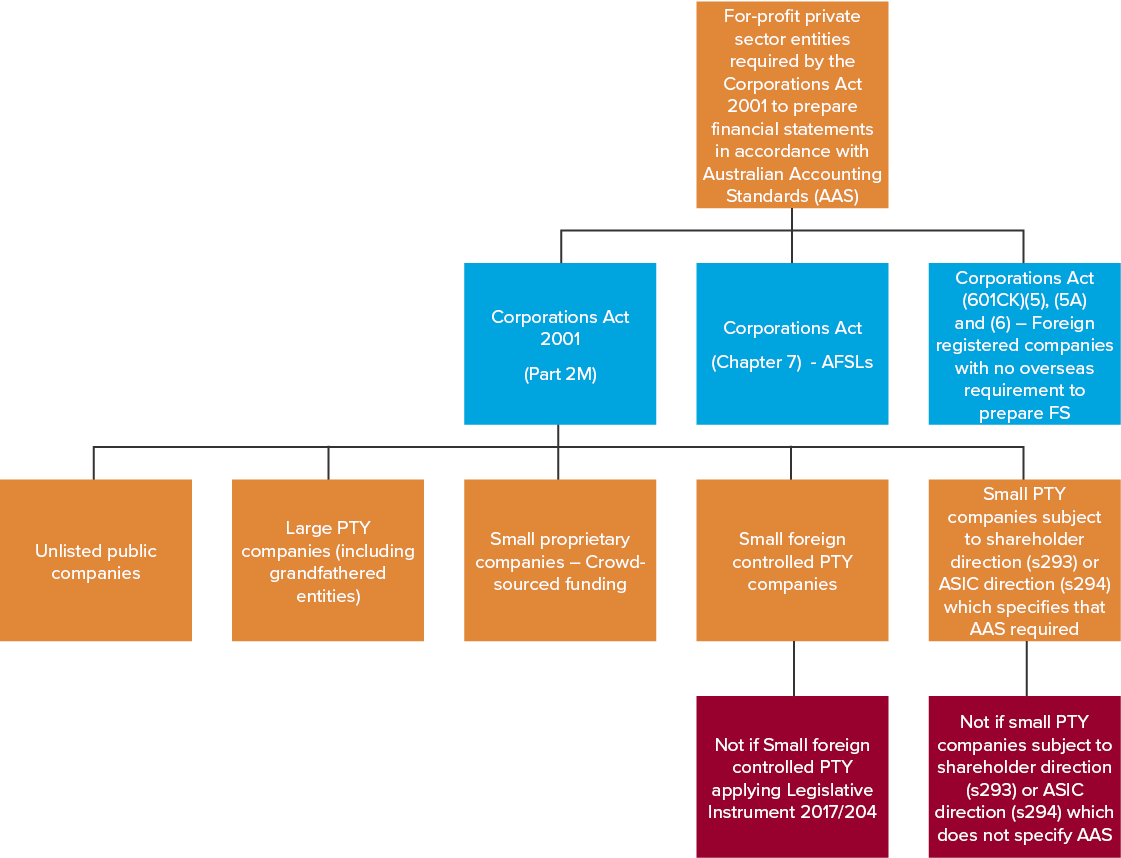

The following diagram illustrates the application of these requirements to the Corporations Act 2001:

It is generally understood that entities preparing financial statements under Part 2M of the Corporations Act 2001 will have to prepare GPFS in future. This includes unlisted public companies, large proprietary companies (including grandfathered entities), as well as the following types of small proprietary companies:

- Those that have raised funding via crowd-sourcing

- Those that are foreign controlled and not included in consolidated financial statements lodged with ASIC (section 292(2(b)), or

- If directed to prepare financial statements by ASIC or a shareholder direction which specifies that Australian Accounting Standards must be applied.

However, many people have overlooked the fact that AFS licensees and registered foreign companies are also likely to be caught by these new requirements.

If yes, should I consider moving to GPFS early, i.e. 30 June 2021?

We encourage most entities required to prepare GPFS for 30 June 2022 to move early (i.e. for 30 June 2021 financial statements). This is because you will be able to use the available transitional relief in one or more of the following cases, which should save you a significant amount of time, particularly if this is the first time you will be preparing consolidated financial statements.

| Relief from… | For periods beginning before… | BDO comments |

| Providing comparative information not previously disclosed in the notes | 1 July 2021 | Will save time for all entities currently preparing SPFS because there will be many additional disclosures. Adopting Simplified Disclosures one year early means you do not need to go back and add disclosures for the prior period. |

| Restating comparative information | 1 July 2021 | Will save time if you do not currently apply all recognition and measurement requirements in SPFS, including consolidation. |

| Distinguishing correction of errors from changes in accounting policies | 1 July 2022 | Will save time because on first-time adoption you will not need to quantify and disclose correction of errors separately from transition adjustments. |

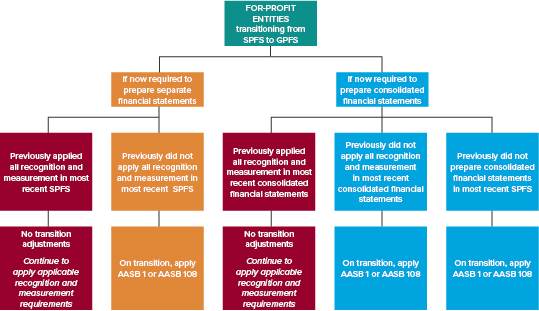

When transitioning from SPFS to GPFS, do I apply AASB 1 First-time Adoption of Australian Accounting Standards or AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors?

Previously applied all recognition and measurement (R&M) requirements

If the entity previously applied all R&M requirements in Australian Accounting Standards (including preparing consolidated financial statements) in SPFS, AASB 1 First-time Adoption of Australian Accounting Standards cannot be applied again. There will be no measurement adjustments in your first GPFS, but more disclosures will be required to comply with AASB 1060 General Purpose Financial Statements - Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities.

Previously did not apply all R&M requirements, or did not prepare consolidated financial statements (if applicable)

If the entity did not previously apply all R&M requirements in Australian Accounting Standards, or did not prepare consolidated financial statements (where required), it has a choice to apply one of the following transition methods when moving from SPFS to GPFS, i.e.:

- Apply AASB 1, or

- Apply AASB 108.

AASB 1

If the entity chooses to apply AASB 1, it may be able to apply various exceptions from full retrospective restatement.

AASB 108

If the entity applies AASB 108, it must apply all Australian Accounting Standards on a fully retrospective basis, unless particular standards allow prospective application in certain circumstances (for example, AASB 13 Fair Value Measurement). This could be a very difficult and expensive task if the entity does not have access to historical information about transactions and events that occurred many years before, particularly when preparing consolidated financial statements for the first time.

These transition methods are illustrated on the diagram below:

Can I apply the Reduced Disclosures for Tier 2 entities?

Tier 2 GPFS are currently prepared using Reduced Disclosures (RDR). However, RDR will be withdrawn for periods beginning on or after 1 July 2021 (30 June 2022 year-ends), so we advise not to apply RDR for new sets of GPFS. Instead, the new Simplified Disclosures, included in AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities should be adopted early.

Need help?

If you require assistance with your transition to GPFS, please contact Aletta Boshoff or visit our web site. You can also view our latest webinar, Applying IFRS 1 to transition to general purpose financial statements or register for our virtual workshops.