Aletta Boshoff

National Leader, Sustainability Reporting

Partner, Advisory

The road to a successful General Purpose Financial Statements (GPFS) transition is neither straight nor uncluttered. Successful navigation requires you to make deliberate, informed decisions along the way. Failure to do so could compromise your relationship with the regulator and other stakeholders, which could in turn erode shareholder value.

Finding the right timing might be your first fork in the road. Mapping out an early transition presents a unique opportunity for your organisation to assess and address your compliance to date, with the recognition and measurement requirements (including consolidation and equity accounting, when relevant) in applicable International Financial Reporting Standards (IFRS) as well as Australian Accounting Standards (AAS).

At BDO, we have a team of financial reporting experts across Australia who are ready to steer your organisation to GPFS compliance. Why not start with a BDO GPFS Health Check to better understand your current situation, and the gaps you’ll need to address. Contact us to get started today.

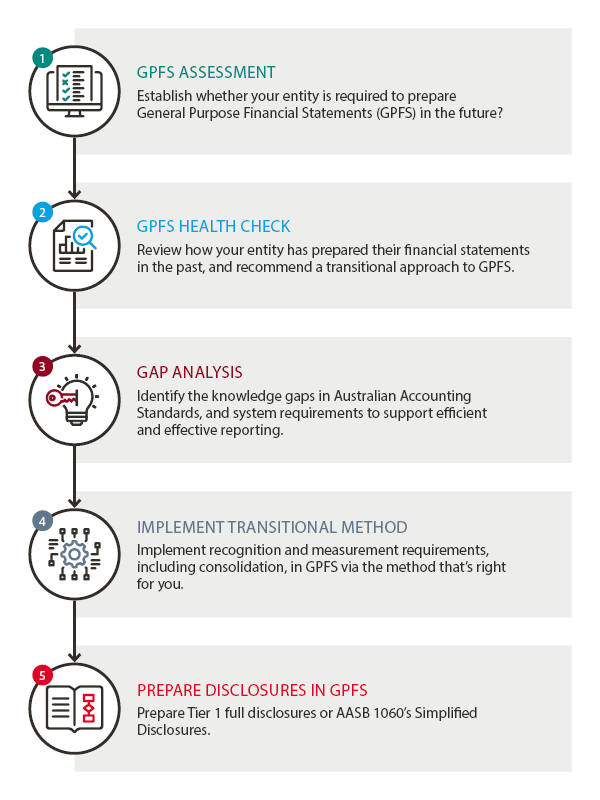

Following these five simple steps can help to ensure you avoid unnecessary speed bumps in your GPFS transition journey. Our team of IFRS specialists across Australia can help you take the wheel, and guide your entity to its destination.

Aletta Boshoff

Alison Wolf

Cate Pozzi

Clark Jarrold

Dean Ardern

Julie Pagcu

Kevin Frohbus

Linh Dao

Sheryl Levine