ASIC focus areas and ASIC feedback from December 2020 surveillance program

Boards and preparers of financial statements for larger listed entities and other public interest entities should be aware of ASIC’s two recent Media Releases outlining:

ASIC focus areas for 30 June 2021

Media Release MR 21-129 notes that entities may continue to face uncertainties about future economic and market conditions, and the future impacts on their business. As such:

- Assumptions underlying estimates should be reasonable and supportable, should be realistic, and not be overly optimistic or pessimistic

- Useful and meaningful disclosure about estimates and judgements required to address these uncertainties is vital, including disclosure of key assumptions and sensitivity analyses

- The Operating and Financial Review (OFR) should complement the financial report and tell the story of how the entity’s business has been impacted by COVID-19, including explaining the underlying drivers of the results and financial position, as well as risks, management strategies and future prospects.

MR 21-129 highlights five focus areas summarised briefly below:

- Asset values

- Provisions

- Solvency and going concern assessments

- Events occurring after the end of the reporting period, but before the completion of the financial report, and

- Disclosures in the financial report and OFR.

MR 21-129 also serves as a reminder about the recent IFRIC agenda decision on configuration and customisation costs in a cloud computing arrangement, and recent developments concerning leave entitlements of casual employees. Refer to June Accounting News for more information. If they do not meet the criteria to be capitalised as an intangible asset or prepayment at 30 June 2021, ASIC’s expectation is that entities should be removing previously capitalised customisation and configuration costs from the balance sheet as soon as possible.

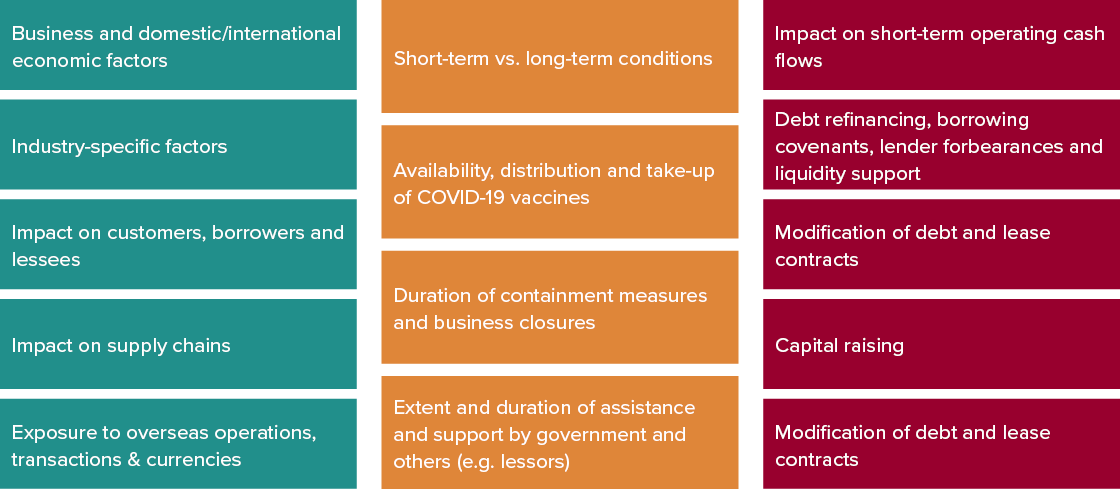

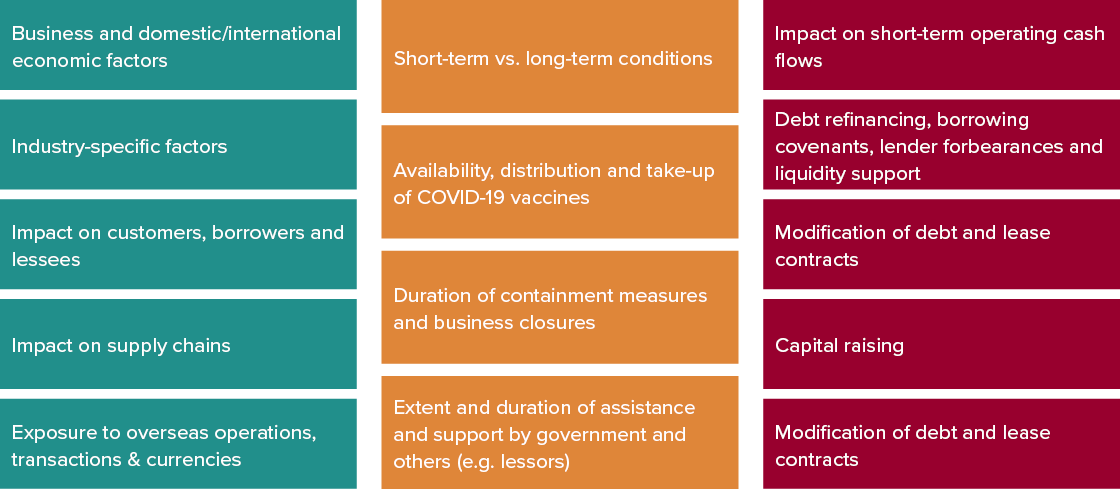

To ‘set the scene’, MR 21-129 notes the following factors to consider when assessing appropriate asset values, liabilities and solvency and going concern (this list is not exhaustive):

Asset values

ASIC’s focus on asset values relates to the following areas:

| Financial statement area | Focus on …. |

Impairment of non-financial assets | - Must conduct an annual impairment test for goodwill, indefinite-life intangible assets, and intangible assets not yet available for use

- Ensure impairment tests are conducted for other non-financial assets if there are new or continuing indicators of impairment

- Ensure key assumptions used to determine recoverable amount are appropriate

- Given COVID-19 uncertainties, it may be necessary to use probability-weighted scenarios when estimating fair value and value in use

- Estimation uncertainties must be disclosed, together with sensitivity analyses on probability-weighted scenarios.

|

Values of property assets | - Despite any absence of market transactions, factors that could adversely affect values of commercial and residential properties should be considered

- Values could be affected by expected changes in office work practices affecting future space requirements of tenants

- Possible changes in consumer preferences between ‘bricks and mortar’ retail shopping and online shopping

- Economic/industry impacts on future tenancy

- Changes in financial conditions of existing tenants

- New or ongoing impacts of restructuring of agreements with tenants

- Complex lease accounting requirements, treatment of rent concessions by lessors and lessees, and impairment of lessees’ right-of-use assets.

Refer BDO’s Lease Accounting page on our web site for more information about the complexities of lease accounting, including information about lease accounting software solutions, training materials and publications. |

Expected credit losses (ECL) on loans and receivables | - Appropriateness of key assumptions used to determine ECL (should be reasonable and supportable)

- The need for more up-to-date information about borrowers’ and debtors’ circumstances

- Short-term liquidity issues for some borrrowers and debtors, as well as their financial condition and earnings capacity

- Past models and experience may not be representative of current expectations (probability-weighted scenarios may be needed)

- Under current loan repayment deferral arrangements for borrowers with short-term liquidity issues, whether the rebuttable presumption in IFRS 9 can continue to be rebutted for loans in arrears for 30 days or 90 days being moved into higher categories for assessing ECL

- Disclosure of estimation uncertainty and key assumptions.

|

Value of other assets | - Value of inventories, including where demand has decreased and where inventory levels have increased

- Whether probable that deferred tax assets will be realised

- Impact of COVID-19 on value of investments in unlisted entities.

|

Provisions

The focus on provisions requires considering the need for provisions to be recognised for onerous contracts, restructuring that takes place as a result of the pandemic, and financial guarantees given to other parties.

Solvency and going concern assessments

This involves considering factors affecting the business which could impact the entity’s solvency and going concern assessment. These were highlighted under the ‘setting the scene’ discussion above.

Subsequent events

Entities should review events occurring after the end of the reporting period to determine whether these are ‘adjusting’ or ‘non-adjusting’ post-balance date events. Particularly in light of recent lockdowns in NSW, WA, NT and QLD, careful attention should be paid in this regard.

Disclosures in the financial report and OFR

Lastly, entities should focus on ensuring adequate disclosures as outlined in the table below:

| Consider … | |

General considerations | - Put yourselves in the shoes of investors and consider what information they would want to know

- Disclosures should be specific to the entity (i.e. not boilerplate)

- Consider changes from previous period and disclose accordingly.

|

Disclosures in financial report | - Disclose uncertainties and sensitivity analyses for key assumptions

- Consider appropriate current vs. non-current classification of assets and liabilities in the balance sheet, having regard to maturity dates, payment terms and compliance with debt covenants.

|

Disclosures in OFR | - Should complement the financial report and ‘tell the story’ as to how the business has been impacted by the COVID-19 pandemic

- Explain underlying drivers of results and financial position, as well as risks, management strategies and future prospects

- Discuss significant factors that are not related to COVID-19 with appropriate prominence, e.g. changes in consumer preferences or new competitors (i.e. don’t blame poor performance all on COVID-19 if there are other reasons)

- Climate change risk could have a material impact on future prospects. Directors should consider disclosing information under recommendations of the Task Force on Climate-related Financial Disclosures.

|

Assistance and support by government and others (e.g. lenders and landlords) | - Prominently disclose in financial report and OFR:

- Material amounts

- Commencement date

- End date or expected duration.

Examples: JobKeeper, land tax relief, loan deferrals and restructuring, and rent deferrals and waivers. |

Non-IFRS financial information | - Should not be presented in a misleading manner

- If asset impairment losses were excluded from a non-IFRS profit measure in a previous year, reversals of impairment should also be excluded in subsequent years

- Net tangible asset figures presented by lessees should include a prominent footnote on same page explaining whether some, all, or no leased right-of-use assets have been included.

|

Disclosure in half-year financial reports | - May need to include significant disclosure about developments and continuing impacts of COVID-19 since 31 December 2020.

|

Results from ASIC’s review of 31 December 2020 financial reports

Media Release MR 21-135 summarises the results of ASIC’s review of the financial statements of 85 listed entities for the period ended 31 December 2020. ASIC made 15 enquiries on 22 entities. The types of enquiries raised by ASIC as a result of these reviews also demonstrate the types of areas they will be focussing on for their reviews of 30 June 2021 financial statements, with impairment at the forefront.

| Matter | Number of enquiries | Enquiries cover…. |

Impairment and other asset values (Goodwill, mining assets and property, plant and equipment) | 8 | - Reasonableness of cash flows and assumptions, having regard to historical trading results, current and forecast commodity prices, or impact of uncertainties due to COVID-19 conditions

- Insufficient disclosures regarding:

- Key assumptions used (discount rates and growth rates) including for probability-weighted scenarios

- For fair values – valuation techniques and inputs used.

|

Expected credit losses (ECL) on trade receivables | 2 | - Lack of disclosure about the basis for determining ECL despite indications of increased credit risk

- ECL rates did not adequately reflect credit risk of long outstanding receivables by using sufficient forward-looking information.

|

Operating and Financial Review (OFR) | 3 | - Quality of OFR and extent to which it complements financial report and ‘told the story’ of how the business impacted by the pandemic

- No information provided about business strategies and future prospects

- No information about impact of COVID-19 on key assumptions

- Statements that the impact of COVID-19 on the business cannot be determined.

|

Consolidation accounting | 2 | - Accounting for loss of control of a subsidiary and treatment of remaining interest as a joint arrangement

- Accounting for a joint arrangement where continuing indicators exist that entity may have control.

|

Lease accounting | 2 | - Accounting for a sale and leaseback which resulted in a material gain on sale

- Other matter explained and resolved.

|

Off-balance sheet arrangements | 1 | - Basis for entity derecognising trade receivables under a debtor securitisation facility.

|

Revenue recognition | 1 | - Revenue recognition dependent on agreed milestones related to product development

- Accounting policy for late fees.

|

Provisions | 1 | - Potential liabilities relating to cyber breaches

|

Other matters | 2 | - Adequacy of make good provisions in connection with leased properties.

|

Total | 22 | |

Need assistance?

Please contact our IFRS Advisory team if you require assistance on any financial reporting matters for your 30 June 2021 financial reports.